621 Azalea St Culpeper, VA 22701

Estimated Value: $323,432 - $360,000

3

Beds

2

Baths

1,056

Sq Ft

$328/Sq Ft

Est. Value

About This Home

This home is located at 621 Azalea St, Culpeper, VA 22701 and is currently estimated at $346,608, approximately $328 per square foot. 621 Azalea St is a home located in Culpeper County with nearby schools including Sycamore Park Elementary School, Culpeper Middle School, and Culpeper County High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 2, 2018

Sold by

Parris Shirley E

Bought by

Parris Gary P

Current Estimated Value

Purchase Details

Closed on

Sep 23, 2008

Sold by

Wells Fargo Bank Na

Bought by

Parris Gene A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$145,354

Outstanding Balance

$96,773

Interest Rate

6.54%

Mortgage Type

FHA

Estimated Equity

$249,835

Purchase Details

Closed on

Dec 28, 2007

Sold by

Equity Trustees Llc Sub Tr and Yancey Matthew C

Bought by

Wells Fargo Bank Na

Purchase Details

Closed on

Sep 25, 1998

Sold by

Breeden B Sue

Bought by

Yancey Matthew C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$97,900

Interest Rate

6.87%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Parris Gary P | -- | None Available | |

| Parris Gene A | $148,000 | -- | |

| Wells Fargo Bank Na | $204,000 | -- | |

| Yancey Matthew C | $97,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Parris Gene A | $145,354 | |

| Previous Owner | Yancey Matthew C | $97,900 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,395 | $260,200 | $75,100 | $185,100 |

| 2023 | $1,369 | $260,200 | $75,100 | $185,100 |

| 2022 | $1,105 | $200,900 | $65,700 | $135,200 |

| 2021 | $1,270 | $200,900 | $65,700 | $135,200 |

| 2020 | $1,174 | $189,300 | $54,500 | $134,800 |

| 2019 | $1,174 | $189,300 | $54,500 | $134,800 |

| 2018 | $1,082 | $161,500 | $46,300 | $115,200 |

| 2017 | $1,082 | $161,500 | $46,300 | $115,200 |

| 2016 | $1,108 | $151,800 | $36,600 | $115,200 |

| 2015 | $1,108 | $151,800 | $36,600 | $115,200 |

| 2014 | $1,152 | $120,000 | $34,000 | $86,000 |

Source: Public Records

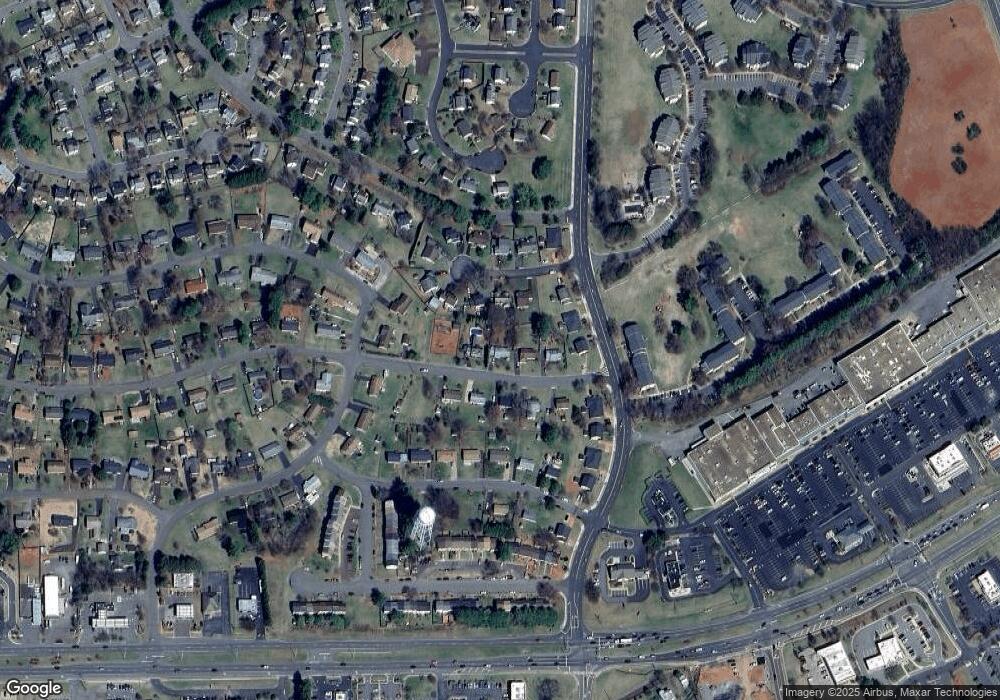

Map

Nearby Homes

- 1568 Harrier Ln

- 613 Overlook St

- 1600 Harrier Ln

- 668 Rocky Knoll Arch

- 501 Barberry St

- 656 Rocky Knoll Arch

- 426 Azalea St

- 1701 Lambert Ct

- 1170 Meander Dr

- 1917 Meadow Lark Dr

- 1109 Farley St

- 1745 Finley Dr

- 14006 Belle Ave

- 1122 Jackson St

- Vantage Plan at ThreeOaks - Freedom 45

- Wonder Plan at ThreeOaks - Freedom 45

- Ascend Plan at ThreeOaks - Freedom 40

- Beacon Plan at ThreeOaks - Freedom 40

- Synergy Plan at ThreeOaks - Freedom 40

- Vantage with Loft Plan at ThreeOaks - Freedom 45