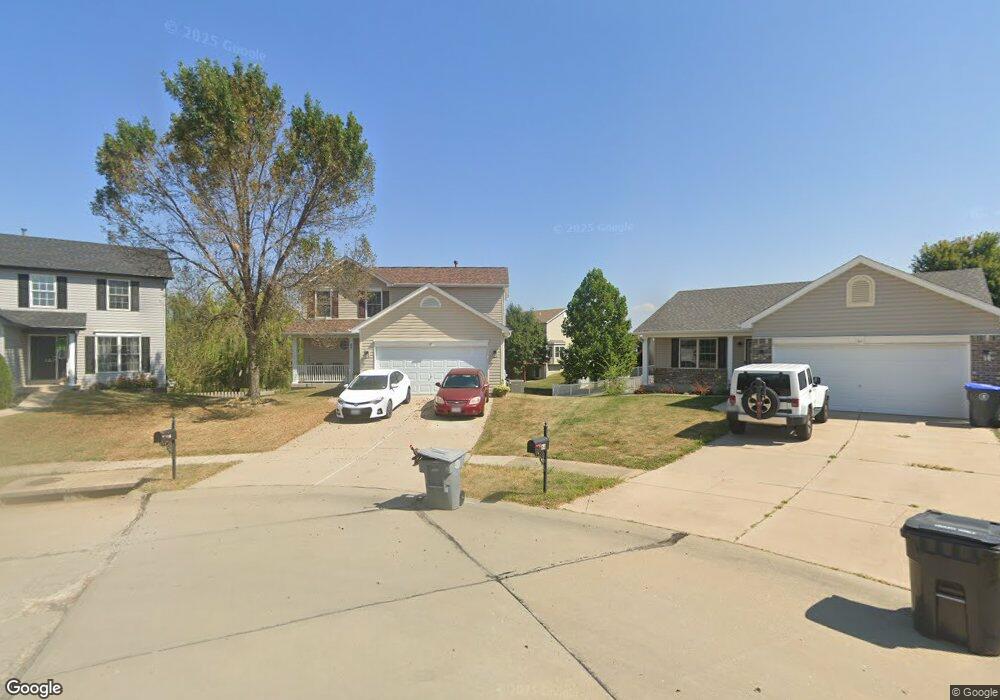

65 E Homefield Point Ct O Fallon, MO 63366

Estimated Value: $343,000 - $370,000

3

Beds

3

Baths

1,574

Sq Ft

$226/Sq Ft

Est. Value

About This Home

This home is located at 65 E Homefield Point Ct, O Fallon, MO 63366 and is currently estimated at $356,354, approximately $226 per square foot. 65 E Homefield Point Ct is a home located in St. Charles County with nearby schools including Westhoff Elementary School, Fort Zumwalt North Middle School, and Fort Zumwalt North High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 30, 2013

Sold by

Wolfe John Robert and Wolfe Dunn Vicki Jean

Bought by

Quinn Steven T and Quinn Elizabeth G

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$148,500

Outstanding Balance

$105,257

Interest Rate

3.41%

Mortgage Type

New Conventional

Estimated Equity

$251,097

Purchase Details

Closed on

Jul 7, 2009

Sold by

Wolfe John Robert

Bought by

Wolfe John Robert and Dunn Vicki Jean

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$149,500

Interest Rate

5.39%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jan 31, 2006

Sold by

T R Hughes Inc

Bought by

Wolfe John Robert

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$19,438

Interest Rate

6.15%

Mortgage Type

Credit Line Revolving

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Quinn Steven T | $165,000 | Ust | |

| Wolfe John Robert | -- | Inv | |

| Wolfe John Robert | -- | Multiple | |

| Tr Hughes Inc | -- | Multiple |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Quinn Steven T | $148,500 | |

| Previous Owner | Wolfe John Robert | $149,500 | |

| Previous Owner | Tr Hughes Inc | $19,438 | |

| Previous Owner | Wolfe John Robert | $155,508 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,320 | $56,078 | -- | -- |

| 2023 | $3,322 | $50,097 | $0 | $0 |

| 2022 | $2,987 | $41,880 | $0 | $0 |

| 2021 | $2,989 | $41,880 | $0 | $0 |

| 2020 | $2,755 | $37,392 | $0 | $0 |

| 2019 | $2,761 | $37,392 | $0 | $0 |

| 2018 | $2,690 | $34,784 | $0 | $0 |

| 2017 | $2,653 | $34,784 | $0 | $0 |

| 2016 | $2,416 | $31,547 | $0 | $0 |

| 2015 | $2,246 | $31,547 | $0 | $0 |

| 2014 | $2,010 | $27,753 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 1612 Homefield Meadows Dr

- 1602 Homefield Meadows Dr

- 18 W Homefield Point Ct

- 2837 Grand Slam Dr

- 17 Homefield Gardens Dr

- 1818 Sapling Dr

- 0 Tom Ginnever Ave

- 6 Green Park Ln

- 57 Green Park Ln

- 1602 Platinum Ct

- 239 Crystal Ridge Dr

- 1110 Cypress Dr

- 621 Zumwalt Crossing

- 211 England Dr

- 6 S Boxwood Ln

- 127 Maryland Dr Unit 89A

- 6 Saint Paul Ct

- 439 Villa Blanc Ct Unit 17A

- 1 Warshire Ct

- 203 Saint Margaret Ln

- 63 E Homefield Point Ct

- 129 Homefield Lake Ct

- 127 Homefield Lake Ct

- 61 E Homefield Point Ct

- 62 E Homefield Point Ct

- 125 Homefield Lake Ct

- 131 Homefield Lake Ct

- 59 E Homefield Point Ct

- 60 E Homefield Point Ct

- 57 E Homefield Point Ct

- 1619 Homefield Meadows Dr

- 123 Homefield Lake Ct

- 1617 Homefield Meadows Dr

- 58 E Homefield Point Ct

- 172 Homefield Gardens Dr

- 176 Homefield Gardens Dr

- 168 Homefield Gardens Dr

- 1615 Homefield Meadows Dr

- 164 Homefield Gardens Dr

- 55 E Homefield Point Ct