6506 W 144th St Overland Park, KS 66223

South Overland Park NeighborhoodEstimated Value: $457,000 - $468,000

3

Beds

3

Baths

2,282

Sq Ft

$203/Sq Ft

Est. Value

About This Home

This home is located at 6506 W 144th St, Overland Park, KS 66223 and is currently estimated at $462,667, approximately $202 per square foot. 6506 W 144th St is a home located in Johnson County with nearby schools including Lakewood Elementary School, Lakewood Middle School, and Blue Valley West High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 18, 2019

Sold by

Degraeve Sharon J

Bought by

Degraeve Sharon J and Sharon J Degraeve Living Trust

Current Estimated Value

Purchase Details

Closed on

May 2, 2018

Sold by

Cohn Louis and Cohn Andrew

Bought by

Degraeve Sharon J

Purchase Details

Closed on

Aug 10, 2016

Sold by

Cohn Hope J

Bought by

Cohn Hope J and Hope J Cohn Trust

Purchase Details

Closed on

Jan 12, 2016

Sold by

Cohn Hope J

Bought by

Cohn Hope J and Hope J Cohn Trust

Purchase Details

Closed on

Feb 28, 2005

Sold by

Vore James B and Vore Sarah

Bought by

Cohn Hope J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$46,980

Interest Rate

5.66%

Mortgage Type

Credit Line Revolving

Purchase Details

Closed on

Jul 3, 2002

Sold by

Thomas French Builder Inc

Bought by

Vore James B and Vore Sarah

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$196,200

Interest Rate

6.73%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Degraeve Sharon J | -- | None Available | |

| Degraeve Sharon J | -- | None Available | |

| Cohn Hope J | -- | None Available | |

| Cohn Hope J | -- | None Available | |

| Cohn Hope J | -- | None Available | |

| Cohn Hope J | -- | Coffelt Land Title Inc | |

| Vore James B | -- | Security Land Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Cohn Hope J | $46,980 | |

| Previous Owner | Cohn Hope J | $187,920 | |

| Previous Owner | Vore James B | $196,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,911 | $48,139 | $7,291 | $40,848 |

| 2023 | $4,683 | $45,057 | $7,291 | $37,766 |

| 2022 | $4,276 | $40,423 | $6,072 | $34,351 |

| 2021 | $4,232 | $37,893 | $5,060 | $32,833 |

| 2020 | $4,075 | $36,248 | $5,060 | $31,188 |

| 2019 | $4,163 | $36,249 | $4,888 | $31,361 |

| 2018 | $4,118 | $35,145 | $4,888 | $30,257 |

| 2017 | $3,967 | $33,270 | $4,255 | $29,015 |

| 2016 | $3,746 | $31,395 | $4,255 | $27,140 |

| 2015 | $3,728 | $31,119 | $4,255 | $26,864 |

| 2013 | -- | $27,278 | $4,255 | $23,023 |

Source: Public Records

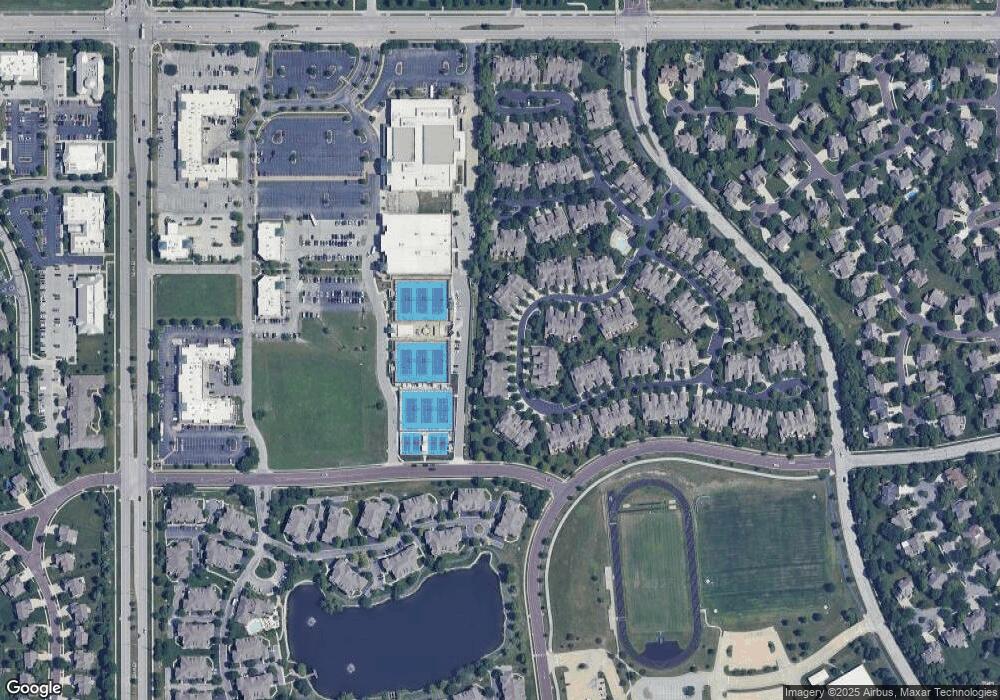

Map

Nearby Homes

- 6402 W 143rd Terrace

- 14302 Russell St

- 14343 Russell St

- 6323 W 145th St

- 14426 Marty St

- 7402 W 145th Terrace

- 14605 Dearborn St

- 6714 W 148th Terrace

- 7502 W 145th Terrace

- 5817 W 147th Place

- 14738 Outlook St

- 14716 Newton St

- 14927 Riggs St

- 7736 W 145th St

- 14712 Maple St

- 14915 Horton St

- 14724 Maple St

- 7633 W 148th Terrace

- 14008 Outlook St

- 5701 W 146th St

- 6504 W 144th St

- 6510 W 144th St

- 6502 W 144th St

- 6512 W 144th St

- 6500 W 144th St

- 6514 W 144th St

- 6516 W 144th St

- 6509 W 144th St

- 6430 W 144th St

- 6511 W 144th St

- 6513 W 144th St

- 6515 W 144th St

- 6428 W 144th St

- 6417 W 144th St

- 6426 W 144th St

- 6441 W 145th St

- 6424 W 144th St

- 6439 W 145th St

- 6413 W 144th St

- 6437 W 145th St