Estimated Value: $762,000 - $805,000

3

Beds

3

Baths

1,635

Sq Ft

$480/Sq Ft

Est. Value

About This Home

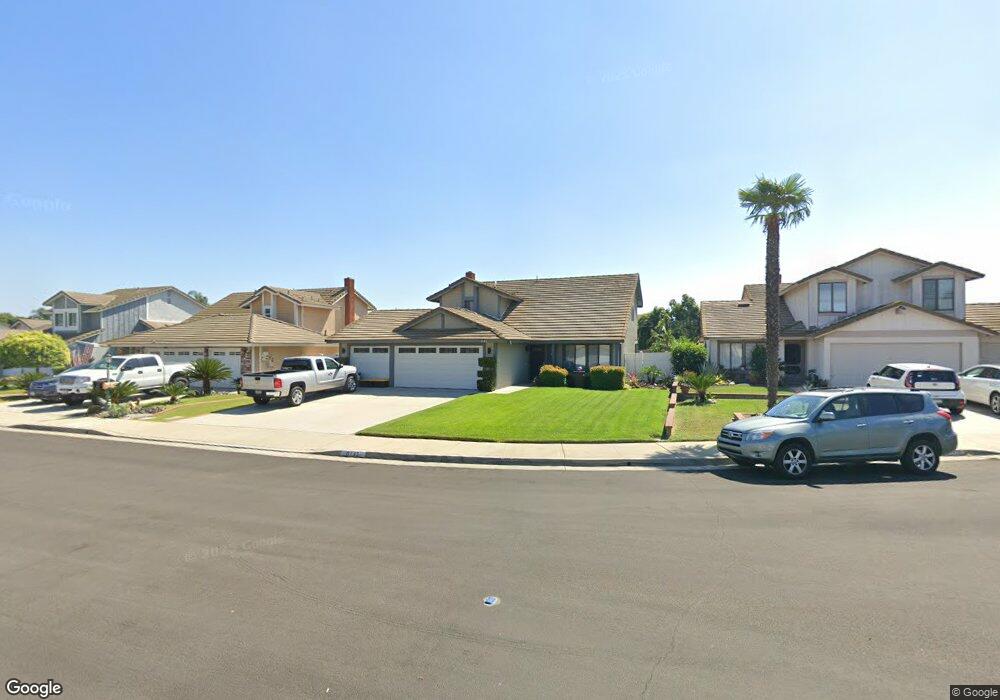

This home is located at 6143 Carter Ct, Chino, CA 91710 and is currently estimated at $784,599, approximately $479 per square foot. 6143 Carter Ct is a home located in San Bernardino County with nearby schools including Howard Cattle Elementary, Magnolia Junior High, and Chino High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 18, 2020

Sold by

Burns Dennis M

Bought by

Burns Dennis M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$215,000

Outstanding Balance

$191,319

Interest Rate

2.8%

Mortgage Type

New Conventional

Estimated Equity

$593,280

Purchase Details

Closed on

Jul 15, 1997

Sold by

Burns Larraine M A

Bought by

Burns Dennis M

Purchase Details

Closed on

Sep 22, 1993

Sold by

Carroll John F and Carroll Marlyn J

Bought by

Burns Dennis M and Burns Larraine M A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$170,100

Interest Rate

6.81%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Burns Dennis M | -- | Ticor Title | |

| Burns Dennis M | -- | -- | |

| Burns Dennis M | $189,000 | World Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Burns Dennis M | $215,000 | |

| Closed | Burns Dennis M | $170,100 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,469 | $321,234 | $80,390 | $240,844 |

| 2024 | $3,469 | $314,936 | $78,814 | $236,122 |

| 2023 | $3,373 | $308,761 | $77,269 | $231,492 |

| 2022 | $3,352 | $302,707 | $75,754 | $226,953 |

| 2021 | $3,286 | $296,772 | $74,269 | $222,503 |

| 2020 | $3,244 | $293,729 | $73,507 | $220,222 |

| 2019 | $3,186 | $287,970 | $72,066 | $215,904 |

| 2018 | $3,116 | $282,324 | $70,653 | $211,671 |

| 2017 | $3,060 | $276,789 | $69,268 | $207,521 |

| 2016 | $2,861 | $271,362 | $67,910 | $203,452 |

| 2015 | $2,804 | $267,286 | $66,890 | $200,396 |

| 2014 | $2,748 | $262,051 | $65,580 | $196,471 |

Source: Public Records

Map

Nearby Homes

- 13555 Magnolia Ave

- 11610 Granville Place

- 13536 Sycamore Ln

- 13775 Harvard Ave

- 6594 Manzanita Ct

- 6169 Winona St

- 6212 Athena St

- 14134 Mountain Ave

- 5962 C St

- 6031 Rosa Ct

- 14212 Willamette Ave

- 13014 Bermuda Ave

- 6162 Davidson St

- 6147 Davidson St

- 12936 Cambridge Ct

- 6570 Encina St

- 14170 Durazno Ave

- 5925 Riverside Dr Unit 12

- 13022 Cypress Ave

- 6441 Susana St

- 6135 Carter Ct

- 6151 Carter Ct

- 6159 Carter Ct

- 6144 Ashley Ct

- 6127 Carter Ct

- 6136 Ashley Ct

- 6152 Ashley Ct

- 6160 Ashley Ct

- 6128 Ashley Ct

- 6167 Carter Ct

- 6142 Carter Ct

- 6150 Carter Ct

- 6134 Carter Ct

- 6168 Ashley Ct

- 6158 Carter Ct

- 13611 Magnolia Ave

- 6126 Carter Ct

- 6108 Schaefer Ave

- 6166 Carter Ct

- 6139 Yorkshire Rd