62 Maegan Place Unit 6 Thousand Oaks, CA 91362

Estimated Value: $464,000 - $528,000

2

Beds

2

Baths

850

Sq Ft

$583/Sq Ft

Est. Value

About This Home

This home is located at 62 Maegan Place Unit 6, Thousand Oaks, CA 91362 and is currently estimated at $495,131, approximately $582 per square foot. 62 Maegan Place Unit 6 is a home located in Ventura County with nearby schools including Conejo Elementary School, Colina Middle School, and Westlake High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 11, 2000

Sold by

Estrada Carmen

Bought by

Vite Joel

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$136,285

Outstanding Balance

$48,967

Interest Rate

7.9%

Mortgage Type

FHA

Estimated Equity

$446,164

Purchase Details

Closed on

Sep 22, 2000

Sold by

Pike Guy W

Bought by

Vite Joel

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$136,285

Outstanding Balance

$48,967

Interest Rate

7.9%

Mortgage Type

FHA

Estimated Equity

$446,164

Purchase Details

Closed on

Sep 22, 1998

Sold by

Federal Home Loan Mortgage Corporation

Bought by

Pike Guy W

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$108,018

Interest Rate

6.88%

Mortgage Type

VA

Purchase Details

Closed on

Jun 25, 1998

Sold by

Panosian Gary D

Bought by

Federal Home Loan Mortgage Corporation

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Vite Joel | -- | Stewart Title | |

| Vite Joel | $140,500 | Stewart Title | |

| Pike Guy W | $106,000 | Chicago Title Co | |

| Federal Home Loan Mortgage Corporation | $98,000 | First American Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Vite Joel | $136,285 | |

| Previous Owner | Pike Guy W | $108,018 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,600 | $211,686 | $84,675 | $127,011 |

| 2024 | $2,600 | $207,536 | $83,015 | $124,521 |

| 2023 | $2,503 | $203,467 | $81,387 | $122,080 |

| 2022 | $2,455 | $199,478 | $79,791 | $119,687 |

| 2021 | $2,409 | $195,567 | $78,226 | $117,341 |

| 2020 | $2,023 | $193,564 | $77,425 | $116,139 |

| 2019 | $1,968 | $189,769 | $75,907 | $113,862 |

| 2018 | $1,928 | $186,049 | $74,419 | $111,630 |

| 2017 | $1,890 | $182,402 | $72,960 | $109,442 |

| 2016 | $1,871 | $178,827 | $71,530 | $107,297 |

| 2015 | $1,837 | $176,142 | $70,456 | $105,686 |

| 2014 | $1,811 | $172,694 | $69,077 | $103,617 |

Source: Public Records

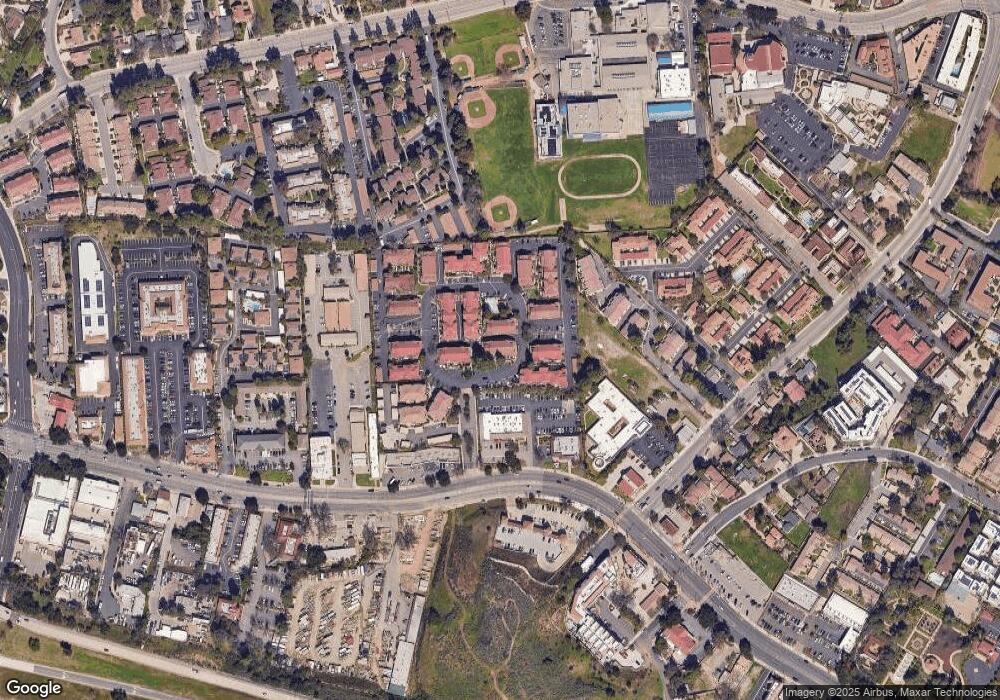

Map

Nearby Homes

- 68 Maegan Place Unit 7

- 110 Maegan Place Unit 13

- 146 Maegan Place Unit 9

- 1710 E Thousand Oaks Blvd

- 1344 E Hillcrest Dr Unit 34

- 96 Erbes Rd

- 170 Erbes Rd

- 295 Toyon Ct

- 2193 Los Feliz Dr Unit 63

- 1000 E Thousand Oaks Blvd

- 567 Lone Oak Dr

- 978 Bower Way

- 1649 Hauser Cir

- 2394 Pleasant Way Unit J

- 0 Rimrock Unit SR25274785

- 327 Wynn Ct

- 2450 Pleasant Way Unit J

- 2450 Pleasant Way Unit N

- 515 Houston Dr

- 764 Brossard Dr

- 62 Maegan Place Unit 7

- 62 Maegan Place Unit N7

- 62 Maegan Place Unit 9

- 62 Maegan Place Unit 5

- 62 Maegan Place Unit 8

- 62 Maegan Place Unit 4

- 62 Maegan Place Unit 3

- 62 Maegan Place Unit 2

- 62 Maegan Place Unit 1

- 68 Maegan Place

- 68 Maegan Place Unit 9

- 68 Maegan Place Unit O3

- 68 Maegan Place Unit 5

- 68 Maegan Place Unit O9

- 68 Maegan Place Unit 6

- 68 Maegan Place Unit 8

- 68 Maegan Place Unit 4

- 68 Maegan Place Unit 2

- 6 Maegan Place

- 110 Maegan Place Unit 2