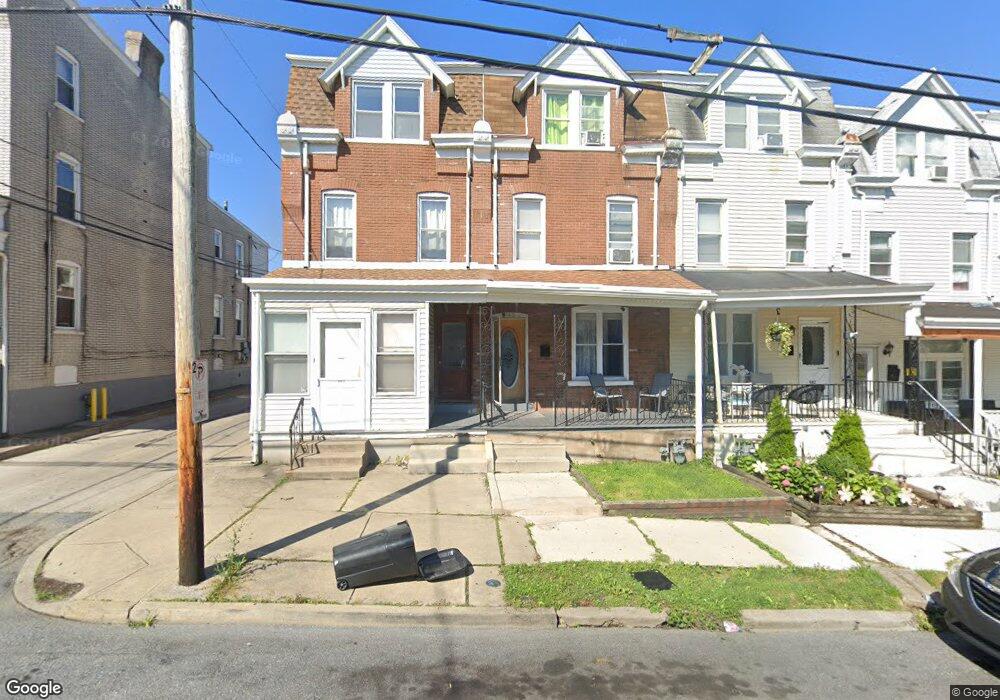

640 N 16th St Allentown, PA 18102

West End Allentown NeighborhoodEstimated Value: $193,000 - $258,000

5

Beds

1

Bath

1,854

Sq Ft

$126/Sq Ft

Est. Value

About This Home

This home is located at 640 N 16th St, Allentown, PA 18102 and is currently estimated at $232,997, approximately $125 per square foot. 640 N 16th St is a home located in Lehigh County with nearby schools including Muhlenberg Elementary School, San Rafael Junior High School, and Trexler Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 13, 2020

Sold by

Molina Jose Angel

Bought by

Diaz Nelson A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$93,960

Outstanding Balance

$83,384

Interest Rate

3.72%

Mortgage Type

Future Advance Clause Open End Mortgage

Estimated Equity

$149,613

Purchase Details

Closed on

Sep 30, 1997

Sold by

Seabald Thomas R and Seabald Heather A

Bought by

Vega Evelyn

Purchase Details

Closed on

Jul 26, 1991

Sold by

Seabald Thomas R and Heather Ann White

Bought by

Seabald Thomas R and Seabald Heather A

Purchase Details

Closed on

Mar 31, 1986

Sold by

Wagner Barbara I

Bought by

Seabald Thomas R and Heather Ann Whit

Purchase Details

Closed on

Nov 1, 1985

Sold by

Rudolph Paul W and Rudolph Naomi B

Bought by

Wagner Barbara I

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Diaz Nelson A | $55,000 | Settlement Usa | |

| Vega Evelyn | $53,000 | -- | |

| Seabald Thomas R | -- | -- | |

| Seabald Thomas R | $36,500 | -- | |

| Wagner Barbara I | $30,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Diaz Nelson A | $93,960 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,040 | $94,500 | $6,400 | $88,100 |

| 2024 | $3,040 | $94,500 | $6,400 | $88,100 |

| 2023 | $3,040 | $94,500 | $6,400 | $88,100 |

| 2022 | $2,932 | $94,500 | $88,100 | $6,400 |

| 2021 | $2,873 | $94,500 | $6,400 | $88,100 |

| 2020 | $2,797 | $94,500 | $6,400 | $88,100 |

| 2019 | $2,751 | $94,500 | $6,400 | $88,100 |

| 2018 | $2,572 | $94,500 | $6,400 | $88,100 |

| 2017 | $2,506 | $94,500 | $6,400 | $88,100 |

| 2016 | -- | $94,500 | $6,400 | $88,100 |

| 2015 | -- | $94,500 | $6,400 | $88,100 |

| 2014 | -- | $94,500 | $6,400 | $88,100 |

Source: Public Records

Map

Nearby Homes

- 638 N 16th St

- 605 N 16th St

- 605 1/2 N 16th St

- 422 N Fulton St

- 1429 W Liberty St

- 1717 W Cedar St

- 1802 W Washington St

- 519 N Saint George St

- 1357 W Liberty St

- 518 N Saint George St

- 329 N 15th St

- 1742 W Chew St

- 1416 W Chew St

- 1605 W Turner St

- 615 N 12th St

- 1144 W Allen St

- 2023 W Washington St

- 631 N Poplar St

- 1009 N 13th St

- 127 N Franklin St