6603 83rd Ct N Brooklyn Park, MN 55445

Candlewood NeighborhoodEstimated Value: $149,000 - $155,000

2

Beds

1

Bath

924

Sq Ft

$163/Sq Ft

Est. Value

About This Home

This home is located at 6603 83rd Ct N, Brooklyn Park, MN 55445 and is currently estimated at $151,001, approximately $163 per square foot. 6603 83rd Ct N is a home located in Hennepin County with nearby schools including Edinbrook Elementary School, North View Middle School, and Osseo Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 28, 2014

Sold by

Secretary Of Housing & Urban Development

Bought by

Champion Katherine M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$26,455

Outstanding Balance

$7,913

Interest Rate

3.37%

Mortgage Type

FHA

Estimated Equity

$143,088

Purchase Details

Closed on

Jul 15, 2013

Sold by

Citimortgage Inc

Bought by

The Secretary Of Housing & Urban Develop

Purchase Details

Closed on

Jun 27, 2013

Sold by

Oelkers Cori Lynne

Bought by

Citimortgage Inc

Purchase Details

Closed on

Feb 13, 2012

Sold by

Fifth Condominium

Bought by

Citimortgage Inc

Purchase Details

Closed on

Sep 2, 2011

Sold by

Oelkers Cori L

Bought by

Stonybrook Fifth Association

Purchase Details

Closed on

Apr 30, 2003

Sold by

Zehnder Ryan N

Bought by

Taylor Joshua Robert and Taylor Cori Lynne

Purchase Details

Closed on

Jun 15, 1999

Sold by

Hinze Mary

Bought by

Zehnder Ryan N

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Champion Katherine M | -- | Burnet Title | |

| The Secretary Of Housing & Urban Develop | -- | None Available | |

| Citimortgage Inc | $120,684 | None Available | |

| Citimortgage Inc | -- | None Available | |

| Stonybrook Fifth Association | $2,844 | -- | |

| Stonybrook Fifth Association | $2,844 | None Available | |

| Taylor Joshua Robert | $110,000 | -- | |

| Zehnder Ryan N | $57,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Champion Katherine M | $26,455 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,921 | $138,600 | $30,000 | $108,600 |

| 2023 | $2,049 | $145,900 | $30,000 | $115,900 |

| 2022 | $1,475 | $147,500 | $30,000 | $117,500 |

| 2021 | $1,405 | $126,300 | $20,000 | $106,300 |

| 2020 | $1,256 | $121,600 | $20,000 | $101,600 |

| 2019 | $1,006 | $107,300 | $20,000 | $87,300 |

| 2018 | $689 | $88,200 | $14,900 | $73,300 |

| 2017 | $709 | $63,700 | $14,900 | $48,800 |

| 2016 | $658 | $58,200 | $14,900 | $43,300 |

| 2015 | $618 | $53,000 | $14,900 | $38,100 |

| 2014 | -- | $45,000 | $14,900 | $30,100 |

Source: Public Records

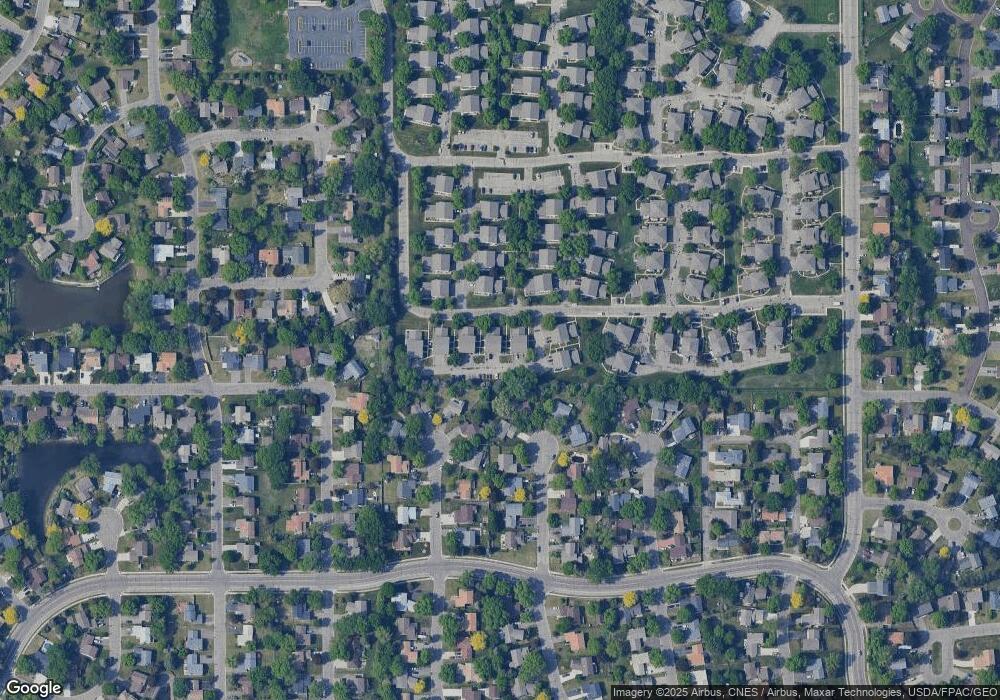

Map

Nearby Homes

- 6523 84th Ct N Unit 6523

- 6526 83rd Ct N

- 6517 83rd Ct N

- 6415 84th Ct N

- 6614 84th Ct N

- 8233 Hampshire Ct N

- 6716 83rd Ave N

- 8400 Brunswick Ave N

- 8357 Jersey Ave N

- 6419 Tessman Terrace N

- 6236 Creekview Ln N

- 8614 Tessman Pkwy N

- 5932 83rd Pkwy N

- 8033 Georgia Ave N

- 8657 Tessman Cir N

- 6508 88th Ave N

- 6601 89th Ave N

- 8426 Yates Ave N

- 5610 84th 1 2 Ave N

- 8576 S Maplebrook Cir

- 6625 83rd Ct N

- 6621 83rd Ct N Unit 6621

- 6619 83rd Ct N

- 6607 83rd Ct N Unit 6607

- 6605 83rd Ct N

- 6601 83rd Ct N Unit 660183

- 6515 6515 83rd-Court-n

- 6603 6603 83rd Ct N

- 6531 6531 83rd-Court-n

- 6525 6525 83rd Ct N

- 6529 6529 83rd Ct N

- 6527 6527 83rd-Court-n

- 6519 6519 83rd Ct N

- 6521 6521 83rd-Court-n

- 6521 6521 83rd Ct N

- 6527 6527 83rd Ct N

- 6523 6523 83rd Ct N

- 6619 6619 83rd Ct N

- 6529 83rd Ct N

- 6527 83rd Ct N Unit 6527