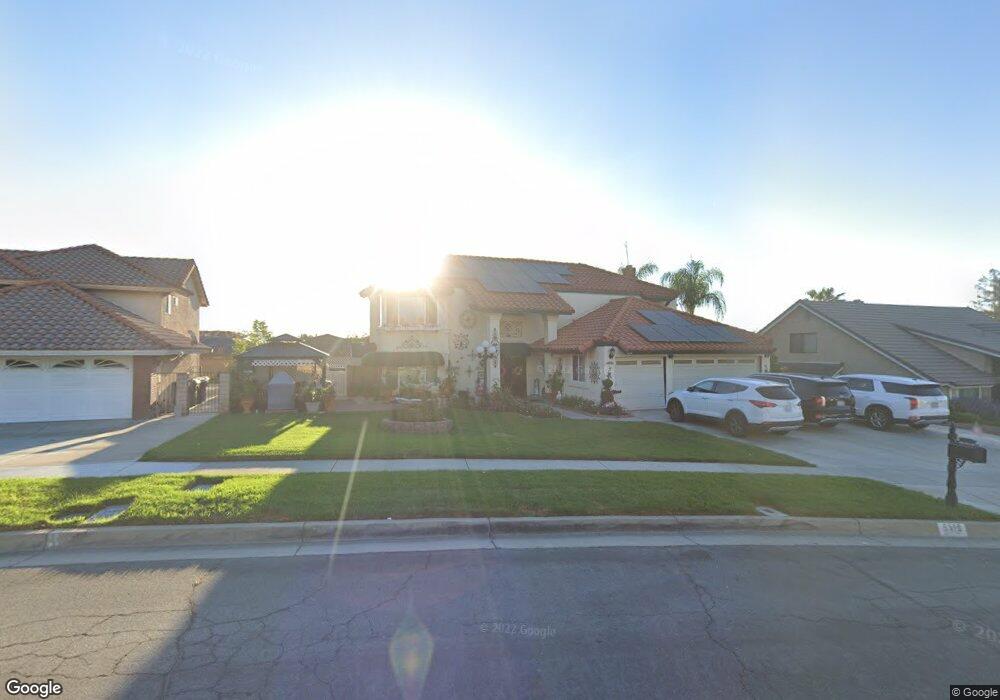

6119 Vineyard Ave Rancho Cucamonga, CA 91701

Alta Loma NeighborhoodEstimated Value: $871,592 - $1,058,000

4

Beds

3

Baths

2,482

Sq Ft

$391/Sq Ft

Est. Value

About This Home

This home is located at 6119 Vineyard Ave, Rancho Cucamonga, CA 91701 and is currently estimated at $970,648, approximately $391 per square foot. 6119 Vineyard Ave is a home located in San Bernardino County with nearby schools including Jasper Elementary, Alta Loma Junior High, and Alta Loma High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 20, 2021

Sold by

Morales Richard M and Morales Lorraine L

Bought by

Morales Richard M and Morales Lorraine L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$300,100

Outstanding Balance

$272,294

Interest Rate

2.9%

Mortgage Type

New Conventional

Estimated Equity

$698,354

Purchase Details

Closed on

Jul 25, 2007

Sold by

Morales Richard M and Morales Lorraine L

Bought by

Morales Richard M and Morales Lorraine L

Purchase Details

Closed on

Dec 31, 1997

Sold by

Scheidler James W and Scheidler Karen M

Bought by

Morales Richard M and Morales Lorraine L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$184,000

Interest Rate

7.16%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Morales Richard M | -- | Amrock Llc | |

| Morales Richard M | -- | Amrock Inc | |

| Morales Richard M | -- | None Available | |

| Morales Richard M | $230,000 | Fidelity National Title Ins |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Morales Richard M | $300,100 | |

| Closed | Morales Richard M | $184,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,159 | $366,376 | $109,745 | $256,631 |

| 2024 | $4,057 | $359,192 | $107,593 | $251,599 |

| 2023 | $3,968 | $352,149 | $105,483 | $246,666 |

| 2022 | $3,957 | $345,244 | $103,415 | $241,829 |

| 2021 | $3,954 | $338,474 | $101,387 | $237,087 |

| 2020 | $3,797 | $335,003 | $100,347 | $234,656 |

| 2019 | $3,837 | $328,434 | $98,379 | $230,055 |

| 2018 | $3,753 | $321,994 | $96,450 | $225,544 |

| 2017 | $3,588 | $315,681 | $94,559 | $221,122 |

| 2016 | $3,494 | $309,491 | $92,705 | $216,786 |

| 2015 | $3,471 | $304,842 | $91,312 | $213,530 |

| 2014 | $3,376 | $298,870 | $89,523 | $209,347 |

Source: Public Records

Map

Nearby Homes

- 6109 Vineyard Ave

- 8867 Mandarin Ave

- 6340 Sacramento Ave

- 6036 Eastwood Ave

- 5848 Burlwood Ct

- 5836 Buckthorn Ave

- 8607 Buggy Whip Rd

- 8635 Orange St

- 8771 Rancho St

- 9379 Monarch Ct

- 6620 Altawoods Way

- 6275 Sapphire St

- 9111 Hamilton St

- 6815 Coral Ct

- 6154 Klusman Ave

- 8979 Camellia Ct

- 6870 Saddleback Place

- 8985 Sage Dr

- 6833 Carnelian St

- 9588 Highland Ave

- 6129 Vineyard Ave

- 6120 Balboa Ct

- 6126 Balboa Ct

- 6110 Balboa Ct

- 6139 Vineyard Ave

- 6118 Vineyard Ave

- 6136 Balboa Ct

- 6128 Vineyard Ave

- 6147 Vineyard Ave

- 6087 Vineyard Ave

- 6148 Balboa Ct

- 6138 Vineyard Ave

- 6088 Vineyard Ave

- 6159 Vineyard Ave

- 6121 Balboa Ct

- 6111 Balboa Ct

- 6127 Balboa Ct

- 6123 Cabrillo Ct

- 6111 Cabrillo Ct

- 6146 Vineyard Ave