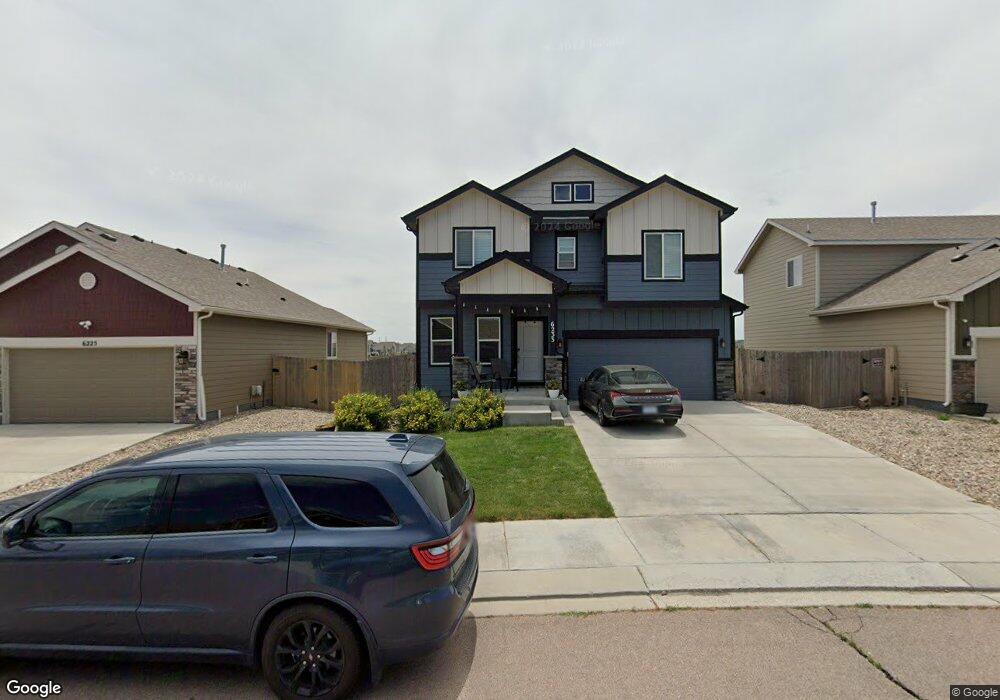

6233 Decker Dr Colorado Springs, CO 80925

Widefield NeighborhoodEstimated Value: $435,527 - $468,000

4

Beds

3

Baths

1,982

Sq Ft

$227/Sq Ft

Est. Value

About This Home

This home is located at 6233 Decker Dr, Colorado Springs, CO 80925 and is currently estimated at $449,882, approximately $226 per square foot. 6233 Decker Dr is a home located in El Paso County with nearby schools including Grand Mountain School, Widefield High School, and Valley Christian Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 16, 2021

Sold by

Muscutt Daniel B

Bought by

Hubbard Micah and Hubbard Mallory

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$455,840

Outstanding Balance

$414,500

Interest Rate

2.9%

Mortgage Type

VA

Estimated Equity

$35,382

Purchase Details

Closed on

Jan 24, 2019

Sold by

Wilson Joshua S and Wilson Megan N

Bought by

Mascutt Daniel B

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$301,342

Interest Rate

4.5%

Mortgage Type

VA

Purchase Details

Closed on

Aug 10, 2017

Sold by

Saint Aubyn Homes Llc

Bought by

Wilson Joshua S and Wilson Megan N

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$288,573

Interest Rate

3.88%

Mortgage Type

VA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hubbard Micah | $440,000 | Legacy Title Group Llc | |

| Mascutt Daniel B | $295,000 | Unified Title Co | |

| Wilson Joshua S | $282,500 | Unified Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hubbard Micah | $455,840 | |

| Previous Owner | Mascutt Daniel B | $301,342 | |

| Previous Owner | Wilson Joshua S | $288,573 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,329 | $32,840 | -- | -- |

| 2024 | $4,278 | $30,620 | $6,040 | $24,580 |

| 2022 | $3,525 | $23,750 | $4,810 | $18,940 |

| 2021 | $3,669 | $24,440 | $4,950 | $19,490 |

| 2020 | $3,338 | $22,020 | $4,330 | $17,690 |

| 2019 | $3,328 | $22,020 | $4,330 | $17,690 |

| 2018 | $3,039 | $19,950 | $4,360 | $15,590 |

| 2017 | $410 | $19,950 | $4,360 | $15,590 |

Source: Public Records

Map

Nearby Homes

- 6115 Fiddle Way

- 10648 Desert Bloom Way

- 6116 Wacissa Dr

- 6157 Cast Iron Dr

- 10525 Abrams Dr

- 10442 Abrams Dr

- 10604 Deer Meadow Cir

- 10886 Matta Dr

- 10420 Deer Meadow Cir

- 10867 Matta Dr

- 6484 Chaplin Dr

- 10463 Desert Bloom Way

- 10394 Abrams Dr

- 10405 Abrams Dr

- 6152 Water Trough Trail

- 11058 Tarbell Dr

- 6142 Mumford Dr

- 6579 Lamine Dr

- 6119 Mumford Dr

- 10634 Abrams Dr

- 6225 Decker Dr

- 6241 Decker Dr

- 6224 Decker Dr

- 6232 Decker Dr

- 6257 Decker Dr

- 6240 Decker Dr

- 6248 Decker Dr

- 6216 Decker Dr

- 6265 Decker Dr

- 6256 Decker Dr

- 10681 Cattle Baron Way

- 10671 Cattle Baron Way

- 6273 Decker Dr

- 10661 Cattle Baron Way

- 6264 Decker Dr

- 6217 Decker Dr

- 6272 Decker Dr

- 10641 Cattle Baron Way

- 6209 Decker Dr

- 6280 Decker Dr