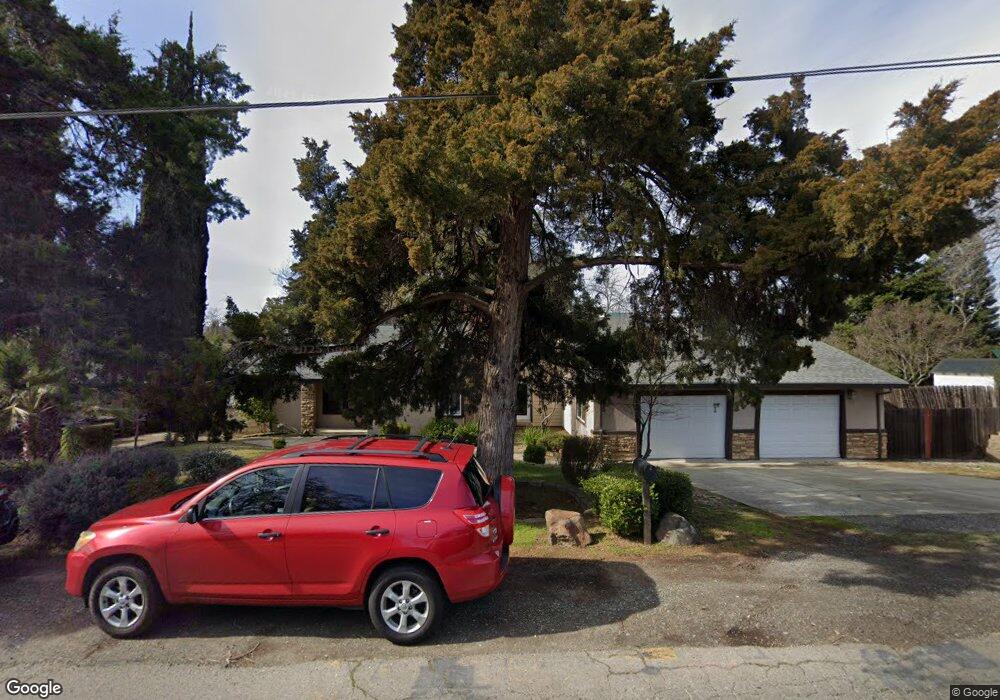

6533 Filbert Ave Orangevale, CA 95662

Estimated Value: $495,000 - $678,000

3

Beds

2

Baths

1,986

Sq Ft

$314/Sq Ft

Est. Value

About This Home

This home is located at 6533 Filbert Ave, Orangevale, CA 95662 and is currently estimated at $624,460, approximately $314 per square foot. 6533 Filbert Ave is a home located in Sacramento County with nearby schools including Ottomon Way Elementary School, Louis Pasteur Fundamental Middle School, and Casa Roble Fundamental High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 2, 2015

Sold by

Becker Zeb X

Bought by

Becker Zeb X and Becker Jodie L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$258,750

Outstanding Balance

$197,369

Interest Rate

3.57%

Mortgage Type

New Conventional

Estimated Equity

$427,091

Purchase Details

Closed on

Jul 17, 2003

Sold by

Cruz Stephanie Ann

Bought by

Becker Zeb X

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$242,000

Interest Rate

6.12%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Mar 3, 2003

Sold by

Cruz Stephanie Ann and John P & Delphine H Forrest Re

Bought by

Cruz Stephanie Ann

Purchase Details

Closed on

Jun 1, 1994

Sold by

Forrest John P and Forrest Delphine H

Bought by

Forrest John P and Forrest Delphine H

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Becker Zeb X | -- | First American Title | |

| Becker Zeb X | $242,000 | Financial Title Company | |

| Cruz Stephanie Ann | -- | -- | |

| Forrest John P | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Becker Zeb X | $258,750 | |

| Closed | Becker Zeb X | $242,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,581 | $469,779 | $48,329 | $421,450 |

| 2024 | $5,581 | $460,569 | $47,382 | $413,187 |

| 2023 | $5,433 | $451,539 | $46,453 | $405,086 |

| 2022 | $5,405 | $442,687 | $45,543 | $397,144 |

| 2021 | $5,323 | $434,007 | $44,650 | $389,357 |

| 2020 | $5,224 | $429,558 | $44,193 | $385,365 |

| 2019 | $5,120 | $421,136 | $43,327 | $377,809 |

| 2018 | $5,061 | $412,879 | $42,478 | $370,401 |

| 2017 | $4,645 | $374,772 | $89,944 | $284,828 |

| 2016 | $4,029 | $340,703 | $81,768 | $258,935 |

| 2015 | $3,750 | $324,480 | $77,875 | $246,605 |

| 2014 | $3,600 | $312,000 | $74,880 | $237,120 |

Source: Public Records

Map

Nearby Homes

- 9013 Green River Way

- 6422 Hazel Ave

- 6600 Rosa Prado Ct

- 9008 Clarissa Dr

- 9340 Orangevale Ave Unit 38

- 6013 Mcneely Way

- 8934 Oro Way

- 6901 Main Ave

- 7120 Hazel Ave

- 8949 Genoa Ave

- 7101 Bobby St

- 8770 Greenback Ln

- 8832 Canarsie Ave

- 9431 Canyon Lake Ln

- 8788 Elm Ave

- 5817 Husker St

- 6132 Main Ave Unit 28

- 5947 Main Ave Unit A

- 9256 Floyd Ave

- 8858 Kona Way

- 6525 Filbert Ave

- 9094 Central Ave

- 9098 Central Ave

- 8933 Cape Windham Place

- 9084 Central Ave

- 6519 Filbert Ave

- 6516 Filbert Ave

- 9076 Central Ave

- 6508 Filbert Ave

- 8937 Cape Windham Place

- 8928 Cape Windham Place

- 9095 Central Ave

- 6504 Filbert Ave

- 6604 Filbert Ave

- 9083 Central Ave

- 9068 Central Ave

- 9115 Central Ave

- 8946 Cape Windham Place

- 6511 Filbert Ave

- 8924 Cape Windham Place

Your Personal Tour Guide

Ask me questions while you tour the home.