6648 Bridle Cir Yorba Linda, CA 92886

Estimated Value: $754,375 - $1,003,000

4

Beds

2

Baths

1,600

Sq Ft

$526/Sq Ft

Est. Value

About This Home

This home is located at 6648 Bridle Cir, Yorba Linda, CA 92886 and is currently estimated at $842,094, approximately $526 per square foot. 6648 Bridle Cir is a home located in Orange County with nearby schools including Glenknoll Elementary, Bernardo Yorba Middle School, and Ivycrest Montessori Private School - Yorba Linda.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 20, 2018

Sold by

Patterson Conrad M and Patterson Nancy E

Bought by

Patterson Conrad M and Patterson Pattreson E

Current Estimated Value

Purchase Details

Closed on

Jan 12, 2004

Sold by

Martinez David C and Martinez Elizabeth A

Bought by

Patterson Conrad M and Patterson Nancy

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$268,500

Outstanding Balance

$123,123

Interest Rate

5.62%

Mortgage Type

Stand Alone First

Estimated Equity

$718,971

Purchase Details

Closed on

Jul 17, 2001

Sold by

Martinez Elizabeth A and Chapman Elizabeth A

Bought by

Martinez David C and Martinez Elizabeth A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$150,000

Interest Rate

7.15%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Patterson Conrad M | -- | None Available | |

| Patterson Conrad M | $358,000 | Old Republic Title | |

| Martinez David C | -- | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Patterson Conrad M | $268,500 | |

| Previous Owner | Martinez David C | $150,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,765 | $508,993 | $399,799 | $109,194 |

| 2024 | $5,765 | $499,013 | $391,960 | $107,053 |

| 2023 | $5,648 | $489,229 | $384,275 | $104,954 |

| 2022 | $5,586 | $479,637 | $376,740 | $102,897 |

| 2021 | $5,484 | $470,233 | $369,353 | $100,880 |

| 2020 | $5,479 | $465,412 | $365,566 | $99,846 |

| 2019 | $5,291 | $456,287 | $358,398 | $97,889 |

| 2018 | $5,220 | $447,341 | $351,371 | $95,970 |

| 2017 | $5,129 | $438,570 | $344,481 | $94,089 |

| 2016 | $5,021 | $429,971 | $337,726 | $92,245 |

| 2015 | $4,801 | $410,000 | $328,491 | $81,509 |

| 2014 | $4,118 | $351,780 | $270,271 | $81,509 |

Source: Public Records

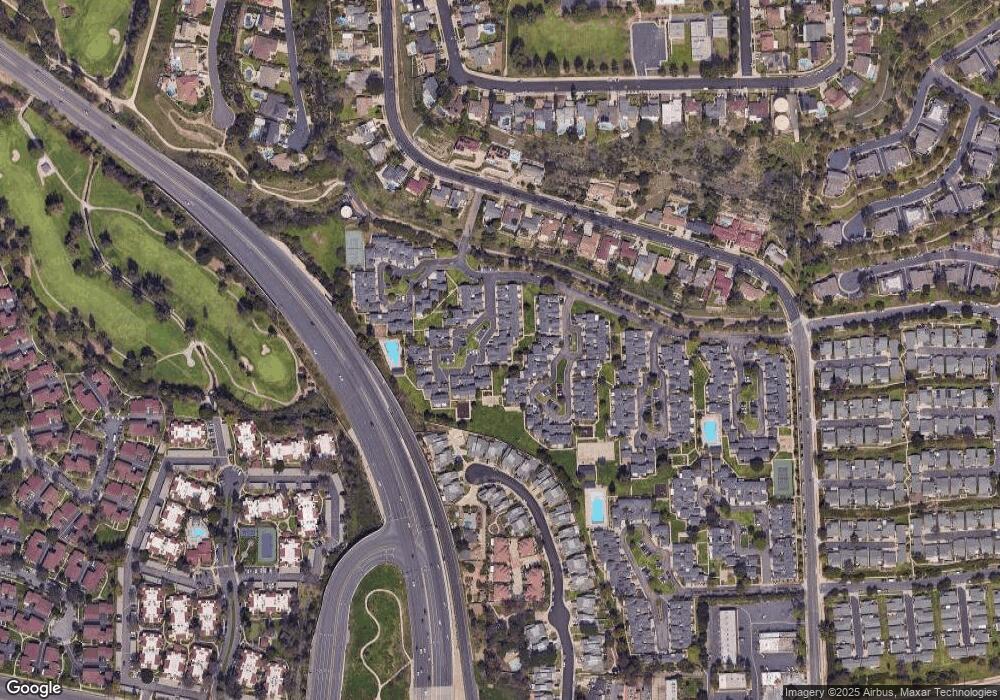

Map

Nearby Homes

- 6635 Bridle Cir

- 6692 Moselle Cir

- 6681 Palma Cir

- 6692 Palma Cir

- 19816 White Spring Ln Unit 36

- 5497 E Willow Woods Ln Unit C

- 19622 Crestknoll Dr

- 5466 E Willow Woods Ln Unit A

- 5455 E Candlewood Cir Unit 61

- 1738 N Cedar Glen Dr Unit B

- 1760 N Oak Knoll Dr Unit B

- 19931 Crestknoll Dr

- 1726 N Oak Knoll Dr Unit D

- 6478 Horse Shoe Ln Unit 9

- 6437 Horse Shoe Ln Unit 2

- 6821 Rocky Grove Ct Unit 13

- 6473 Horse Shoe Ln Unit 6

- 20065 Berkeley Way

- 5815 E La Palma Ave Unit 74

- 5815 E La Palma Ave Unit 190

- 6656 Bridle Cir

- 6644 Bridle Cir

- 6642 Bridle Cir

- 6662 Bridle Cir

- 6638 Bridle Cir

- 6666 Bridle Cir

- 6655 Moselle Cir

- 6671 Moselle Cir

- 6661 Moselle Cir

- 6665 Moselle Cir

- 6636 Bridle Cir

- 6649 Moselle Cir

- 6675 Moselle Cir

- 6668 Bridle Cir

- 6632 Bridle Cir

- 6645 Moselle Cir

- 6681 Moselle Cir

- 6631 Bridle Cir

- 6639 Bridle Cir

- 6672 Bridle Cir