6119 Thornton Ave Unit F Newark, CA 94560

Estimated Value: $691,000 - $732,000

2

Beds

3

Baths

1,166

Sq Ft

$609/Sq Ft

Est. Value

About This Home

This home is located at 6119 Thornton Ave Unit F, Newark, CA 94560 and is currently estimated at $709,876, approximately $608 per square foot. 6119 Thornton Ave Unit F is a home located in Alameda County with nearby schools including Coyote Hills Elementary School, Newark Junior High School, and Newark Memorial High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 2, 2019

Sold by

Trujillo Linda

Bought by

William O Leary and Wu Desiree

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$544,500

Outstanding Balance

$477,009

Interest Rate

3.5%

Mortgage Type

New Conventional

Estimated Equity

$232,867

Purchase Details

Closed on

Jul 16, 2015

Sold by

Nachand Carolyn and Nachand Carolyn

Bought by

Trujillo Linda

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$372,000

Interest Rate

4.01%

Mortgage Type

New Conventional

Purchase Details

Closed on

Aug 14, 2002

Sold by

Foshay Judy

Bought by

Nachand Carolyn

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$242,400

Interest Rate

6.52%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| William O Leary | $605,000 | Chicago Title Company | |

| Trujillo Linda | $467,500 | Old Republic Title Company | |

| Nachand Carolyn | -- | Old Republic Title Company | |

| Nachand Carolyn | $303,000 | Alliance Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | William O Leary | $544,500 | |

| Previous Owner | Trujillo Linda | $372,000 | |

| Previous Owner | Nachand Carolyn | $242,400 | |

| Closed | Nachand Carolyn | $60,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,048 | $654,645 | $198,493 | $463,152 |

| 2024 | $8,048 | $641,674 | $194,602 | $454,072 |

| 2023 | $7,830 | $635,957 | $190,787 | $445,170 |

| 2022 | $7,732 | $616,488 | $187,046 | $436,442 |

| 2021 | $7,543 | $604,267 | $183,380 | $427,887 |

| 2020 | $7,436 | $605,000 | $181,500 | $423,500 |

| 2019 | $6,273 | $496,110 | $148,833 | $347,277 |

| 2018 | $6,180 | $486,386 | $145,916 | $340,470 |

| 2017 | $6,023 | $476,850 | $143,055 | $333,795 |

| 2016 | $5,960 | $467,500 | $140,250 | $327,250 |

| 2015 | $4,795 | $365,126 | $109,538 | $255,588 |

| 2014 | $4,670 | $357,975 | $107,392 | $250,583 |

Source: Public Records

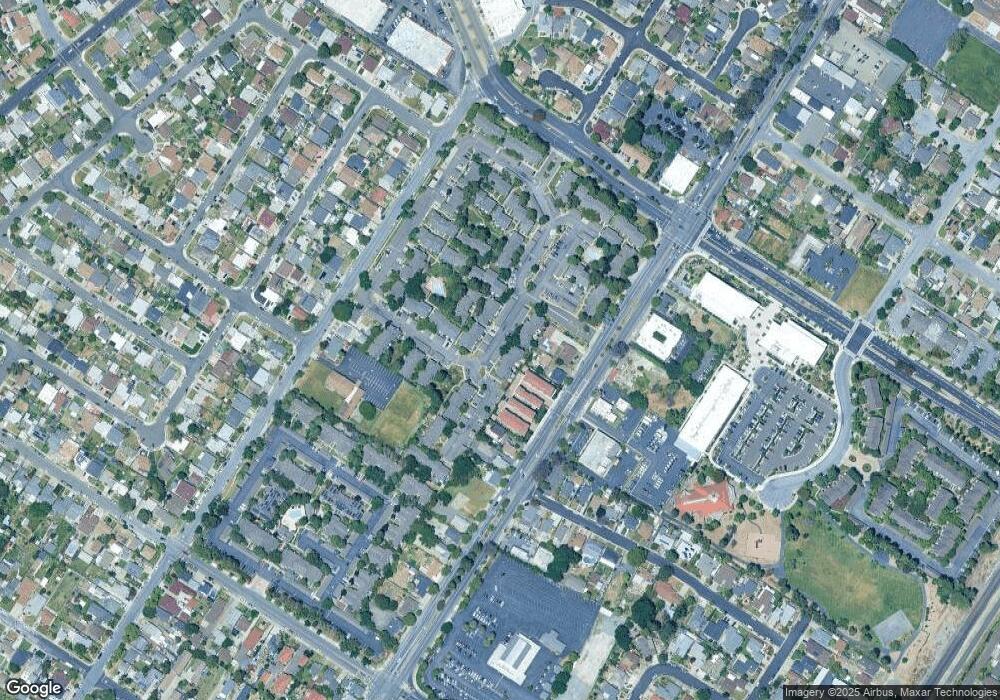

Map

Nearby Homes

- 6153 Thornton Ave Unit D

- 6278 Dairy Ave

- 6433 Thornton Ave

- 6364 Noel Ave

- 36593 Leone St

- 6198 Civic Terrace Ave Unit A

- 36976 Mulberry St

- 36523 Cherry St

- 36702 Olive St

- 6176 Thomas Ave

- 37136 Magnolia St

- 36535 Mulberry St

- 6025 Radcliffe Ave

- 37282 Magnolia St

- 5879 Caleb Ct

- 36466 Haley St

- 36563 Beutke Dr

- 37643 Crocus Ct

- 5447 Saint Mark Ave

- 5315 Port Sailwood Dr Unit 7

- 6119 Thornton Ave

- 6115 Thornton Ave Unit F

- 6115 Thornton Ave Unit E

- 6115 Thornton Ave Unit D

- 6115 Thornton Ave Unit C

- 6115 Thornton Ave Unit B

- 6115 Thornton Ave Unit A

- 6119 Thornton Ave Unit E

- 6119 Thornton Ave Unit D

- 6119 Thornton Ave Unit C

- 6119 Thornton Ave Unit B

- 6119 Thornton Ave Unit A

- 6235 Thornton Ave

- 6223 Thornton Ave

- 6233 Thornton Ave

- 6211 Thornton Ave

- 6231 Thornton Ave

- 6241 Thornton Ave

- 6123 Thornton Ave

- 6123 Thornton Ave Unit A