625 Fulton St Sidney, OH 45365

Estimated Value: $154,000 - $176,000

3

Beds

2

Baths

1,872

Sq Ft

$88/Sq Ft

Est. Value

About This Home

This home is located at 625 Fulton St, Sidney, OH 45365 and is currently estimated at $165,098, approximately $88 per square foot. 625 Fulton St is a home located in Shelby County with nearby schools including Sidney High School, Holy Angels Catholic School, and Christian Academy Schools.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 16, 2015

Sold by

Lukey Veronica and Lukey Nathan A

Bought by

Weymer Zachary K and Weymer Anissa J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$91,832

Outstanding Balance

$62,840

Interest Rate

0.78%

Mortgage Type

VA

Estimated Equity

$102,258

Purchase Details

Closed on

Nov 16, 2007

Sold by

Carey Jamie S and Carey Dana M

Bought by

Lukey Veronica and Lukey Nathan A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$89,200

Interest Rate

6.33%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Oct 24, 2007

Sold by

Snyder Timothy R and Snyder Deborah L

Bought by

Carey Jamie S and Carey Dana M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$89,200

Interest Rate

6.33%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Nov 10, 2006

Sold by

Strunk Larry W and Strunk Vickie J

Bought by

Us Bank Na and Green Tree Home Loan Grantor Trust 2003-

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Weymer Zachary K | $89,900 | Attorney | |

| Lukey Veronica | $86,200 | Dark County Land Title Agenc | |

| Carey Jamie S | -- | First Title Agency Inc | |

| Us Bank Na | $48,667 | Attorney |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Weymer Zachary K | $91,832 | |

| Previous Owner | Lukey Veronica | $89,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,431 | $40,840 | $5,830 | $35,010 |

| 2023 | $1,431 | $40,840 | $5,830 | $35,010 |

| 2022 | $1,172 | $29,280 | $5,060 | $24,220 |

| 2021 | $1,183 | $29,280 | $5,060 | $24,220 |

| 2020 | $1,183 | $29,280 | $5,060 | $24,220 |

| 2019 | $1,030 | $25,570 | $4,270 | $21,300 |

| 2018 | $1,015 | $25,570 | $4,270 | $21,300 |

| 2017 | $1,021 | $25,570 | $4,270 | $21,300 |

| 2016 | $863 | $21,910 | $4,270 | $17,640 |

| 2015 | $890 | $21,910 | $4,270 | $17,640 |

| 2014 | $890 | $21,910 | $4,270 | $17,640 |

| 2013 | $990 | $23,170 | $4,270 | $18,900 |

Source: Public Records

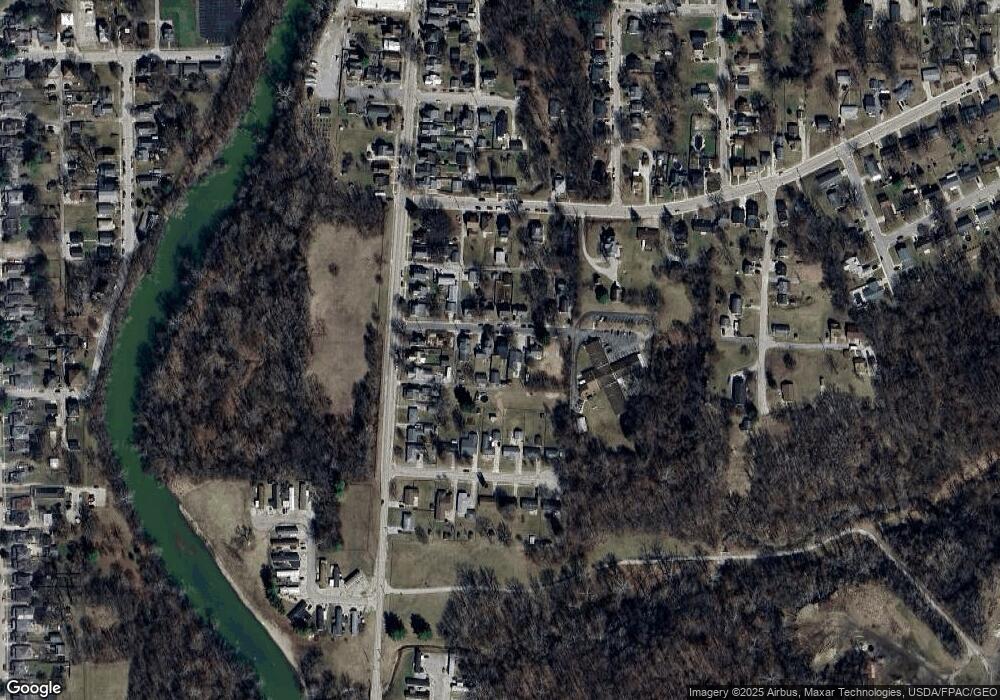

Map

Nearby Homes

- 321 Oldham Ave

- 803 Dingman St

- 115 Brooklyn Ave

- 414 & 416 E Court St

- 807 Dingman St

- 413 E Poplar St

- 109 E Water St

- 420 S Ohio Ave

- 608 S Ohio Ave

- 620 S Ohio Ave

- 119 & 121 W Water St

- 131 Mound St

- 105 N Ohio Ave Unit C

- 107 N Ohio Ave Unit C

- 330 S Walnut Ave

- 315 Washington St

- 610 Fair Rd

- 747 Chestnut Ave

- 608 Foraker Ave

- 812 Chestnut Ave

- 629 Fulton St

- 623 Fulton St

- 633 Fulton St

- 617 Fulton St

- 626 Fulton St

- 622 Fulton St

- 628 Fulton St

- 618 Fulton St

- 504 Brooklyn Ave

- 622 Ardiss Place

- 508 Brooklyn Ave

- 626 Ardiss Place

- 632 Fulton St

- 618 Ardiss Place

- 518 Brooklyn Ave

- 518 Brooklyn Ave

- 428 Brooklyn Ave

- 630 Ardiss Place

- 634 Fulton St

- 614 Ardiss Place