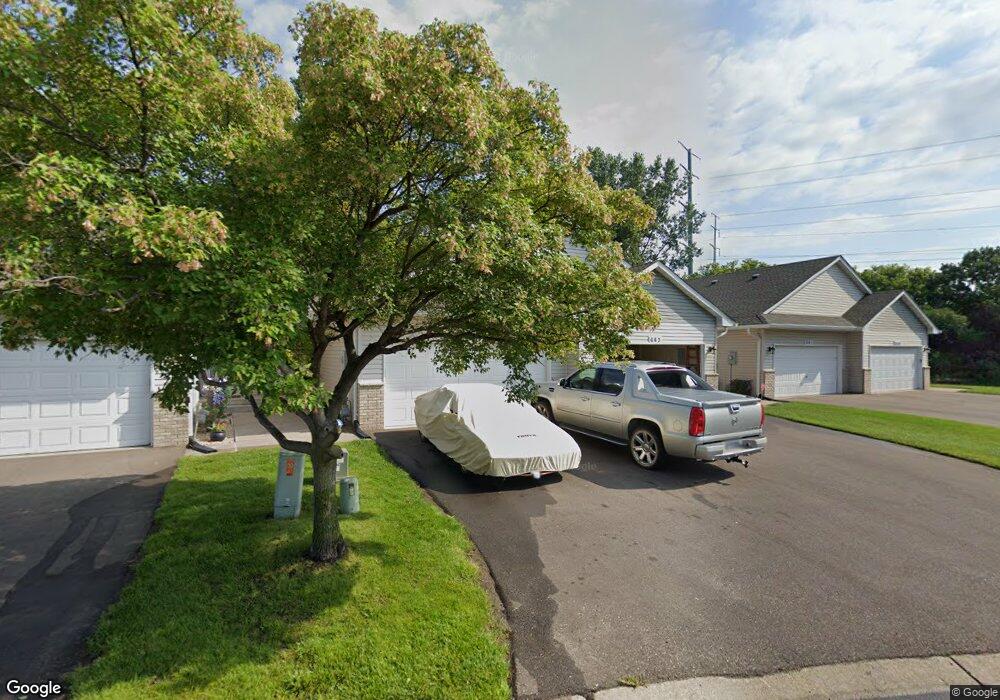

663 86th Ln NW Unit 56 Coon Rapids, MN 55433

Estimated Value: $250,000 - $281,870

2

Beds

2

Baths

1,607

Sq Ft

$165/Sq Ft

Est. Value

About This Home

This home is located at 663 86th Ln NW Unit 56, Coon Rapids, MN 55433 and is currently estimated at $265,957, approximately $165 per square foot. 663 86th Ln NW Unit 56 is a home located in Anoka County with nearby schools including Adams Elementary School, Coon Rapids Middle School, and Coon Rapids Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 17, 2021

Sold by

Swierczek Taylor Rose and Swierczek Taylor Jordan

Bought by

Linderman Wendlin and Linderman Darlene

Purchase Details

Closed on

Nov 17, 2017

Sold by

The Estate Of Barbara A Snadberg

Bought by

The Estate Of Barbara A Sandberg

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$500,000

Interest Rate

3.88%

Mortgage Type

Credit Line Revolving

Purchase Details

Closed on

Oct 17, 2017

Sold by

Stuart James

Bought by

River Village Estates Condominium Associ

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$500,000

Interest Rate

3.88%

Mortgage Type

Credit Line Revolving

Purchase Details

Closed on

May 30, 2002

Sold by

Ritter Jennifer J

Bought by

Sandberg Barbara A

Purchase Details

Closed on

Aug 26, 1999

Sold by

Prime Builders Inc

Bought by

Ritter Jennifer J

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Linderman Wendlin | $240,000 | Titlesmart Inc | |

| The Estate Of Barbara A Sandberg | $5,994 | None Available | |

| River Village Estates Condominium Associ | $5,994 | None Available | |

| Sandberg Barbara A | $156,000 | -- | |

| Ritter Jennifer J | $109,223 | -- | |

| Linderman Wendlin Wendlin | $240,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Gause Taylor | $166,250 | |

| Previous Owner | The Estate Of Barbara A Sandberg | $500,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,478 | $256,500 | $45,000 | $211,500 |

| 2024 | $2,241 | $247,300 | $45,000 | $202,300 |

| 2023 | $2,291 | $232,900 | $45,500 | $187,400 |

| 2022 | $2,201 | $242,800 | $40,000 | $202,800 |

| 2021 | $2,295 | $209,800 | $24,000 | $185,800 |

| 2020 | $1,972 | $198,900 | $20,000 | $178,900 |

| 2019 | $1,882 | $179,700 | $15,000 | $164,700 |

| 2018 | $2,163 | $168,000 | $0 | $0 |

| 2017 | $1,740 | $153,400 | $0 | $0 |

| 2016 | $1,723 | $147,000 | $0 | $0 |

| 2015 | $1,575 | $147,000 | $18,900 | $128,100 |

| 2014 | -- | $119,800 | $8,000 | $111,800 |

Source: Public Records

Map

Nearby Homes

- 8692 Norway St NW

- 8794 Norway St NW

- 691 85th Ln NW Unit 1

- 8710 E River Rd NW

- 8506 E River Rd NW

- 8433 E River Rd NW

- 8385 E River Rd NW

- 8456 Mississippi Blvd NW

- 381 Ironton St NE

- 600 Kimball St NE

- XXX Holly St NW

- 9230 Unity St NW

- 620 Glencoe St NE

- 630 Glencoe St NE

- 9540 Irving Ave N

- 670 Glencoe St NE

- 440 Ely St NE

- 200 94th Ave NW

- 614 Cheryl St NE

- 161 91st Ave NE

- 665 86th Ln NW

- 661 86th Ln NW Unit 55

- 667 86th Ln NW Unit 58

- 659 86th Ln NW

- 669 86th Ln NW Unit 59

- 655 86th Ln NW

- 653 86th Ln NW Unit 52

- 670 86th Ln NW Unit 15

- 651 86th Ln NW Unit 51

- 672 86th Ln NW

- 652 86th Ln NW Unit 16

- 674 86th Ln NW Unit 13

- 649 86th Ln NW

- 679 86th Ln NW

- 650 86th Ln NW

- 676 86th Ln NW

- 681 86th Ln NW

- 648 86th Ln NW

- 645 86th Ln NW

- 678 86th Ln NW Unit 11