6604 Sutton Dr Urbandale, IA 50322

Estimated Value: $239,848 - $292,000

3

Beds

1

Bath

1,660

Sq Ft

$159/Sq Ft

Est. Value

About This Home

This home is located at 6604 Sutton Dr, Urbandale, IA 50322 and is currently estimated at $263,462, approximately $158 per square foot. 6604 Sutton Dr is a home located in Polk County with nearby schools including Timber Ridge Elementary School, Johnston Middle School, and Summit Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 15, 2020

Sold by

Wilde David G

Bought by

Wilde David G and Millette Wilde Nancy

Current Estimated Value

Purchase Details

Closed on

Mar 27, 2010

Sold by

Mcbroom Dianne Kay and Mcbroom Joseph M

Bought by

Wilde David G

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$156,021

Interest Rate

4.87%

Mortgage Type

FHA

Purchase Details

Closed on

Oct 22, 2003

Sold by

James Dorothy Jean

Bought by

James Dorothy Jean and Mcbroom Dianne Kay

Purchase Details

Closed on

Sep 4, 2003

Sold by

Gerdeman Arlene and Petersen Judith Kay

Bought by

James Dorothy J

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wilde David G | -- | None Available | |

| Wilde David G | -- | Bollman Matthew | |

| Wilde David G | $158,500 | None Available | |

| James Dorothy Jean | -- | -- | |

| James Dorothy J | $159,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Wilde David G | $156,021 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,456 | $245,500 | $32,700 | $212,800 |

| 2024 | $3,456 | $230,300 | $30,300 | $200,000 |

| 2023 | $3,440 | $230,300 | $30,300 | $200,000 |

| 2022 | $3,868 | $192,500 | $26,100 | $166,400 |

| 2021 | $3,874 | $192,500 | $26,100 | $166,400 |

| 2020 | $3,808 | $183,000 | $26,400 | $156,600 |

| 2019 | $3,744 | $183,000 | $26,400 | $156,600 |

| 2018 | $3,604 | $169,900 | $25,400 | $144,500 |

| 2017 | $3,482 | $169,900 | $25,400 | $144,500 |

| 2016 | $3,396 | $160,800 | $25,700 | $135,100 |

| 2015 | $3,396 | $160,800 | $25,700 | $135,100 |

| 2014 | $3,290 | $154,800 | $30,800 | $124,000 |

Source: Public Records

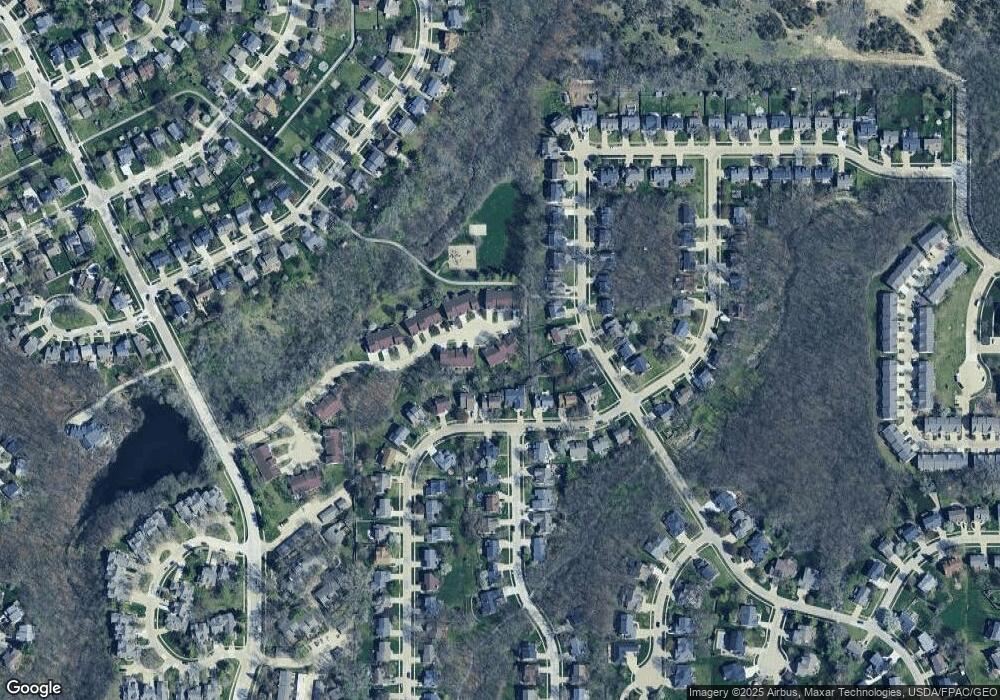

Map

Nearby Homes

- 4709 67th St

- 6810 Hickory Ln

- 4629 66th St

- 4633 Lockner Dr Unit 3

- 4848 63rd St

- 6822 Oakwood Dr

- 7037 Hickory Ln

- 5916 Sutton Place Unit 1

- 7036 Sharon Dr

- 6404 Meredith Dr

- 4511 67th St

- 4719 71st St

- 7014 Northview Dr

- 4718 71st St

- 4501 65th St

- 4831 71st St

- 4410 67th St

- 4519 61st St

- 4503 62nd St

- 4850 72nd St