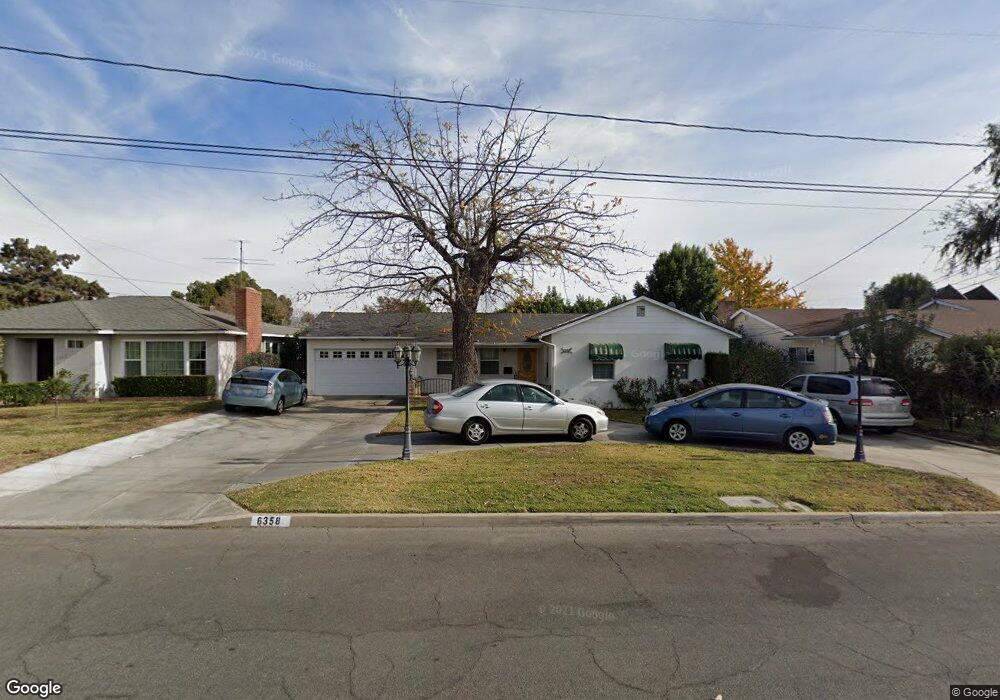

6358 Trelawney Ave Temple City, CA 91780

Estimated Value: $1,290,000 - $1,661,000

3

Beds

2

Baths

1,557

Sq Ft

$934/Sq Ft

Est. Value

About This Home

This home is located at 6358 Trelawney Ave, Temple City, CA 91780 and is currently estimated at $1,453,780, approximately $933 per square foot. 6358 Trelawney Ave is a home located in Los Angeles County with nearby schools including Longden Elementary School, Oak Avenue Intermediate School, and Temple City High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 2, 2015

Sold by

Luu Howard Khanh

Bought by

Luu Family Trust

Current Estimated Value

Purchase Details

Closed on

May 24, 2005

Sold by

Chan Benny Kin Keung and Tse Miffie Chau Mai

Bought by

Luu Howard K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$320,000

Interest Rate

5.72%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

May 28, 2003

Sold by

Huang Dong Qi

Bought by

Chan Benny Kin Keung

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$318,000

Interest Rate

5.71%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jun 11, 1996

Sold by

Paquin Richard

Bought by

Huang Dong Qi

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$175,000

Interest Rate

8.01%

Mortgage Type

Balloon

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Luu Family Trust | -- | None Available | |

| Luu Howard K | $768,000 | Southland Title | |

| Chan Benny Kin Keung | $467,000 | Investors Title Company | |

| Huang Dong Qi | $247,000 | First American |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Luu Howard K | $320,000 | |

| Previous Owner | Chan Benny Kin Keung | $318,000 | |

| Previous Owner | Huang Dong Qi | $175,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $12,433 | $1,070,507 | $802,886 | $267,621 |

| 2024 | $12,433 | $1,049,518 | $787,144 | $262,374 |

| 2023 | $12,149 | $1,028,940 | $771,710 | $257,230 |

| 2022 | $11,358 | $1,008,766 | $756,579 | $252,187 |

| 2021 | $11,009 | $938,000 | $704,000 | $234,000 |

| 2019 | $10,917 | $938,000 | $704,000 | $234,000 |

| 2018 | $10,836 | $938,000 | $704,000 | $234,000 |

| 2016 | $9,728 | $842,000 | $632,000 | $210,000 |

| 2015 | $9,236 | $800,000 | $600,000 | $200,000 |

| 2014 | $9,270 | $800,000 | $600,000 | $200,000 |

Source: Public Records

Map

Nearby Homes

- 9665 Longden Ave

- 6226 Primrose Ave

- 6204 Oak Ave

- 6119 Temple City Blvd

- 6326 Golden Ave W

- 9618 E Camino Real Ave

- 6433 Livia Ave

- 9711 Garibaldi Ave

- 9861 E Lemon Ave

- 6770 Oak Ave

- 6227 Sultana Ave

- 5929 Oak Ave

- 8939 Emperor Ave

- 1222 Temple City Blvd

- 6839 Oak Ave

- 1214 Temple City Blvd Unit 8

- 1228 Temple City Blvd

- 639 W Longden Ave

- 1004 W Duarte Rd Unit 6

- 6159 Rosemead Blvd

- 6362 Trelawney Ave

- 6350 Trelawney Ave

- 6342 Trelawney Ave

- 6400 Trelawney Ave

- 6355 Temple City Blvd

- 6351 Temple City Blvd Unit 3

- 6349 Temple City Blvd

- 6357 Temple City Blvd

- 6353 Temple City Blvd Unit 1/2

- 6353 Temple City Blvd Unit 6

- 6353 1/2 Temple City Blvd Unit 6

- 6353 Temple City Blvd

- 6363 Temple City Blvd

- 6336 Trelawney Ave

- 6355 Trelawney Ave

- 6335 Primrose Ave

- 6361 Trelawney Ave

- 6412 Trelawney Ave

- 6349 Trelawney Ave

- 6403 Trelawney Ave