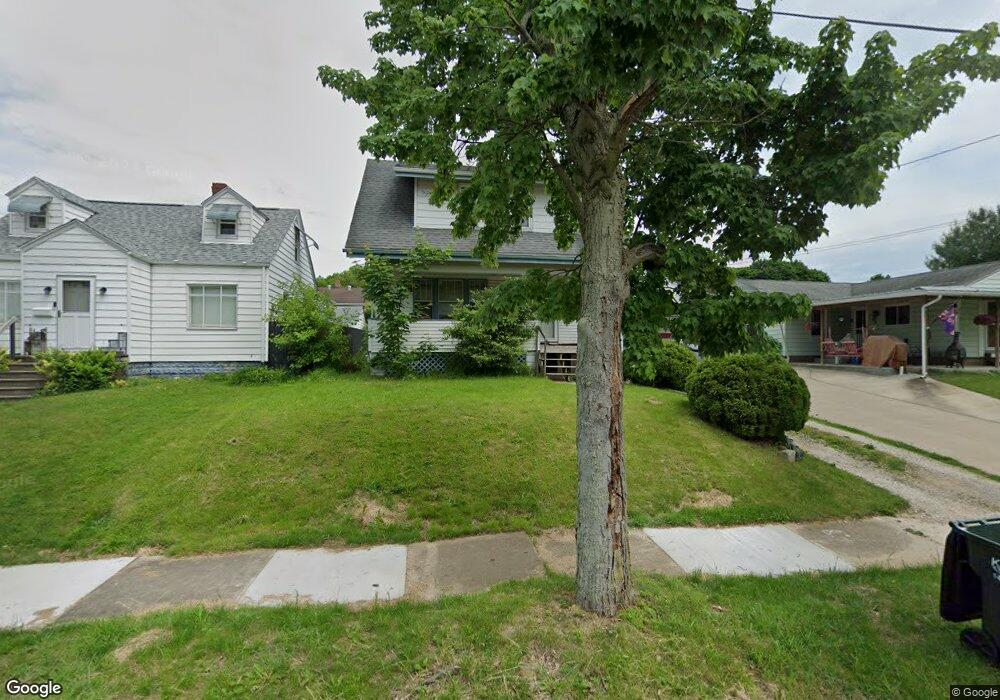

645 Charles Ave Barberton, OH 44203

North Barberton NeighborhoodEstimated Value: $133,596 - $163,000

3

Beds

1

Bath

1,336

Sq Ft

$113/Sq Ft

Est. Value

About This Home

This home is located at 645 Charles Ave, Barberton, OH 44203 and is currently estimated at $150,899, approximately $112 per square foot. 645 Charles Ave is a home located in Summit County with nearby schools including Barberton Middle School, Barberton Intermediate School 3-5, and Barberton High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 22, 2006

Sold by

Bruning Erik R and Breitenstine Charles A

Bought by

Sarver Brian and Sarver Jennifer

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$99,750

Outstanding Balance

$66,526

Interest Rate

8.6%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$84,373

Purchase Details

Closed on

Jan 17, 2006

Sold by

Wells Fargo Bank Minnesota Na

Bought by

Bruning Erik and Breitenstine Charles A

Purchase Details

Closed on

Jul 18, 2005

Sold by

Sees Richard A

Bought by

Wells Fargo Bank Minnesota Na and Option One Mortgage Loan Trust 2002-A

Purchase Details

Closed on

Sep 26, 1996

Sold by

Rutledge David J

Bought by

Joseph Gary R and Sitz Michelle L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$72,223

Interest Rate

7.97%

Mortgage Type

FHA

Purchase Details

Closed on

Apr 28, 1995

Sold by

Kindel Connie J

Bought by

Rutledge David J and Rutledge Elizabeth A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$60,583

Interest Rate

8.42%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sarver Brian | $105,000 | First Security Title | |

| Bruning Erik | $64,500 | Intitle Agency Inc | |

| Wells Fargo Bank Minnesota Na | $50,000 | -- | |

| Joseph Gary R | $73,800 | -- | |

| Rutledge David J | $59,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Sarver Brian | $99,750 | |

| Previous Owner | Joseph Gary R | $72,223 | |

| Previous Owner | Rutledge David J | $60,583 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,802 | $36,064 | $8,120 | $27,944 |

| 2024 | $1,802 | $36,064 | $8,120 | $27,944 |

| 2023 | $1,802 | $36,064 | $8,120 | $27,944 |

| 2022 | $1,358 | $23,573 | $5,310 | $18,263 |

| 2021 | $1,357 | $23,573 | $5,310 | $18,263 |

| 2020 | $1,328 | $23,570 | $5,310 | $18,260 |

| 2019 | $1,354 | $21,770 | $4,670 | $17,100 |

| 2018 | $1,333 | $21,770 | $4,670 | $17,100 |

| 2017 | $1,351 | $21,770 | $4,670 | $17,100 |

| 2016 | $1,600 | $21,770 | $4,670 | $17,100 |

| 2015 | $1,351 | $21,770 | $4,670 | $17,100 |

| 2014 | $1,344 | $21,770 | $4,670 | $17,100 |

| 2013 | $1,298 | $21,810 | $4,670 | $17,140 |

Source: Public Records

Map

Nearby Homes

- 690 Saint Clair Ave

- 645 Madison Ave

- 44 W Summit St

- 0 Wooster Rd N

- 103 Mitchell St

- 613 Wooster Rd N

- 30 W Hiram St

- 818 N Summit St

- 146 Hermann St

- 277 Glenn St

- 412 Grandview Ave

- 137 Hermann St

- 213 Hermann St

- 250 Evergreen St

- 320 Lincoln Ave Unit 322

- 1924 Caroline Ave

- 143 Glenn St

- 1960 Newton St

- 0 Romig Ave

- 46 Brown St

- 641 Charles Ave

- 641 Charles Ave

- 651 Charles Ave

- 646 Orchard Ave

- 161 W Way St

- 635 Charles Ave

- 652 Orchard Ave

- 642 Orchard Ave

- 638 Orchard Ave

- 165 W Way St

- 630 Orchard Ave

- 660 Orchard Ave

- 625 Charles Ave

- 173 W Way St

- 664 Orchard Ave

- 177 W Way St

- 621 Charles Ave

- 181 W Way St Unit 183

- 181 W Way St Unit 183

- 677 Charles Ave