640 S Beach Rd Point Roberts, WA 98281

Estimated Value: $379,000 - $387,617

2

Beds

1

Bath

864

Sq Ft

$444/Sq Ft

Est. Value

About This Home

This home is located at 640 S Beach Rd, Point Roberts, WA 98281 and is currently estimated at $383,904, approximately $444 per square foot. 640 S Beach Rd is a home located in Whatcom County with nearby schools including Point Roberts Primary School, Blaine Middle School, and Blaine High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 17, 2024

Sold by

Rock Kristen

Bought by

Alphenaar Jenna and Hengstler Ben

Current Estimated Value

Purchase Details

Closed on

May 1, 2018

Sold by

Valencia Myrna and Estate Of Festyn David Dill

Bought by

Rock Kristen

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$56,000

Interest Rate

4.45%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Sep 26, 2017

Sold by

Rastad Judith Ann and Roblin Carol Jean

Bought by

Estate Of Arthur Lawrence Rastad and Estate Of Jean Olga Rastad

Purchase Details

Closed on

Sep 25, 2017

Sold by

Roy Craig

Bought by

Rock Kristen

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Alphenaar Jenna | $400,000 | Whatcom Land Title | |

| Rock Kristen | $55,000 | Whatcom Land Title Co Inc | |

| Estate Of Arthur Lawrence Rastad | $148,000 | Chicago Title Insurance | |

| Rock Kristen | -- | Chicago Title Insurance |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Rock Kristen | $56,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,599 | $341,791 | $132,495 | $209,296 |

| 2023 | $2,599 | $311,388 | $120,450 | $190,938 |

| 2022 | $2,321 | $284,373 | $110,000 | $174,373 |

| 2021 | $2,312 | $228,948 | $113,696 | $115,252 |

| 2020 | $2,303 | $211,986 | $105,273 | $106,713 |

| 2019 | $2,138 | $203,342 | $100,980 | $102,362 |

| 2018 | $2,014 | $182,802 | $90,780 | $92,022 |

| 2017 | $1,746 | $174,586 | $86,700 | $87,886 |

| 2016 | $1,757 | $171,163 | $85,000 | $86,163 |

| 2015 | $1,869 | $167,421 | $82,119 | $85,302 |

| 2014 | -- | $0 | $0 | $0 |

| 2013 | -- | $0 | $0 | $0 |

Source: Public Records

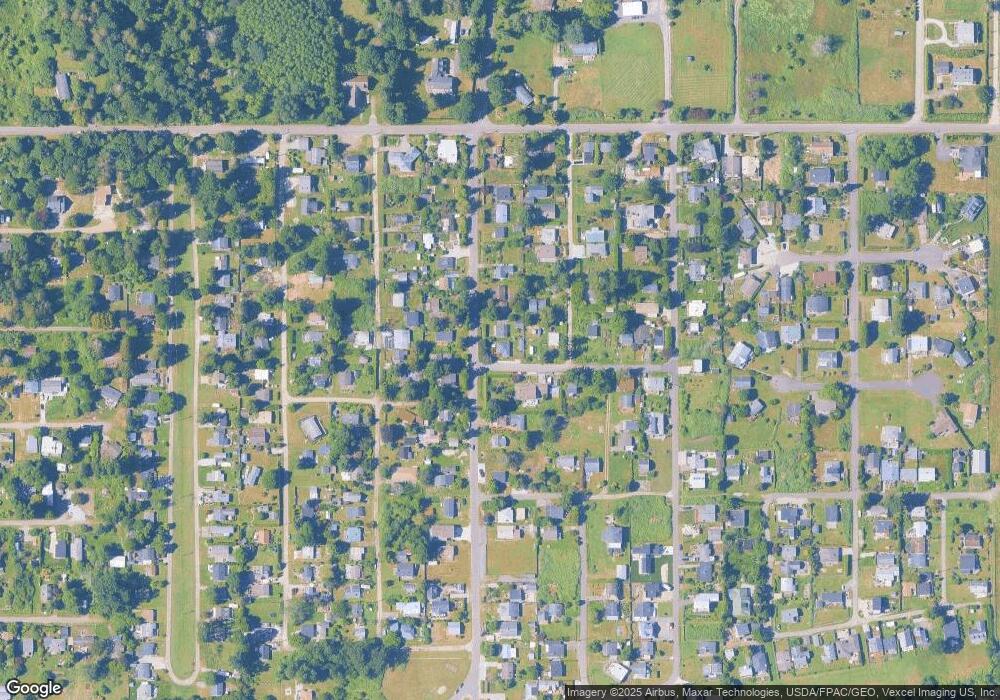

Map

Nearby Homes

- 634 S Beach Rd

- 1911 Apa Rd

- 661 Driftwood Ln

- 1934 Waters Rd

- 1940 Apa Rd

- 698 Kendor Dr

- 1927 Orcas View Way

- 675 Sylvia Dr

- 1881 Edwards Dr

- 1920 Patos Way

- 1976 Cedar Park Dr

- 2045 Apa Rd

- lot 14 Cedar Park Dr Unit 14

- 0 6 39 Acres South Beach Rd

- Lot 2 Greenwood Dr

- 2 Benson Rd

- 2149 Seabright Loop

- 2250 Seabright Loop

- 2246 Seabright Loop

- 2242 Seabright Loop