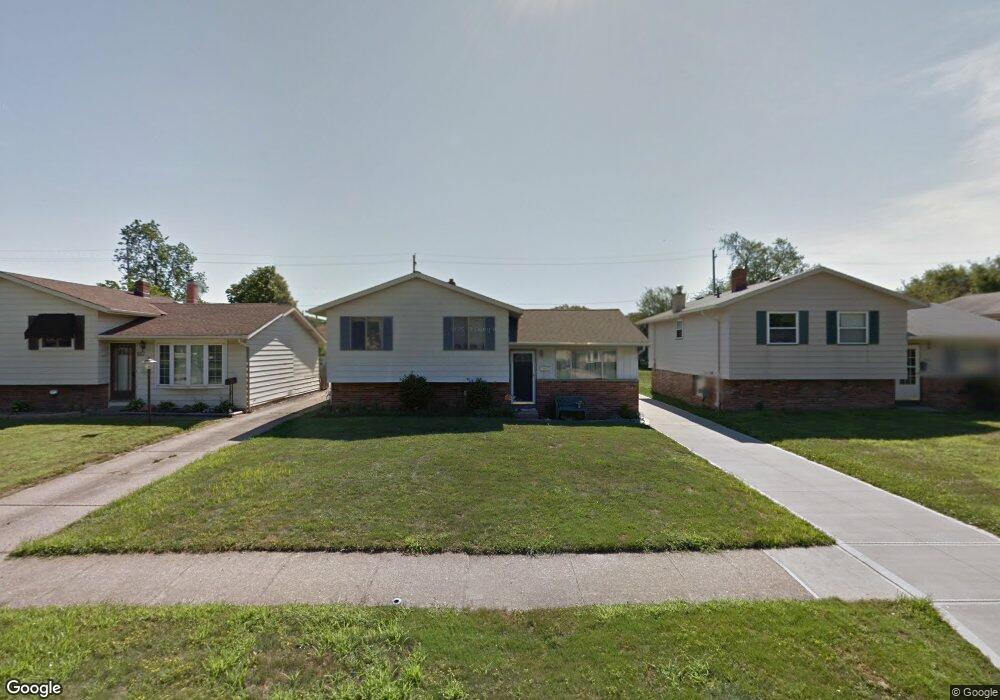

6359 Schaaf Dr Brookpark, OH 44142

Estimated Value: $254,000 - $307,000

3

Beds

2

Baths

2,157

Sq Ft

$125/Sq Ft

Est. Value

About This Home

This home is located at 6359 Schaaf Dr, Brookpark, OH 44142 and is currently estimated at $270,495, approximately $125 per square foot. 6359 Schaaf Dr is a home located in Cuyahoga County with nearby schools including Berea-Midpark Middle School, Berea-Midpark High School, and Huber Heights Preparatory Academy Parma Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 24, 2021

Sold by

Estate Of Paul A Frenchik

Bought by

Frenchik Deborah and Frenchik Deborah Rose

Current Estimated Value

Purchase Details

Closed on

Sep 22, 1998

Sold by

Frenchik Paul A and Frencik Paul A

Bought by

Frenchik Paul A and Frenchik Deborah Rose

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$76,000

Interest Rate

6.69%

Purchase Details

Closed on

Jun 1, 1987

Sold by

Frenchik Paul A

Bought by

Frenchik Paul A

Purchase Details

Closed on

Nov 1, 1979

Sold by

Frenchik Paul A and Frenchik Yvonne M

Bought by

Frenchik Paul A

Purchase Details

Closed on

Jan 1, 1975

Bought by

Frenchik Paul A and Frenchik Yvonne M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Frenchik Deborah | -- | None Available | |

| Frenchik Paul A | -- | First Service Title Agency I | |

| Frenchik Paul A | -- | -- | |

| Frenchik Paul A | -- | -- | |

| Frenchik Paul A | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Frenchik Paul A | $76,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,172 | $82,705 | $12,425 | $70,280 |

| 2023 | $3,563 | $58,490 | $9,490 | $49,000 |

| 2022 | $3,538 | $58,490 | $9,490 | $49,000 |

| 2021 | $3,598 | $58,490 | $9,490 | $49,000 |

| 2020 | $3,245 | $46,410 | $7,530 | $38,890 |

| 2019 | $3,150 | $132,600 | $21,500 | $111,100 |

| 2018 | $2,971 | $46,410 | $7,530 | $38,890 |

| 2017 | $3,033 | $41,440 | $7,560 | $33,880 |

| 2016 | $3,008 | $41,440 | $7,560 | $33,880 |

| 2015 | $2,694 | $41,440 | $7,560 | $33,880 |

| 2014 | $2,694 | $39,480 | $7,210 | $32,270 |

Source: Public Records

Map

Nearby Homes

- 14398 Sheldon Rd

- 13750 Belfair Dr

- 6131 Hardin Dr

- 14024 Donald Dr

- 6377 Ledgebrook Dr

- 15490 Oakshire Ct

- 6095 Stark Dr

- 6103 Westbrook Dr

- 13602 Holland Rd

- 13375 Kathleen Dr

- 6815 Middlebrook Blvd

- 6759 Quarrystone Ln

- 6710 Woodruff Ct

- 13874 Heatherwood Dr

- 6333 W 130th St

- 6014 Westbrook Dr

- 6871 Franke Rd

- 6919 N Parkway Dr

- 16001 Sylvia Dr

- 6624 Big Creek Pkwy

Your Personal Tour Guide

Ask me questions while you tour the home.