6441 SE Windsong Ln Unit 113 Stuart, FL 34997

Estimated Value: $247,162 - $263,000

2

Beds

2

Baths

1,288

Sq Ft

$200/Sq Ft

Est. Value

About This Home

This home is located at 6441 SE Windsong Ln Unit 113, Stuart, FL 34997 and is currently estimated at $257,791, approximately $200 per square foot. 6441 SE Windsong Ln Unit 113 is a home located in Martin County with nearby schools including Sea Wind Elementary School, Murray Middle School, and South Fork High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 31, 2023

Sold by

Robert Lionel A and Robert Diana S

Bought by

Robert Christopher

Current Estimated Value

Purchase Details

Closed on

Dec 14, 2014

Sold by

Robert Lionel A and Robert Diana S

Bought by

Robert Lionel A

Purchase Details

Closed on

Aug 1, 2012

Sold by

Robert Lionel A and Robert Diana S

Bought by

Robert Lionel A and Robert Diana S

Purchase Details

Closed on

Mar 14, 2011

Sold by

Deutsche Bank National Trust Company

Bought by

Robert Diana and Robert Lionel

Purchase Details

Closed on

Aug 4, 2003

Sold by

Borner Ryan E

Bought by

Borner Leanne L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$86,250

Interest Rate

8.5%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Dec 20, 2000

Sold by

Roberts Charles G and Roberts Barbara D

Bought by

Borner Leanne L and Borner Rayn E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$70,419

Interest Rate

7.81%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Robert Christopher | -- | -- | |

| Robert Lionel A | $100 | -- | |

| Robert Lionel A | -- | Attorney | |

| Robert Diana | $45,000 | Watson Title Ins Agency Inc | |

| Borner Leanne L | $35,400 | Stewart Title Of Martin Cnty | |

| Borner Leanne L | $71,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Borner Leanne L | $86,250 | |

| Previous Owner | Borner Leanne L | $70,419 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,622 | $144,157 | -- | -- |

| 2024 | $1,583 | $140,095 | -- | -- |

| 2023 | $1,583 | $136,015 | $0 | $0 |

| 2022 | $1,515 | $132,054 | $0 | $0 |

| 2021 | $1,511 | $128,208 | $0 | $0 |

| 2020 | $1,495 | $126,438 | $0 | $0 |

| 2019 | $1,461 | $123,595 | $0 | $0 |

| 2018 | $1,420 | $121,290 | $49,000 | $72,290 |

| 2017 | $1,729 | $117,770 | $60,000 | $57,770 |

| 2016 | $1,570 | $103,550 | $45,000 | $58,550 |

| 2015 | $1,205 | $91,830 | $32,500 | $59,330 |

| 2014 | $1,205 | $78,110 | $18,000 | $60,110 |

Source: Public Records

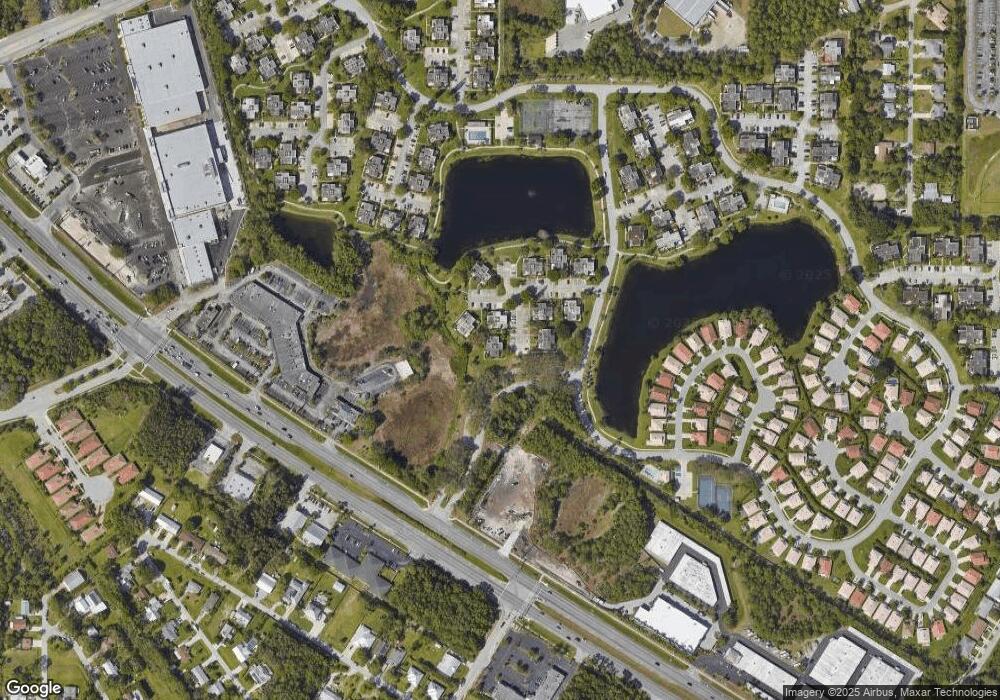

Map

Nearby Homes

- 6435 SE Windsong Ln Unit 114

- 5818 SE Windsong Ln Unit 212

- 5818 SE Windsong Ln

- 5804 SE Windsong Ln Unit 220

- 6520 SE Windsong Ln Unit 728

- 5742 SE Windsong Ln

- 6524 SE Windsong Ln Unit 732

- 5773 SE Windsong Ln Unit 603

- 5738 SE Windsong Ln Unit 315

- 5708 SE Windsong Ln

- 5662 SE Windsong Ln Unit 408

- 4471 SE Village Rd

- 6300 SE Phillips Bend Ave

- 3878 SE Grant St

- 5400 SE Jack Ave

- 4500 SE Salvatori Rd

- 3785 SE Middle St

- 6539 SE Held Ct

- 6325 SE Colonial Dr

- 0 SE Grant St

- 6439 SE Windsong Ln Unit 116

- 6439 SE Windsong Ln

- 6437 SE 115 Windsong Ln Unit 115

- 6437 SE Windsong Ln Unit 115

- 6431 SE Windsong Ln Unit 117

- 6429 SE Windsong Ln Unit 120

- 6433 SE Windsong Ln Unit 118

- 6423 SE Windsong Ln Unit 121

- 6427 SE Windsong Ln Unit 119

- 6425 SE Windsong Ln Unit 122

- 6425 SE Windsong Ln

- 6443 SE Windsong Ln Unit 112

- 6443 SE Windsong Ln

- 6449 SE Windsong Ln Unit 111

- 6449 SE Windsong Ln

- 6421 SE Windsong Ln Unit 124

- 6419 SE Windsong Ln Unit 123

- 6453 SE Windsong Ln Unit 108

- 6445 SE Windsong Ln Unit 109

- 6447 SE Windsong Ln Unit 110