Estimated Value: $963,965 - $1,109,000

5

Beds

3

Baths

2,848

Sq Ft

$365/Sq Ft

Est. Value

About This Home

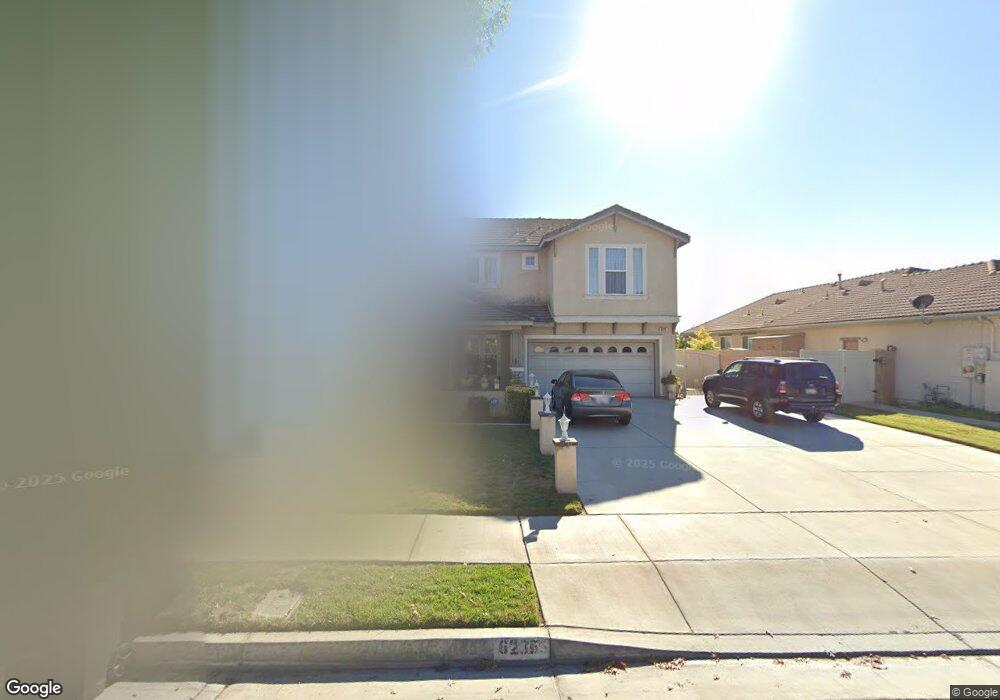

This home is located at 6235 Pablo St, Chino, CA 91710 and is currently estimated at $1,038,491, approximately $364 per square foot. 6235 Pablo St is a home located in San Bernardino County with nearby schools including Howard Cattle Elementary, Magnolia Junior High, and Chino High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 28, 2013

Sold by

Ancheta Victoria B

Bought by

Cacayuran Ancheta Victoria B and Cacayuran Ancheta Reynaldo

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$260,000

Outstanding Balance

$66,069

Interest Rate

4.27%

Mortgage Type

New Conventional

Estimated Equity

$972,422

Purchase Details

Closed on

Apr 14, 2003

Sold by

Ancheta Reynaldo C

Bought by

Ancheta Victoria B

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$339,850

Interest Rate

5.77%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Cacayuran Ancheta Victoria B | -- | None Available | |

| Ancheta Victoria B | -- | Fidelity | |

| Ancheta Victoria B | $425,000 | Fidelity |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Cacayuran Ancheta Victoria B | $260,000 | |

| Closed | Ancheta Victoria B | $339,850 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,892 | $624,711 | $215,372 | $409,339 |

| 2024 | $6,892 | $612,462 | $211,149 | $401,313 |

| 2023 | $6,701 | $600,453 | $207,009 | $393,444 |

| 2022 | $6,654 | $588,679 | $202,950 | $385,729 |

| 2021 | $6,519 | $577,137 | $198,971 | $378,166 |

| 2020 | $6,433 | $571,219 | $196,931 | $374,288 |

| 2019 | $6,320 | $560,019 | $193,070 | $366,949 |

| 2018 | $6,179 | $549,038 | $189,284 | $359,754 |

| 2017 | $6,070 | $538,273 | $185,573 | $352,700 |

| 2016 | $5,675 | $527,718 | $181,934 | $345,784 |

| 2015 | $5,561 | $519,791 | $179,201 | $340,590 |

| 2014 | $5,452 | $509,609 | $175,691 | $333,918 |

Source: Public Records

Map

Nearby Homes

- 13014 Bermuda Ave

- 12936 Cambridge Ct

- 6031 Rosa Ct

- 6441 Susana St

- 13022 Cypress Ave

- 13006 Falcon Place

- 5925 Riverside Dr Unit 12

- 12951 Red Cedar Way

- 12947 Robin Ln

- 12811 Oaks Ave

- 6630 Mogano Dr

- 13555 Magnolia Ave

- 6648 Riverside Dr Unit 3

- 13119 San Antonio Ave

- 12689 Cypress Ave

- 4610 Avondale Ct

- 11610 Granville Place

- 12951 Benson Ave Unit 118

- 12796 17th St

- 13536 Sycamore Ln