620 Highland St West Concord, MN 55985

Estimated Value: $188,000 - $217,000

3

Beds

2

Baths

2,066

Sq Ft

$97/Sq Ft

Est. Value

About This Home

This home is located at 620 Highland St, West Concord, MN 55985 and is currently estimated at $200,420, approximately $97 per square foot. 620 Highland St is a home located in Dodge County with nearby schools including Triton Elementary School, Triton Middle School, and Triton High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 14, 2021

Sold by

Schollmeier Alan James and Schollmeier Nancy Beth

Bought by

Ulrich Dale Robert

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$168,692

Outstanding Balance

$155,152

Interest Rate

3.11%

Mortgage Type

VA

Estimated Equity

$45,268

Purchase Details

Closed on

Feb 1, 2016

Sold by

Bishop Mary Jane

Bought by

Schollmeier Alan James and Schollmeier Nancy Beth

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$61,483

Interest Rate

3.95%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ulrich Dale Robert | $164,900 | None Available | |

| Schollmeier Alan James | $58,000 | Attorney |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ulrich Dale Robert | $168,692 | |

| Previous Owner | Schollmeier Alan James | $61,483 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,502 | $174,000 | $14,600 | $159,400 |

| 2024 | $2,572 | $171,000 | $14,600 | $156,400 |

| 2023 | $2,552 | $175,100 | $14,600 | $160,500 |

| 2022 | $2,450 | $166,900 | $14,600 | $152,300 |

| 2021 | $2,034 | $138,000 | $14,600 | $123,400 |

| 2020 | $1,966 | $89,300 | $9,300 | $80,000 |

| 2019 | $1,782 | $80,200 | $9,300 | $70,900 |

| 2018 | $1,800 | $63,000 | $9,300 | $53,700 |

| 2017 | $1,092 | $58,000 | $9,300 | $48,700 |

| 2016 | $1,098 | $57,400 | $9,300 | $48,100 |

| 2015 | $1,066 | $53,600 | $9,300 | $44,300 |

| 2014 | $1,016 | $0 | $0 | $0 |

Source: Public Records

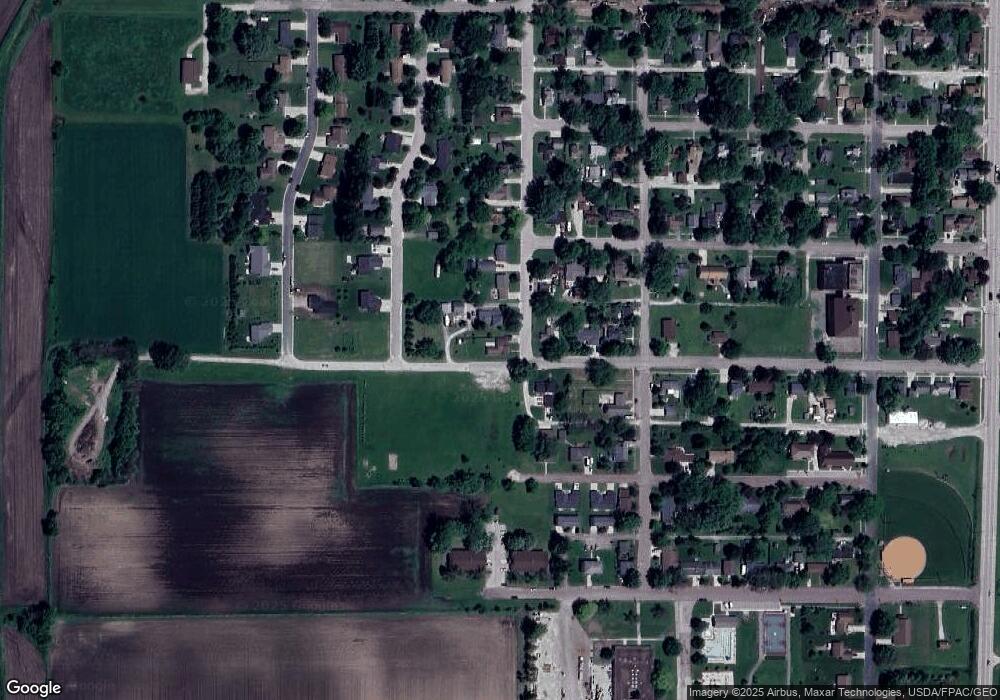

Map

Nearby Homes

- 501 Shady Ln

- 520 State St

- 215 Irvin St

- 416 State St

- 113 Olive St

- 55570 State Highway 56

- 124 Ellington St

- 18216 535th St

- County Road 22

- 20128 554th St

- 59879 185th Ave

- 54185 232nd Ave

- 22842 530th St

- 20918 604th St

- xxxxx 530th St

- 62539 185th Ave

- 1218 Highway St N

- 809 5th Ave NW

- 406 7th St NW

- 12224 270th St E