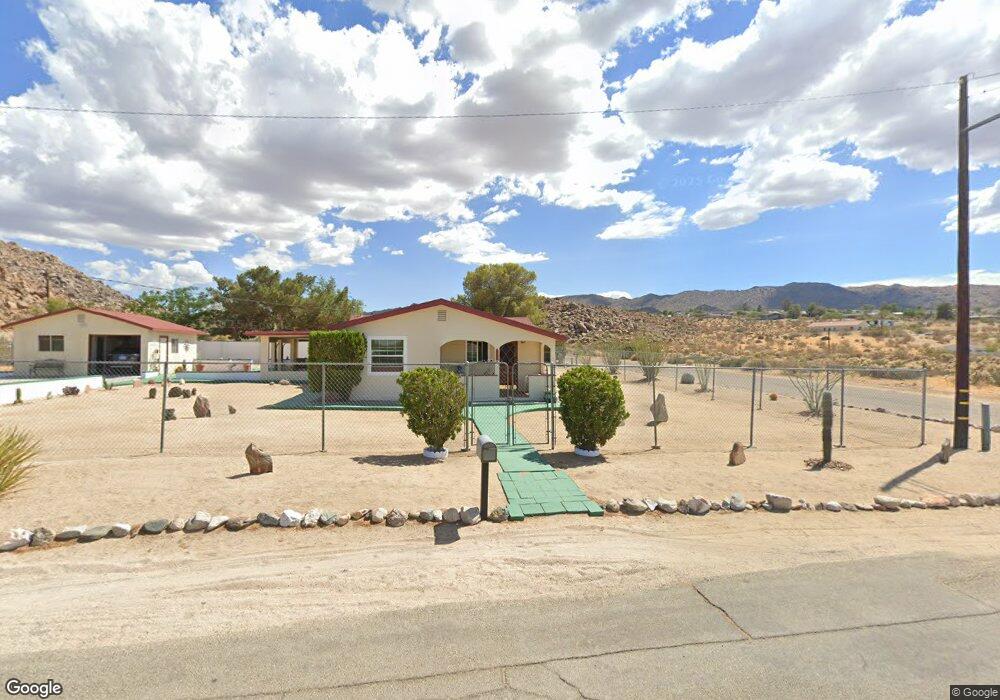

62015 Easterly Place Joshua Tree, CA 92252

Estimated Value: $269,000 - $326,000

1

Bed

2

Baths

1,066

Sq Ft

$271/Sq Ft

Est. Value

About This Home

This home is located at 62015 Easterly Place, Joshua Tree, CA 92252 and is currently estimated at $289,359, approximately $271 per square foot. 62015 Easterly Place is a home located in San Bernardino County with nearby schools including Joshua Tree Elementary School, La Contenta Middle School, and Yucca Valley High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 7, 2013

Sold by

Ortiz Steven Lee

Bought by

Ortiz Douglas Alan

Current Estimated Value

Purchase Details

Closed on

Dec 26, 2007

Sold by

Ortiz Betty Jane

Bought by

Ortiz Douglas Alan

Purchase Details

Closed on

Nov 2, 2005

Sold by

Ortiz Douglas Alan

Bought by

Ortiz Betty Jane and The Betty Jane Ortiz Seperate

Purchase Details

Closed on

Sep 27, 2004

Sold by

Ortiz Betty Jane

Bought by

Ortiz Douglas Alan

Purchase Details

Closed on

Sep 21, 1994

Sold by

Hud

Bought by

Ortiz Betty Jane and Betty Jane Ortiz Separate Prop

Purchase Details

Closed on

Jan 5, 1994

Sold by

Hansen Hans Christian and Hansen Charlene

Bought by

Bancboston Mtg Corp

Purchase Details

Closed on

Jan 12, 1993

Sold by

Bancboston Mtg Corp

Bought by

Hud

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ortiz Douglas Alan | $10,000 | None Available | |

| Ortiz Douglas Alan | -- | None Available | |

| Ortiz Betty Jane | -- | -- | |

| Ortiz Douglas Alan | -- | -- | |

| Ortiz Betty Jane | $41,000 | Commonwealth Land Title Co | |

| Bancboston Mtg Corp | -- | First Southwestern Title Co | |

| Hud | -- | First Southwestern Title Co |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,085 | $71,293 | $11,620 | $59,673 |

| 2024 | $1,043 | $69,895 | $11,392 | $58,503 |

| 2023 | $1,022 | $68,525 | $11,169 | $57,356 |

| 2022 | $1,002 | $67,181 | $10,950 | $56,231 |

| 2021 | $988 | $65,863 | $10,735 | $55,128 |

| 2020 | $978 | $65,188 | $10,625 | $54,563 |

| 2019 | $1,023 | $63,910 | $10,417 | $53,493 |

| 2018 | $856 | $62,657 | $10,213 | $52,444 |

| 2017 | $847 | $61,429 | $10,013 | $51,416 |

| 2016 | $833 | $60,225 | $9,817 | $50,408 |

| 2015 | $797 | $59,321 | $9,670 | $49,651 |

| 2014 | $821 | $58,159 | $9,481 | $48,678 |

Source: Public Records

Map

Nearby Homes

- 62070 Easterly Place

- 61981 Sunburst Cir

- 61879 Valley View Cir

- 61956 Mountain View Cir

- 61855 Valley View Cir

- 6935 Alturas Dr

- 61975 Sunburst Cir

- 61851 Sunburst Cir

- 61869 Grand View Cir

- 61945 Grand View Cir

- 61853 Grand View Cir

- 61891 El Reposo Cir

- 6967 Park Blvd

- 62147 Desert Air Rd

- 6884 Park Blvd

- 61936 El Reposo Cir

- 62004 Sunburst Cir

- 62016 Valley View Cir

- 16890 El Reposo Cir

- 61998 El Reposo Cir

- 0 East Pkwy Unit DC12010499

- 0 East Pkwy Unit 17-268590PS

- 0 East Pkwy Unit CRJT23211794

- 0 East Pkwy Unit JT23211794

- 0 East Pkwy Unit 219090466PS

- 0 East Pkwy Unit 219090465PS

- 0 East Pkwy Unit IV20094397

- 0 East Pkwy Unit 17268590DA

- 6891 Easterly Dr

- 62060 Easterly Place

- 62010 Easterly Place

- 61951 Sunburst Cir

- 61952 Sunburst Cir

- 6837 Easterly Dr

- 61950 Sunburst Cir

- 6850 Easterly Dr

- 61964 Sunburst Cir

- 61953 Sunburst Cir

- 6917 Easterly Dr