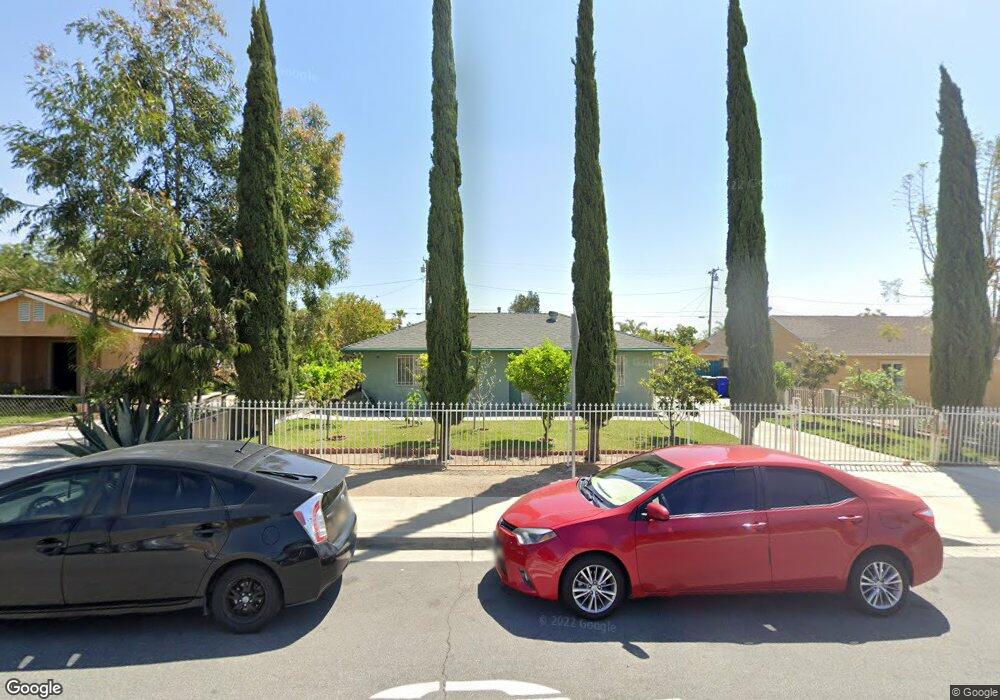

6613 Jacaranda Ave Fontana, CA 92336

Estimated Value: $450,640 - $511,000

2

Beds

1

Bath

720

Sq Ft

$677/Sq Ft

Est. Value

About This Home

This home is located at 6613 Jacaranda Ave, Fontana, CA 92336 and is currently estimated at $487,410, approximately $676 per square foot. 6613 Jacaranda Ave is a home located in San Bernardino County with nearby schools including Dorothy Grant Elementary School, Wayne Ruble Middle School, and Summit High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 29, 2003

Sold by

Diaz Porfirio G

Bought by

Diaz Porfirio G

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$89,000

Interest Rate

5.29%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Mar 10, 1998

Sold by

Vaquerano Santos

Bought by

Diaz Porfirio G and Gutierez Jose Heriberto

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$74,950

Interest Rate

7.18%

Mortgage Type

FHA

Purchase Details

Closed on

Sep 12, 1997

Sold by

Vaquerano Sonia I

Bought by

Vaquerano Santos

Purchase Details

Closed on

Sep 2, 1997

Sold by

Yancy Herbert

Bought by

Lee Edward G and Jacaranda Trust

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Diaz Porfirio G | -- | Atc | |

| Diaz Porfirio G | $75,000 | Northern Counties Title | |

| Vaquerano Santos | -- | Stewart Title | |

| Vaquerano Santos | $32,500 | Stewart Title | |

| Lee Edward G | $20,000 | Stewart Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Diaz Porfirio G | $89,000 | |

| Closed | Diaz Porfirio G | $74,950 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,431 | $140,891 | $40,033 | $100,858 |

| 2024 | $2,268 | $138,128 | $39,248 | $98,880 |

| 2023 | $1,765 | $135,419 | $38,478 | $96,941 |

| 2022 | $1,740 | $132,764 | $37,724 | $95,040 |

| 2021 | $1,714 | $130,160 | $36,984 | $93,176 |

| 2020 | $1,695 | $128,826 | $36,605 | $92,221 |

| 2019 | $1,654 | $126,300 | $35,887 | $90,413 |

| 2018 | $1,654 | $123,823 | $35,183 | $88,640 |

| 2017 | $1,619 | $121,395 | $34,493 | $86,902 |

| 2016 | $1,570 | $119,015 | $33,817 | $85,198 |

| 2015 | -- | $117,227 | $33,309 | $83,918 |

| 2014 | $1,519 | $114,931 | $32,657 | $82,274 |

Source: Public Records

Map

Nearby Homes

- Residence 1602 Plan at Citrus Lane

- Residence 1500 Plan at Citrus Lane

- 16186 Lumia Way

- 16202 Lumia Way

- 16208 Lumia Way

- 16210 Lumia Way

- 16229 Castello Ln Unit 6

- 16125 Gelato Ct Unit 3

- 16020 Sunny Ct

- 16281 Castello Ln Unit 2

- 16573 Botanical Ln

- 16224 Sun Glory Way

- 6126 Cooper Ave

- 15645 Gulfstream Ave

- 6367 Moonfire Ln

- 15532 Skylark Ave

- 6375 Moonfire Ln

- 6373 Moonfire Ln

- 6363 Moonfire Ln

- 6366 Moonfire Ln

- 6603 Jacaranda Ave

- 6623 Jacaranda Ave

- 6599 Jacaranda Ave

- 6631 Jacaranda Ave

- 6614 Tokay Ave

- 6624 Tokay Ave

- 6591 Jacaranda Ave

- 6641 Jacaranda Ave

- 6598 Tokay Ave

- 6632 Tokay Ave

- 6614 Jacaranda Ave

- 6624 Jacaranda Ave

- 6604 Jacaranda Ave

- 6651 Jacaranda Ave

- 6581 Jacaranda Ave

- 6590 Tokay Ave

- 6642 Tokay Ave

- 6632 Jacaranda Ave

- 6598 Jacaranda Ave

- 6642 Jacaranda Ave