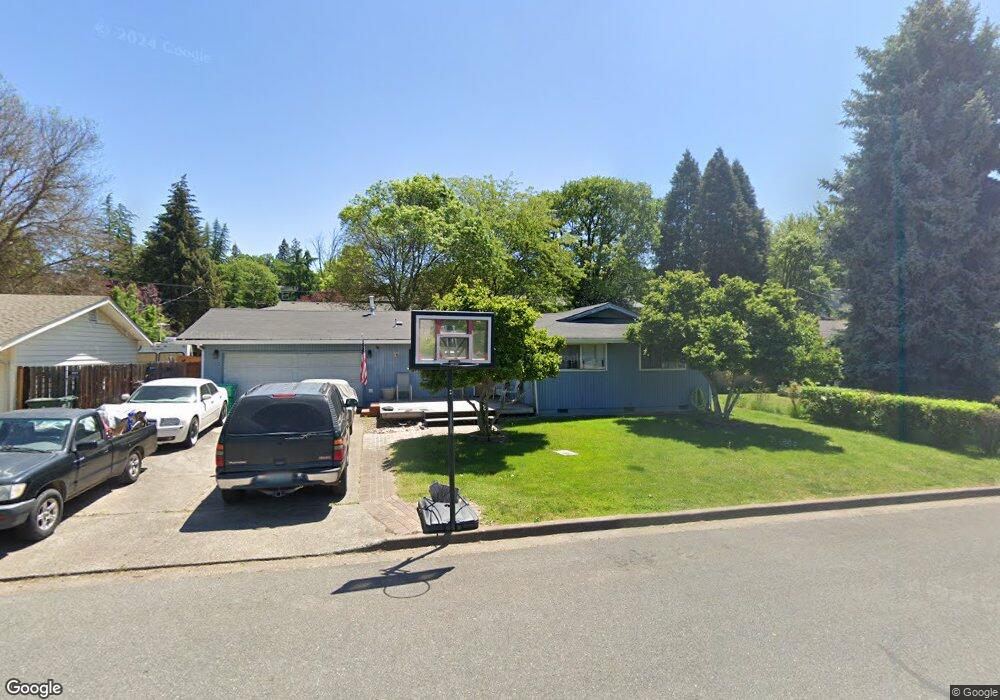

663 Talbot St Eagle Point, OR 97524

Estimated Value: $286,000 - $326,725

3

Beds

2

Baths

1,100

Sq Ft

$276/Sq Ft

Est. Value

About This Home

This home is located at 663 Talbot St, Eagle Point, OR 97524 and is currently estimated at $303,931, approximately $276 per square foot. 663 Talbot St is a home located in Jackson County with nearby schools including Eagle Point Middle School, White Mountain Middle School, and Eagle Point High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 8, 2008

Sold by

Lee Gerald T and Lee Victoria

Bought by

Dee Jim and Dee Eunice

Current Estimated Value

Purchase Details

Closed on

May 3, 2005

Sold by

Lee Gerald T

Bought by

Lee Gerald T and Lee Victoria

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$175,750

Interest Rate

7.15%

Mortgage Type

Unknown

Purchase Details

Closed on

Aug 31, 2004

Sold by

Bates Jean M and Bates Bette A

Bought by

Lee Gerald T

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$126,000

Interest Rate

5.99%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Dee Jim | $127,501 | Ticor Title | |

| Lee Gerald T | -- | Lawyers Title Ins | |

| Lee Gerald T | $157,500 | First American |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Lee Gerald T | $175,750 | |

| Previous Owner | Lee Gerald T | $126,000 | |

| Closed | Lee Gerald T | $31,500 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2026 | $2,323 | $170,740 | -- | -- |

| 2025 | $2,268 | $165,770 | $52,740 | $113,030 |

| 2024 | $2,268 | $160,950 | $51,200 | $109,750 |

| 2023 | $2,192 | $156,270 | $49,720 | $106,550 |

| 2022 | $2,132 | $156,270 | $49,720 | $106,550 |

| 2021 | $2,069 | $151,720 | $48,270 | $103,450 |

| 2020 | $2,198 | $147,310 | $46,860 | $100,450 |

| 2019 | $2,164 | $138,860 | $44,170 | $94,690 |

| 2018 | $2,123 | $134,820 | $42,880 | $91,940 |

| 2017 | $2,071 | $134,820 | $42,880 | $91,940 |

| 2016 | $2,031 | $127,090 | $40,430 | $86,660 |

| 2015 | $1,964 | $127,090 | $40,430 | $86,660 |

| 2014 | $1,908 | $119,800 | $38,110 | $81,690 |

Source: Public Records

Map

Nearby Homes

- 522 Meadow Ln

- 620 S Royal Ave

- 888 Arrowhead Trail

- 0 Sf Little Butte Unit 220204792

- 133 Edith Cir

- 959 Pumpkin Ridge Dr

- 839 St Andrews Way

- 650 Sarah Ln

- 131 Bellerive Dr

- 964 Pumpkin Ridge

- 869 St Andrews Way

- 421 Stevens Rd Unit 20

- 421 Stevens Rd Unit 14

- 421 Stevens Rd Unit 52

- 0 Crater Lake Hwy

- 1065 S Shasta Ave

- 124 Paxon Ave

- 10569 Hannon Rd

- 142 Onyx St

- 220 Pine Lake Dr

Your Personal Tour Guide

Ask me questions while you tour the home.