6131 Metrowest Blvd Unit 105 Orlando, FL 32835

MetroWest NeighborhoodEstimated Value: $188,000 - $210,000

1

Bed

1

Bath

1,072

Sq Ft

$185/Sq Ft

Est. Value

About This Home

This home is located at 6131 Metrowest Blvd Unit 105, Orlando, FL 32835 and is currently estimated at $197,895, approximately $184 per square foot. 6131 Metrowest Blvd Unit 105 is a home located in Orange County with nearby schools including Westpointe Elementary, Chain of Lakes Middle School, and Olympia High.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 5, 2017

Sold by

Panella Berbesi Jose Gabriel

Bought by

Castro Jaime Luis Suarez

Current Estimated Value

Purchase Details

Closed on

Apr 30, 2015

Sold by

Reinoso Pedro and De Reinoso Gloria

Bought by

Maxi Properties Llc

Purchase Details

Closed on

Sep 29, 2010

Sold by

U S Bank National Association

Bought by

Reinoso Pedro and Reinoso Gloria

Purchase Details

Closed on

May 28, 2010

Sold by

Ordinola Maria T

Bought by

Us Bank National Association

Purchase Details

Closed on

Nov 30, 2005

Sold by

Mcz Centrum Florida Vii Owner Llc

Bought by

Ordinola Maria T

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$187,110

Interest Rate

3.5%

Mortgage Type

Fannie Mae Freddie Mac

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Castro Jaime Luis Suarez | -- | None Available | |

| Maxi Properties Llc | $95,000 | Homeland Title Services | |

| Reinoso Pedro | $53,200 | First American Title | |

| Us Bank National Association | -- | None Available | |

| Ordinola Maria T | $207,900 | Landamerica Gulfatlantic Tit |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Ordinola Maria T | $187,110 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,877 | $172,618 | -- | -- |

| 2024 | $2,666 | $156,925 | -- | -- |

| 2023 | $2,666 | $171,500 | $34,300 | $137,200 |

| 2022 | $2,189 | $117,900 | $23,580 | $94,320 |

| 2021 | $2,611 | $144,700 | $28,940 | $115,760 |

| 2020 | $2,386 | $144,700 | $28,940 | $115,760 |

| 2019 | $2,186 | $115,800 | $23,160 | $92,640 |

| 2018 | $1,988 | $101,800 | $20,360 | $81,440 |

| 2017 | $1,959 | $99,700 | $19,940 | $79,760 |

| 2016 | $1,813 | $90,000 | $18,000 | $72,000 |

| 2015 | $1,549 | $83,100 | $16,620 | $66,480 |

| 2014 | $1,449 | $77,400 | $15,480 | $61,920 |

Source: Public Records

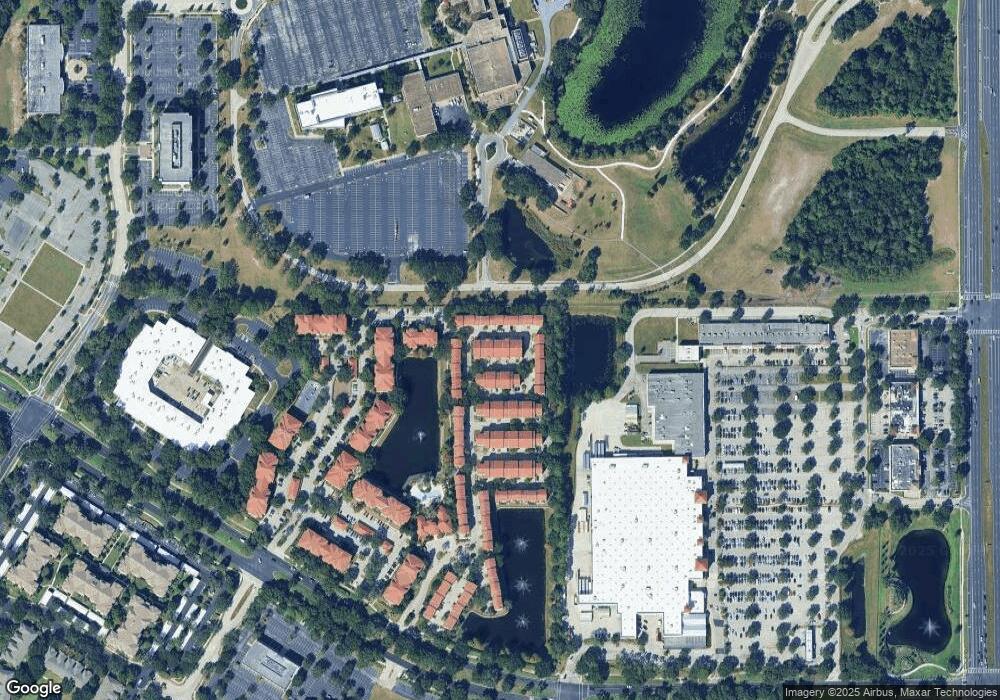

Map

Nearby Homes

- 6135 Metrowest Blvd Unit 105

- 6141 Metrowest Blvd Unit 307

- 6141 Metrowest Blvd Unit 303

- 6119 Metrowest Blvd Unit 106

- 6117 Metrowest Blvd Unit 106

- 6177 Metrowest Blvd Unit 102

- 6177 Metrowest Blvd Unit 303

- 6153 Metrowest Blvd Unit 205

- 6171 Metrowest Blvd Unit 306

- 6105 Metrowest Blvd Unit 103

- 6169 Metrowest Blvd Unit 307

- 6402 Cava Alta Dr Unit 107

- 2484 San Tecla St Unit 309

- 6451 Old Park Ln Unit 110

- 6451 Old Park Ln Unit 204

- 6466 Cava Alta Dr Unit 101

- 2804 Polvadero Ln Unit 107

- 2864 Polana St Unit 106

- 2579 San Tecla St Unit 105

- 6206 Castelven Dr Unit 104

- 6131 Metro Blvd W Unit 119

- 6131 Metrowest Blvd

- 6131 Metrowest Blvd Unit 17-111

- 6131 Metrowest Blvd

- 6131 Metrowest Blvd Unit 109

- 6131 Metrowest Blvd Unit 115

- 6131 Metrowest Blvd Unit 107

- 6131 Metrowest Blvd Unit 113

- 6131 Metrowest Blvd Unit 106N

- 6131 Metrowest Blvd Unit 102

- 6131 Metrowest Blvd Unit 103

- 6131 Metrowest Blvd Unit 116

- 6131 Metrowest Blvd Unit 120

- 6131 Metrowest Blvd Unit 119

- 6131 Metrowest Blvd Unit 118

- 6131 Metrowest Blvd Unit 114

- 6131 Metrowest Blvd Unit 111

- 6131 Metrowest Blvd Unit 110

- 6131 Metrowest Blvd Unit 108

- 6131 Metrowest Blvd Unit 104