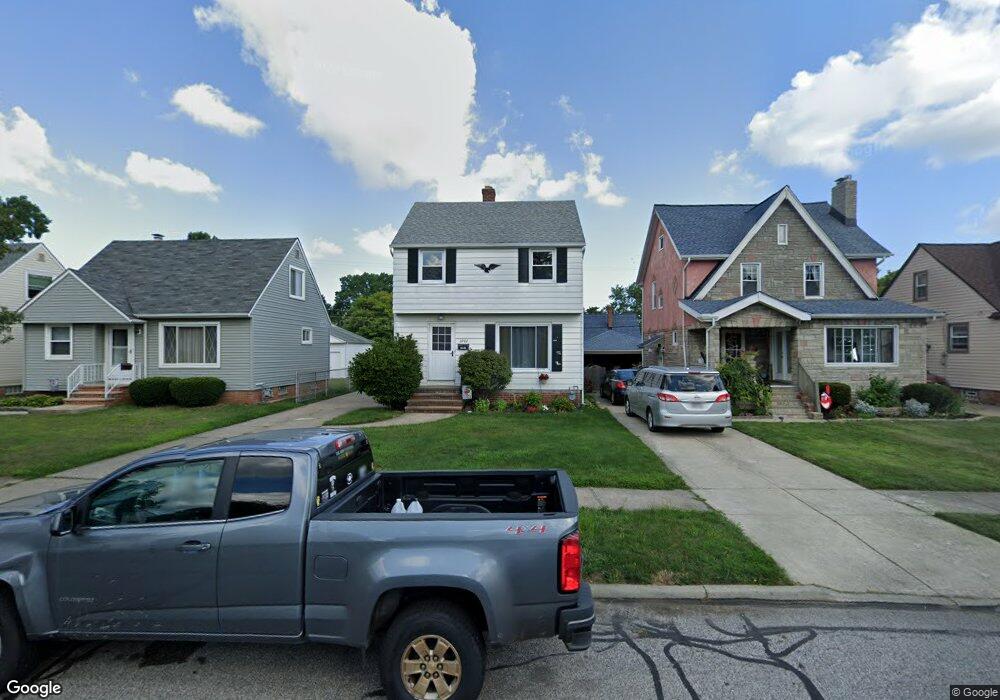

6202 Westlake Ave Cleveland, OH 44129

Estimated Value: $184,244 - $219,000

3

Beds

1

Bath

1,309

Sq Ft

$152/Sq Ft

Est. Value

About This Home

This home is located at 6202 Westlake Ave, Cleveland, OH 44129 and is currently estimated at $198,561, approximately $151 per square foot. 6202 Westlake Ave is a home located in Cuyahoga County with nearby schools including Thoreau Park Elementary School, Shiloh Middle School, and Parma High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 10, 2003

Sold by

Cline Karen J and Cline Ronnie

Bought by

Koppa James G and Koppa Deneen M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$123,982

Outstanding Balance

$53,970

Interest Rate

6.3%

Mortgage Type

FHA

Estimated Equity

$144,591

Purchase Details

Closed on

Mar 23, 2000

Sold by

Cline Ronnie W and Cline Karen J

Bought by

Cline Karen J

Purchase Details

Closed on

Oct 29, 1998

Sold by

Hodous Mary Lee and Hodous Dale A

Bought by

Cline Ronnie W

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$102,250

Interest Rate

6.78%

Mortgage Type

FHA

Purchase Details

Closed on

Aug 30, 1978

Sold by

Gengic Daniel and L A

Bought by

Hodous Mary Lee

Purchase Details

Closed on

Jan 1, 1975

Bought by

Gengic Daniel and L A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Koppa James G | $125,000 | City Title Company | |

| Cline Karen J | -- | -- | |

| Cline Ronnie W | $117,000 | Ohio Title Corporation | |

| Hodous Mary Lee | $54,500 | -- | |

| Gengic Daniel | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Koppa James G | $123,982 | |

| Closed | Cline Ronnie W | $102,250 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,373 | $55,195 | $9,940 | $45,255 |

| 2023 | $3,019 | $42,420 | $8,190 | $34,230 |

| 2022 | $2,990 | $42,420 | $8,190 | $34,230 |

| 2021 | $3,075 | $42,420 | $8,190 | $34,230 |

| 2020 | $2,693 | $32,620 | $6,300 | $26,320 |

| 2019 | $2,577 | $93,200 | $18,000 | $75,200 |

| 2018 | $2,593 | $32,620 | $6,300 | $26,320 |

| 2017 | $2,503 | $29,370 | $5,250 | $24,120 |

| 2016 | $2,487 | $29,370 | $5,250 | $24,120 |

| 2015 | $2,377 | $29,370 | $5,250 | $24,120 |

| 2014 | $2,377 | $29,970 | $5,360 | $24,610 |

Source: Public Records

Map

Nearby Homes

- 5815 Westlake Ave

- 6011 Theota Ave

- 5914 Forest Ave

- 6606 Theota Ave

- 6215 Forest Ave

- 6306 Gilbert Ave

- 5618 Bradley Ave

- 6711 Forest Ave

- 6014 Laverne Ave

- 5810 Laverne Ave

- 6903 Forest Ave

- 6211 Luelda Ave

- 5212 Wood Ave

- 6403 Kenneth Ave

- 5000 Torrington Ave

- 5906 Velma Ave

- 5511 Velma Ave

- 6021 Snow Rd

- 4910 Russell Ave

- 5521 W 48th St

- 6206 Westlake Ave

- 6106 Westlake Ave

- 6210 Westlake Ave

- 6214 Westlake Ave

- 6205 Ridgewood Ave

- 6102 Westlake Ave

- 6111 Ridgewood Ave

- 6207 Ridgewood Ave

- 6107 Ridgewood Ave

- 6211 Ridgewood Ave

- 6302 Westlake Ave

- 6010 Westlake Ave

- 6103 Ridgewood Ave

- 6215 Ridgewood Ave

- 6203 Westlake Ave

- 6111 Westlake Ave

- 6207 Westlake Ave

- 6211 Westlake Ave

- 6107 Westlake Ave

- 6304 Westlake Ave