6116 Myron St Unit 175 Columbus, OH 43213

East Broad NeighborhoodEstimated Value: $374,270 - $449,000

3

Beds

4

Baths

1,888

Sq Ft

$214/Sq Ft

Est. Value

About This Home

This home is located at 6116 Myron St Unit 175, Columbus, OH 43213 and is currently estimated at $403,818, approximately $213 per square foot. 6116 Myron St Unit 175 is a home located in Franklin County with nearby schools including Lincoln Elementary School, Gahanna South Middle School, and Lincoln High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 8, 2021

Sold by

Heintz Daniel P

Bought by

Heintz Jennifer and Johnson Jennifer

Current Estimated Value

Purchase Details

Closed on

Jun 27, 2018

Sold by

Jenkins Daniel C and Jenkins Jillian S

Bought by

Heintz Daniel P and Johnson Jennifer

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$250,381

Outstanding Balance

$217,472

Interest Rate

4.6%

Mortgage Type

FHA

Estimated Equity

$186,346

Purchase Details

Closed on

Feb 12, 2010

Sold by

M/I Homes Of Central Ohio Llc

Bought by

Jenkins Daniel C and Jenkins Jillian S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$178,924

Interest Rate

4.75%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Heintz Jennifer | -- | None Available | |

| Heintz Daniel P | $255,000 | Great American Title | |

| Jenkins Daniel C | $182,300 | Transohio |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Heintz Daniel P | $250,381 | |

| Previous Owner | Jenkins Daniel C | $178,924 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $6,110 | $120,940 | $29,760 | $91,180 |

| 2023 | $6,023 | $120,925 | $29,750 | $91,175 |

| 2022 | $6,409 | $101,900 | $17,510 | $84,390 |

| 2021 | $6,419 | $101,900 | $17,510 | $84,390 |

| 2020 | $6,356 | $101,900 | $17,510 | $84,390 |

| 2019 | $5,002 | $81,530 | $14,010 | $67,520 |

| 2018 | $4,262 | $81,530 | $14,010 | $67,520 |

| 2017 | $4,521 | $81,530 | $14,010 | $67,520 |

| 2016 | $3,562 | $58,740 | $14,430 | $44,310 |

| 2015 | $3,565 | $58,740 | $14,430 | $44,310 |

| 2014 | $3,532 | $58,740 | $14,430 | $44,310 |

| 2013 | $85 | $2,835 | $2,835 | $0 |

Source: Public Records

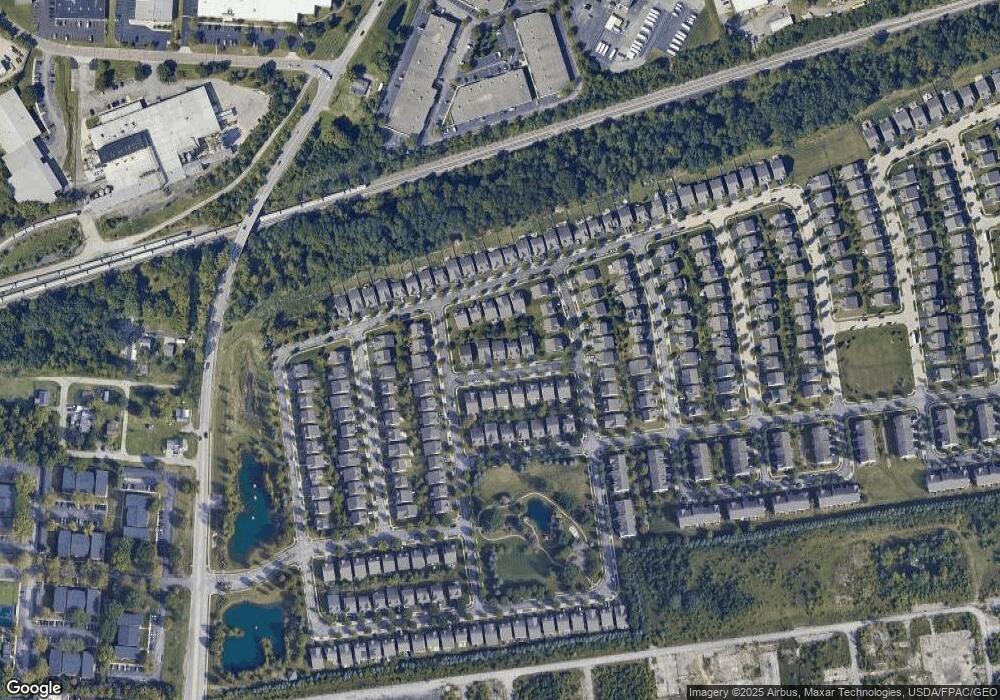

Map

Nearby Homes

- 6162 Stockton Trail Way

- 6343 Hoffman Trace Dr

- 875 Taylor Station Rd

- 970 Claycraft Rd

- 85 Stornoway Dr W Unit 85

- 6198 Stornoway Dr S Unit 6198

- 117 Stornoway Dr E

- 5850 Forestview Dr

- 147 Shadymere Ln Unit 5

- 142 Villamere Dr Unit 6

- 1252 Rice Ave

- 6913 Onyxbluff Ln

- 6924 Shady Rock Ln

- 5671 Bastille Place

- 6610 Olivetree Ct

- 5613 Chowning Way Unit 6B

- 6972 Shady Rock Ln

- 6033 McNaughten Grove Ln

- 6056 Naughten Pond Dr

- 6052 Naughten Pond Dr

- 6116 Myron St

- 6110 Myron St

- 6110 Myron St Unit 174

- 6122 Myron St

- 6122 Myron St Unit 176

- 6128 Myron St

- 6104 Myron St Unit 173

- 6121 Stockton Trail Way

- 6121 Stockton Trail Way Unit 191

- 6127 Stockton Trail Way Unit 190

- 6115 Stockton Trail Way

- 6133 Stockton Trail Way

- 6133 Stockton Trail Way Unit 189

- 6109 Stockton Trail Way

- 6109 Stockton Trail Way Unit 193

- 6113 Myron St Unit 163

- 6113 Myron St

- 6119 Myron St Unit 162

- 6119 Myron St

- 6107 Myron St