Estimated Value: $681,818 - $731,000

3

Beds

3

Baths

1,958

Sq Ft

$359/Sq Ft

Est. Value

About This Home

This home is located at 624 Serpa Ranch Rd, Tracy, CA 95377 and is currently estimated at $703,455, approximately $359 per square foot. 624 Serpa Ranch Rd is a home located in San Joaquin County with nearby schools including George Kelly Elementary School, John C. Kimball High School, and Tracy Independent Study Charter School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 26, 2020

Sold by

Martinez Michael Joseph and Martinez Sirsey Helen

Bought by

Martinez Michael Joseph and Martinez Sirsey Helen

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$461,000

Outstanding Balance

$409,403

Interest Rate

3.3%

Mortgage Type

New Conventional

Estimated Equity

$294,052

Purchase Details

Closed on

Apr 19, 2019

Sold by

Voress Chester J and Voress Stephanie K

Bought by

Martinez Michael and Martinez Sirsey

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$465,000

Interest Rate

4.4%

Mortgage Type

New Conventional

Purchase Details

Closed on

Oct 3, 2005

Sold by

Standard Pacific Corp

Bought by

Voress Chester J and Voress Stephanie K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$416,400

Interest Rate

1%

Mortgage Type

Negative Amortization

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Martinez Michael Joseph | -- | Wfg National Title Ins Co | |

| Martinez Michael | $480,000 | Old Republic Title Co San | |

| Voress Chester J | $520,500 | Old Republic Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Martinez Michael Joseph | $461,000 | |

| Closed | Martinez Michael | $465,000 | |

| Previous Owner | Voress Chester J | $416,400 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,291 | $535,444 | $167,325 | $368,119 |

| 2024 | $6,777 | $524,946 | $164,045 | $360,901 |

| 2023 | $6,661 | $514,654 | $160,829 | $353,825 |

| 2022 | $6,798 | $504,564 | $157,676 | $346,888 |

| 2021 | $6,694 | $494,672 | $154,585 | $340,087 |

| 2020 | $6,632 | $489,600 | $153,000 | $336,600 |

| 2019 | $6,709 | $490,000 | $120,000 | $370,000 |

| 2018 | $6,432 | $467,000 | $150,000 | $317,000 |

| 2017 | $5,895 | $434,000 | $150,000 | $284,000 |

| 2016 | $6,028 | $434,000 | $173,000 | $261,000 |

| 2014 | $5,092 | $364,000 | $145,000 | $219,000 |

Source: Public Records

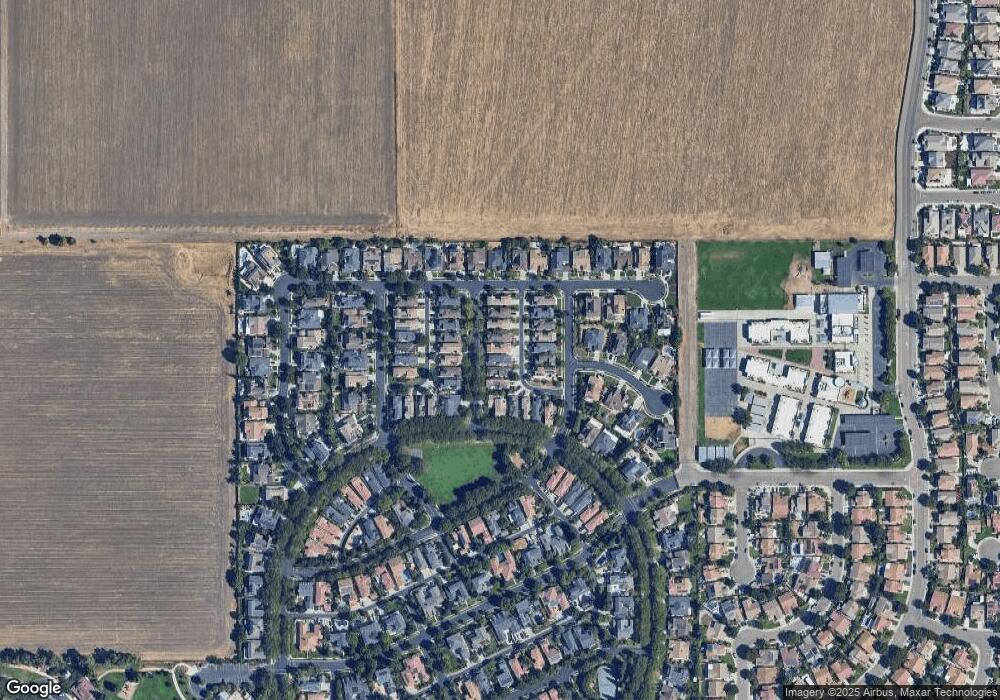

Map

Nearby Homes

- 538 New Haven Dr

- 2736 Daisy Ln

- 1050 Belmont Ln

- 573 Veneto Ct

- 2461 Martin Anthony Ct

- 1322 Cottage Grove Ct

- 2421 Martin Anthony Ct

- 2352 Gretchen Elizabeth Ct

- 2271 Robert Gabriel Dr

- 3168 Hutton Place

- 2280 Gibralter Ln

- 2248 Golden Leaf Ln

- 2228 Carol Ann Dr

- 723 Ann Gabriel Ln

- 2921 Compton Place

- 2432 Tennis Ln

- 2325 Alamo Ct

- 481 Keys Ct

- 2689 Jackson Ave

- 2132 Tennis Ln

- 644 Serpa Ranch Rd

- 574 Serpa Ranch Rd

- 674 Serpa Ranch Rd

- 554 Serpa Ranch Rd

- 694 Serpa Ranch Rd

- 534 Serpa Ranch Rd

- 633 Castle Haven Dr

- 583 Castle Haven Dr

- 653 Castle Haven Dr

- 514 Serpa Ranch Rd

- 563 Castle Haven Dr

- 625 Serpa Ranch Rd

- 575 Serpa Ranch Rd

- 645 Serpa Ranch Rd

- 683 Castle Haven Dr

- 565 Serpa Ranch Rd

- 665 Serpa Ranch Rd

- 543 Castle Haven Dr

- 509 Belmont Ln

Your Personal Tour Guide

Ask me questions while you tour the home.