615 Villa Rd Unit A Springfield, OH 45503

Estimated Value: $92,150 - $101,000

2

Beds

2

Baths

1,088

Sq Ft

$89/Sq Ft

Est. Value

About This Home

This home is located at 615 Villa Rd Unit A, Springfield, OH 45503 and is currently estimated at $96,717, approximately $88 per square foot. 615 Villa Rd Unit A is a home located in Clark County with nearby schools including Kenton Elementary School, Roosevelt Middle School, and Springfield High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 23, 2019

Sold by

Palmer Stephanie A and Frantz Daniel J

Bought by

Properties Plus 1 Llc

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$27,200

Outstanding Balance

$11,111

Interest Rate

4.3%

Mortgage Type

Future Advance Clause Open End Mortgage

Estimated Equity

$85,606

Purchase Details

Closed on

Oct 24, 2006

Sold by

Hixon William E and Hixon Ethel W

Bought by

Palmer Stephanie A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$54,642

Interest Rate

6.5%

Mortgage Type

FHA

Purchase Details

Closed on

Sep 29, 2000

Sold by

Hakel Carol

Bought by

Hixon William E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$30,000

Interest Rate

7.86%

Purchase Details

Closed on

Feb 25, 2000

Sold by

Hartman Ruth M

Bought by

Hakel Carol

Purchase Details

Closed on

Feb 23, 1996

Sold by

Layton Charles T

Bought by

Ruth M Hartman

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Properties Plus 1 Llc | $34,000 | None Available | |

| Palmer Stephanie A | $55,500 | Ohio Real Estate Title | |

| Hixon William E | $45,000 | -- | |

| Hakel Carol | -- | -- | |

| Ruth M Hartman | $45,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Properties Plus 1 Llc | $27,200 | |

| Previous Owner | Palmer Stephanie A | $54,642 | |

| Previous Owner | Hixon William E | $30,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $612 | $12,380 | $2,020 | $10,360 |

| 2023 | $612 | $12,380 | $2,020 | $10,360 |

| 2022 | $626 | $12,380 | $2,020 | $10,360 |

| 2021 | $710 | $12,920 | $1,930 | $10,990 |

| 2020 | $712 | $12,920 | $1,930 | $10,990 |

| 2019 | $696 | $12,920 | $1,930 | $10,990 |

| 2018 | $626 | $11,190 | $1,490 | $9,700 |

| 2017 | $625 | $12,296 | $1,488 | $10,808 |

| 2016 | $626 | $12,296 | $1,488 | $10,808 |

| 2015 | $773 | $14,186 | $1,750 | $12,436 |

| 2014 | $770 | $14,186 | $1,750 | $12,436 |

| 2013 | $762 | $14,186 | $1,750 | $12,436 |

Source: Public Records

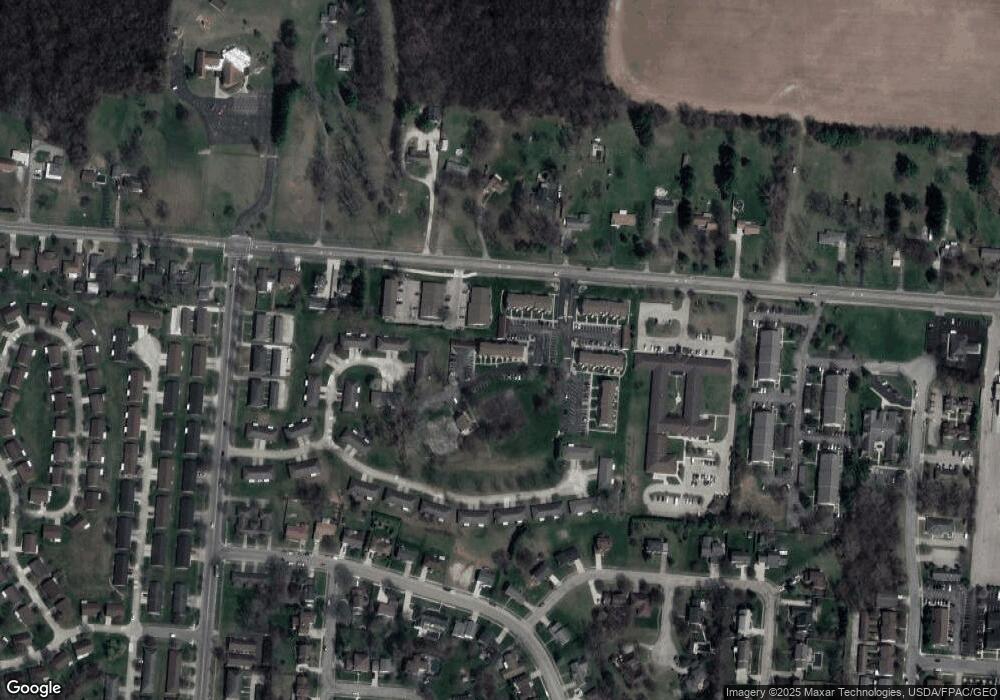

Map

Nearby Homes

- 732 Grandview Dr Unit 732

- 647 Villa Rd Unit A

- 542 Villa Rd

- 2933 Stonehaven Dr

- 2933 Bahia Dr

- 1225 Vester Ave

- 2813 Wellsford Dr

- 537 Rensselaer St

- 2677 Carousel Dr

- 3032 Armsgate Rd Unit 25

- 2683 Home Orchard Dr

- 3029 Bradford Dr Unit 46

- 3046 Brixton Dr W Unit 173

- 2524 Home Orchard Dr

- 2540 Rebecca Dr

- 2516 Balsam Dr

- 1506 Hyannis Dr

- 1148 Foxboro Rd

- 2541 Derr Rd

- 2408 Balsam Dr

- 615 Villa Rd Unit H

- 615 Villa Rd Unit I

- 615 Villa Rd Unit G

- 615 Villa Rd Unit F

- 615 Villa Rd Unit J

- 615 Villa Rd

- 615 Villa Rd Unit K

- 615 Villa Rd Unit C

- 615 Villa Rd Unit B

- 615 Villa Rd Unit L

- 615 Villa Rd Unit E

- 615 Villa Rd Unit 615-K

- 615 Villa Rd Unit T

- 615 Villa Rd Unit 615F

- 615 Villa Rd J Unit J

- 613 Villa #J Rd

- 613 Villa Road H Unit H

- 720 Grandview Dr Unit 720

- 613 Villa Rd Unit H

- 613 Villa Rd Unit I