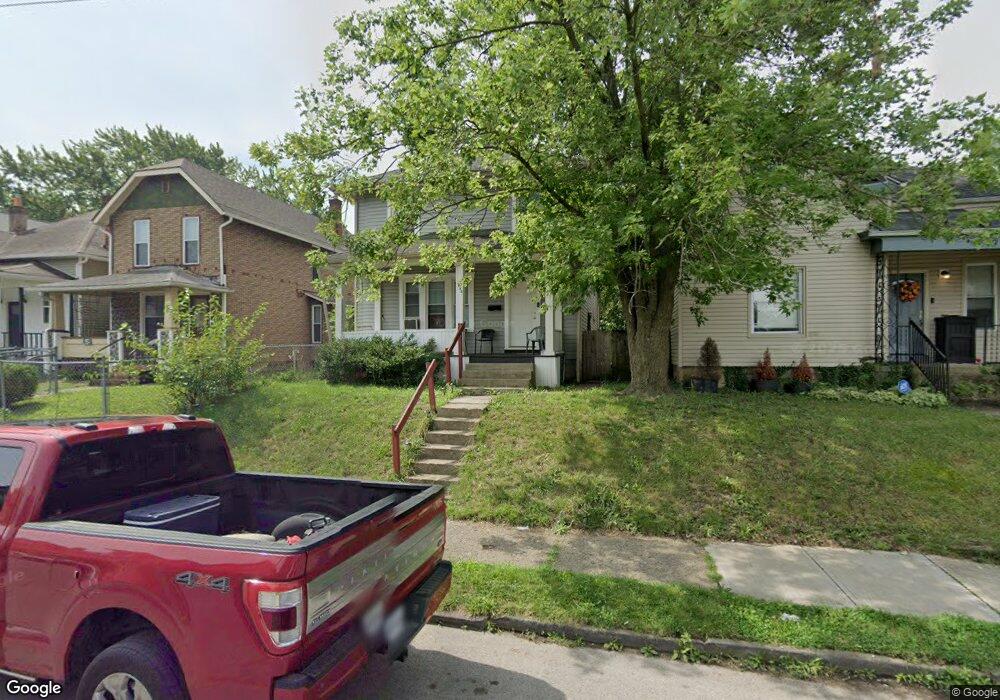

653 Siebert St Columbus, OH 43206

Karns Park NeighborhoodEstimated Value: $228,812 - $296,000

3

Beds

2

Baths

1,536

Sq Ft

$170/Sq Ft

Est. Value

About This Home

This home is located at 653 Siebert St, Columbus, OH 43206 and is currently estimated at $260,453, approximately $169 per square foot. 653 Siebert St is a home located in Franklin County with nearby schools including Lincoln Park Elementary School, South High School, and South Columbus Preparatory Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 17, 2020

Sold by

Patriarch Bt Holdings Llc

Bought by

Patriarch Bt Investments Llc

Current Estimated Value

Purchase Details

Closed on

Nov 20, 2015

Sold by

Childrens Development Llc

Bought by

Patriarch Bt Holdings Llc

Purchase Details

Closed on

Nov 4, 2013

Sold by

Parker Georgia

Bought by

Childrens Development Llc

Purchase Details

Closed on

Feb 28, 2008

Sold by

Atfh Real Property Llc

Bought by

Parker Georgia

Purchase Details

Closed on

Feb 27, 2008

Sold by

American Tax Funding Llc

Bought by

Atfh Real Property Llc

Purchase Details

Closed on

Feb 25, 2007

Sold by

Sickler Deborah L and Leonard Edward

Bought by

American Tax Funding Llc

Purchase Details

Closed on

May 13, 1994

Bought by

Sickler Deborah L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Patriarch Bt Investments Llc | -- | Chase Title | |

| Patriarch Bt Holdings Llc | $114,000 | Chase Title | |

| Childrens Development Llc | -- | None Available | |

| Parker Georgia | $15,300 | None Available | |

| Atfh Real Property Llc | -- | None Available | |

| American Tax Funding Llc | $11,000 | Atttorney | |

| Sickler Deborah L | -- | -- |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,470 | $75,710 | $22,510 | $53,200 |

| 2024 | $3,470 | $75,710 | $22,510 | $53,200 |

| 2023 | $3,426 | $75,705 | $22,505 | $53,200 |

| 2022 | $1,555 | $29,270 | $5,430 | $23,840 |

| 2021 | $1,558 | $29,270 | $5,430 | $23,840 |

| 2020 | $1,607 | $29,270 | $5,430 | $23,840 |

| 2019 | $1,341 | $21,570 | $4,170 | $17,400 |

| 2018 | $1,128 | $21,570 | $4,170 | $17,400 |

| 2017 | $1,341 | $21,570 | $4,170 | $17,400 |

| 2016 | $1,008 | $14,840 | $3,360 | $11,480 |

| 2015 | $918 | $14,840 | $3,360 | $11,480 |

| 2014 | $920 | $14,840 | $3,360 | $11,480 |

| 2013 | $478 | $15,610 | $3,535 | $12,075 |

Source: Public Records

Map

Nearby Homes

- 735 Reinhard Ave

- 640 E Whittier St

- 550 Stewart Ave

- 790 Siebert St

- 000 Gilbert St

- 00 Gilbert St

- 779-781 Stanley Ave

- 530 Stewart Ave

- 630 Stanley Ave

- 516 Cline St

- 514 Cline St

- 512 Cline St

- 531 E Deshler Ave

- 510 Cline St

- 524 Thurman Ave

- 1178 Wager St

- 960 Carpenter St

- 1106-1116 Parsons Ave

- 693 Thurman Ave

- 539 Thurman Ave

- 649 Siebert St

- 657 Siebert St

- 643 Siebert St

- 661 Siebert St

- 641 Siebert St

- 665 Siebert St Unit 667

- 646 Stewart Ave

- 640 Stewart Ave

- 650 Stewart Ave

- 675 Siebert St

- 658 Stewart Ave

- 658 Stewart Ave Unit 502

- 634 Stewart Ave

- 1091 S 17th St

- 662 Stewart Ave

- 679 Siebert St

- 627 Siebert St

- 630 Stewart Ave

- 656 Siebert St

- 660 Siebert St

Your Personal Tour Guide

Ask me questions while you tour the home.