6176 Park St Georgetown, IN 47122

Estimated Value: $569,000 - $633,553

3

Beds

5

Baths

3,488

Sq Ft

$174/Sq Ft

Est. Value

About This Home

This home is located at 6176 Park St, Georgetown, IN 47122 and is currently estimated at $605,518, approximately $173 per square foot. 6176 Park St is a home located in Floyd County with nearby schools including Georgetown Elementary School, Highland Hills Middle School, and Floyd Central High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 16, 2018

Sold by

Elijah Wagner Lura E

Bought by

Wagner Lura E Elijah

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$176,798

Outstanding Balance

$149,158

Interest Rate

3.93%

Mortgage Type

New Conventional

Estimated Equity

$456,360

Purchase Details

Closed on

Jan 13, 2018

Sold by

Testamentary Trust

Bought by

Elijah Wager Lura E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$176,798

Outstanding Balance

$149,158

Interest Rate

3.93%

Mortgage Type

New Conventional

Estimated Equity

$456,360

Purchase Details

Closed on

Aug 15, 2008

Sold by

Wagner Donald A and Wagner Laura E Elijah

Bought by

Wagner Laura E Elijah and Gerald Elijah Testmentary Trust

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wagner Lura E Elijah | -- | -- | |

| Elijah Wager Lura E | -- | -- | |

| Wagner Laura E Elijah | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Elijah Wager Lura E | $176,798 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,739 | $422,300 | $74,000 | $348,300 |

| 2023 | $5,934 | $434,400 | $74,000 | $360,400 |

| 2022 | $4,069 | $438,800 | $74,000 | $364,800 |

| 2021 | $3,808 | $412,500 | $74,000 | $338,500 |

| 2020 | $3,786 | $416,400 | $74,000 | $342,400 |

| 2019 | $3,479 | $397,200 | $74,000 | $323,200 |

| 2018 | $3,171 | $362,600 | $74,000 | $288,600 |

| 2017 | $3,289 | $353,800 | $74,000 | $279,800 |

| 2016 | $2,855 | $353,700 | $74,000 | $279,700 |

| 2014 | $3,078 | $325,600 | $74,000 | $251,600 |

| 2013 | -- | $320,000 | $74,000 | $246,000 |

Source: Public Records

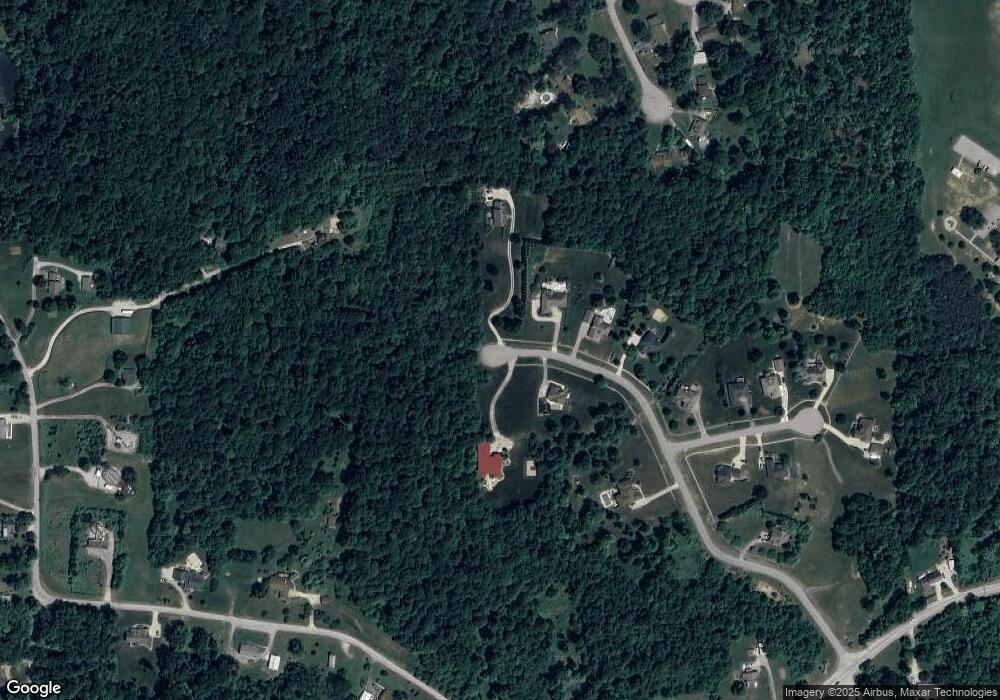

Map

Nearby Homes

- 6201 Cherry Grove Ct

- 6160 Park St

- 6812 Corydon Ridge Rd

- 6121 State Road 62

- 7017 Oaken Ln

- 7007 Oaken Ln

- The Solara Plan at The Springs of Old Georgetown

- The Brooklynn Plan at The Springs of Old Georgetown

- The Emerson Plan at The Springs of Old Georgetown

- 1042 Dunbarton Way Unit LOT 210

- 1040 Dunbarton Way Unit LOT 209

- 1036 Dunbarton Way Unit LOT 207

- 1032 Dunbarton Way Unit LOT 205

- 1038 Dunbarton Way Unit LOT 208

- 1135 Pinewood Dr

- 1213 Oakes Way

- Avondale Plan at Poplar Woods

- Allen Plan at Poplar Woods

- Laurel Plan at Poplar Woods

- Independence Plan at Poplar Woods