648 Baldwin Heights Cir Howard, OH 43028

Apple Valley NeighborhoodEstimated Value: $318,724 - $424,000

3

Beds

3

Baths

1,992

Sq Ft

$188/Sq Ft

Est. Value

About This Home

This home is located at 648 Baldwin Heights Cir, Howard, OH 43028 and is currently estimated at $373,681, approximately $187 per square foot. 648 Baldwin Heights Cir is a home located in Knox County with nearby schools including East Knox Elementary School and East Knox High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 19, 2010

Sold by

The Estate Of Joseph V Hall and Hall Michael J

Bought by

Hall James E and Hall Dianne M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$75,000

Outstanding Balance

$49,888

Interest Rate

4.74%

Mortgage Type

New Conventional

Estimated Equity

$323,793

Purchase Details

Closed on

Sep 28, 2005

Sold by

Hannan Diane K and Russell Diane K

Bought by

Green Tree Servicing Llc

Purchase Details

Closed on

Sep 12, 2005

Sold by

Green Tree Servicing Llc

Bought by

Hall Joseph

Purchase Details

Closed on

May 14, 2001

Sold by

Kight Brian D

Bought by

Hannan Jeffrey R and Hannan Diane

Purchase Details

Closed on

Nov 1, 1999

Bought by

Kight Brian D

Purchase Details

Closed on

Mar 9, 1995

Sold by

Seimer Lewis A and Seimer Bernice

Bought by

Seimer Family Trust

Purchase Details

Closed on

Nov 5, 1992

Sold by

Seimer Lewis A and Seimer Bernice

Bought by

Seimer Lewis A and Seimer Bernice

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hall James E | $116,100 | None Available | |

| Green Tree Servicing Llc | $135,000 | Sovereign Title Agency Llc | |

| Hall Joseph | $99,750 | Sovereign Title Agency Llc | |

| Hannan Jeffrey R | $184,500 | -- | |

| Kight Brian D | $5,000 | -- | |

| Seimer Family Trust | -- | -- | |

| Seimer Lewis A | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hall James E | $75,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,131 | $78,010 | $3,440 | $74,570 |

| 2023 | $3,131 | $78,010 | $3,440 | $74,570 |

| 2022 | $3,253 | $69,720 | $2,990 | $66,730 |

| 2021 | $3,253 | $69,720 | $2,990 | $66,730 |

| 2020 | $3,097 | $69,720 | $2,990 | $66,730 |

| 2019 | $2,952 | $60,980 | $2,940 | $58,040 |

| 2018 | $2,764 | $60,980 | $2,940 | $58,040 |

| 2017 | $2,739 | $60,980 | $2,940 | $58,040 |

| 2016 | $2,574 | $56,460 | $2,720 | $53,740 |

| 2015 | $2,342 | $56,460 | $2,720 | $53,740 |

| 2014 | $2,346 | $56,460 | $2,720 | $53,740 |

| 2013 | $2,542 | $58,150 | $3,540 | $54,610 |

Source: Public Records

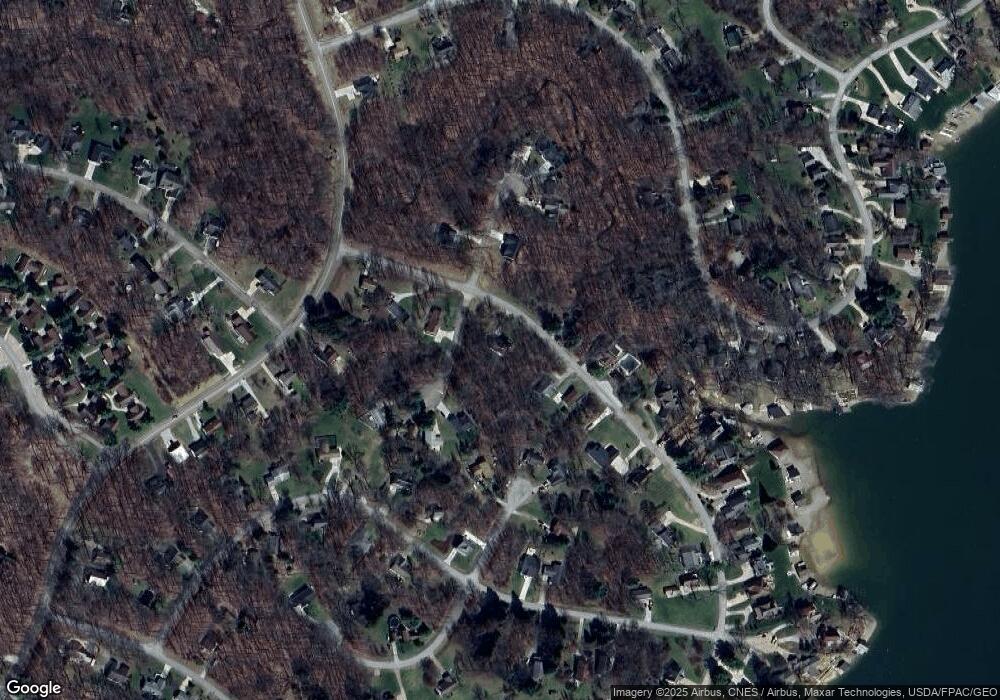

Map

Nearby Homes

- 305 Apple Hill S

- 729 Valleywood Heights Dr

- 657 Valleywood Heights Dr

- 956 Valleywood Heights Dr

- 2204 Apple Valley Dr

- 865 Terrace View Dr

- 745 Valleywood Heights Dr

- 151 Heatherwood Dr

- 116 Heatherwood Dr

- 916 Valleywood Heights Dr

- 480 Baldwin Hgts Cir

- 480 Baldwin Heights Cir

- 577 Floral Valley Dr W

- 434 Orchid Ct

- 2406 Apple Valley Dr

- 2422 Apple Valley Dr

- 3425 Apple Valley Dr

- 229 Green Valley Dr

- 741 Floral Valley Dr E

- 657 King Beach Dr

- 0 Apple Hill S

- 636 Baldwin Heights Cir

- 664 Baldwin Heights Cir

- 657 Baldwin Hts Cir

- 641 Baldwin Heights Cir

- Lot 151 Baldwin Heights Subdivision

- 632 Baldwin Heights Cir

- 325 Apple Hill Dr S

- 657 Baldwin Heights Cir

- 216 Terrace View N

- 633 Baldwin Heights Cir

- 633 Baldwin Heights Cir

- 672 Baldwin Heights Cir

- 321 Apple Hill S

- 438 Apple Hill Dr N

- 321 Apple Hill Dr S

- 224 Terrace View N

- 620 Baldwin Heights Cir

- 317 Apple Hill S

- 317 Apple Hill Dr S