63 El Toro Ct Fairfield, CA 94533

Estimated Value: $235,278 - $271,000

2

Beds

2

Baths

1,000

Sq Ft

$258/Sq Ft

Est. Value

About This Home

This home is located at 63 El Toro Ct, Fairfield, CA 94533 and is currently estimated at $258,320, approximately $258 per square foot. 63 El Toro Ct is a home located in Solano County with nearby schools including Dover Elementary School, Grange Middle School, and Fairfield High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 20, 2021

Sold by

Hung Kwen Hu and Hung Hsueh Mei

Bought by

Hung Kwen Hu and Hung Hsueh Mei

Current Estimated Value

Purchase Details

Closed on

Jul 8, 2010

Sold by

Rice Kim

Bought by

Hung Kwen Hu and Hung Hsueh Mei

Purchase Details

Closed on

Jun 22, 2004

Sold by

Mason Richard L

Bought by

Rice Kim

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$133,600

Interest Rate

5.99%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Nov 17, 1999

Sold by

Beck Linda G

Bought by

Mason Richard L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$55,108

Interest Rate

5.05%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hung Kwen Hu | -- | None Available | |

| Hung Kwen Hu | $41,000 | Fidelity National Title Co | |

| Rice Kim | $167,000 | Placer Title Co | |

| Mason Richard L | $61,500 | Frontier Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Rice Kim | $133,600 | |

| Previous Owner | Mason Richard L | $55,108 | |

| Closed | Rice Kim | $33,400 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $615 | $52,514 | $8,960 | $43,554 |

| 2024 | $615 | $51,485 | $8,785 | $42,700 |

| 2023 | $597 | $50,476 | $8,613 | $41,863 |

| 2022 | $590 | $49,488 | $8,446 | $41,042 |

| 2021 | $585 | $48,519 | $8,281 | $40,238 |

| 2020 | $572 | $48,023 | $8,197 | $39,826 |

| 2019 | $558 | $47,083 | $8,037 | $39,046 |

| 2018 | $575 | $46,161 | $7,880 | $38,281 |

| 2017 | $550 | $45,257 | $7,726 | $37,531 |

| 2016 | $536 | $44,371 | $7,575 | $36,796 |

| 2015 | $501 | $43,706 | $7,462 | $36,244 |

| 2014 | $497 | $42,851 | $7,316 | $35,535 |

Source: Public Records

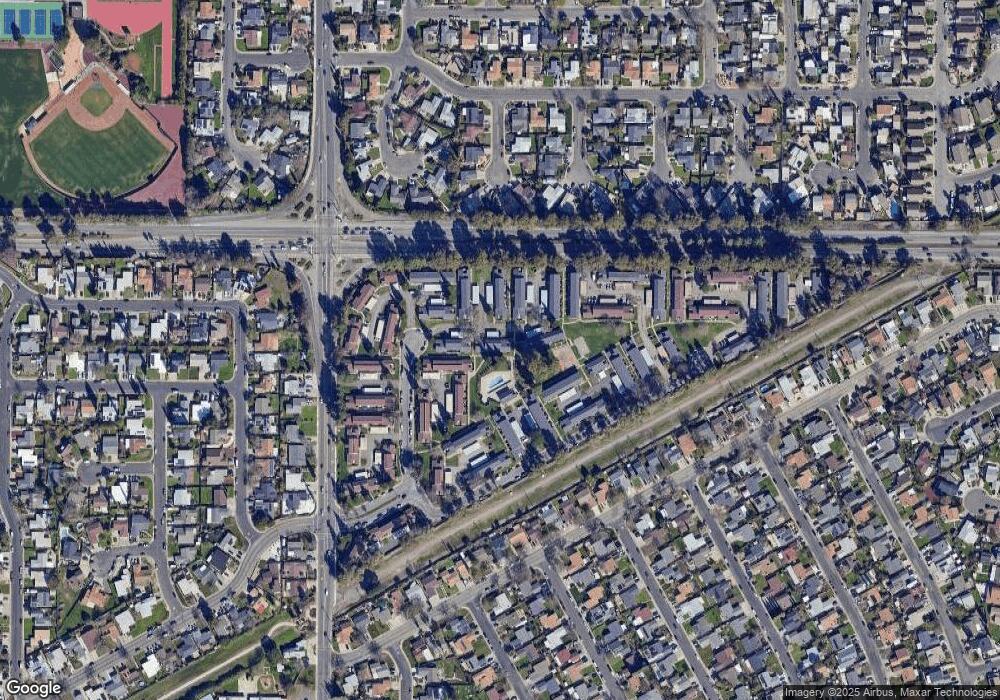

Map

Nearby Homes

- 68 El Toro Ct

- 175 Del Sur Ct

- 217 Del Luz Ct

- 50 El Basset Ct Unit 1

- 237 Del Loma Ct

- 2275 Dover Ave

- 400 Santa Maria Dr

- 2386 Baltic Ct

- 2373 Dawn Way

- 2429 Baltic Dr

- 2049 Swan Way

- 2532 Beaufort Ct

- 2513 Sunrise Dr

- 1012 Sparrow Ln

- 772 Largo Ct

- 849 Finch Way

- Bennett Plan at Villages at Fairfield - Summerwalk at the Villages

- Arlo Plan at Villages at Fairfield - Summerwalk at the Villages

- Darby Plan at Villages at Fairfield - Summerwalk at the Villages

- 2571 Sunrise Dr