665 Hidden Valley Ct Fairborn, OH 45324

Estimated Value: $152,000 - $187,000

2

Beds

3

Baths

1,428

Sq Ft

$117/Sq Ft

Est. Value

About This Home

This home is located at 665 Hidden Valley Ct, Fairborn, OH 45324 and is currently estimated at $167,308, approximately $117 per square foot. 665 Hidden Valley Ct is a home located in Greene County with nearby schools including Fairborn Primary School, Fairborn Intermediate School, and Fairborn Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 23, 2014

Sold by

Herman Sabrina A

Bought by

Federal National Mortgage Association

Current Estimated Value

Purchase Details

Closed on

May 27, 2003

Sold by

Askew Jeffrey E and Askew Doris

Bought by

Herman Sabrina A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$61,000

Interest Rate

5.88%

Mortgage Type

Unknown

Purchase Details

Closed on

Aug 3, 1995

Sold by

Nolin Robert M

Bought by

Asken Jeffrey E and Asken Doris

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$74,550

Interest Rate

7.56%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Federal National Mortgage Association | $52,000 | None Available | |

| Herman Sabrina A | $85,000 | -- | |

| Asken Jeffrey E | $78,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Herman Sabrina A | $61,000 | |

| Previous Owner | Asken Jeffrey E | $74,550 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,297 | $47,960 | $3,150 | $44,810 |

| 2023 | $2,297 | $47,960 | $3,150 | $44,810 |

| 2022 | $1,921 | $33,770 | $3,150 | $30,620 |

| 2021 | $1,949 | $33,770 | $3,150 | $30,620 |

| 2020 | $1,959 | $33,770 | $3,150 | $30,620 |

| 2019 | $1,936 | $33,410 | $3,150 | $30,260 |

| 2018 | $1,957 | $33,410 | $3,150 | $30,260 |

| 2017 | $1,880 | $33,410 | $3,150 | $30,260 |

| 2016 | $1,880 | $32,080 | $3,150 | $28,930 |

| 2015 | $1,793 | $32,080 | $3,150 | $28,930 |

| 2014 | $1,715 | $32,080 | $3,150 | $28,930 |

Source: Public Records

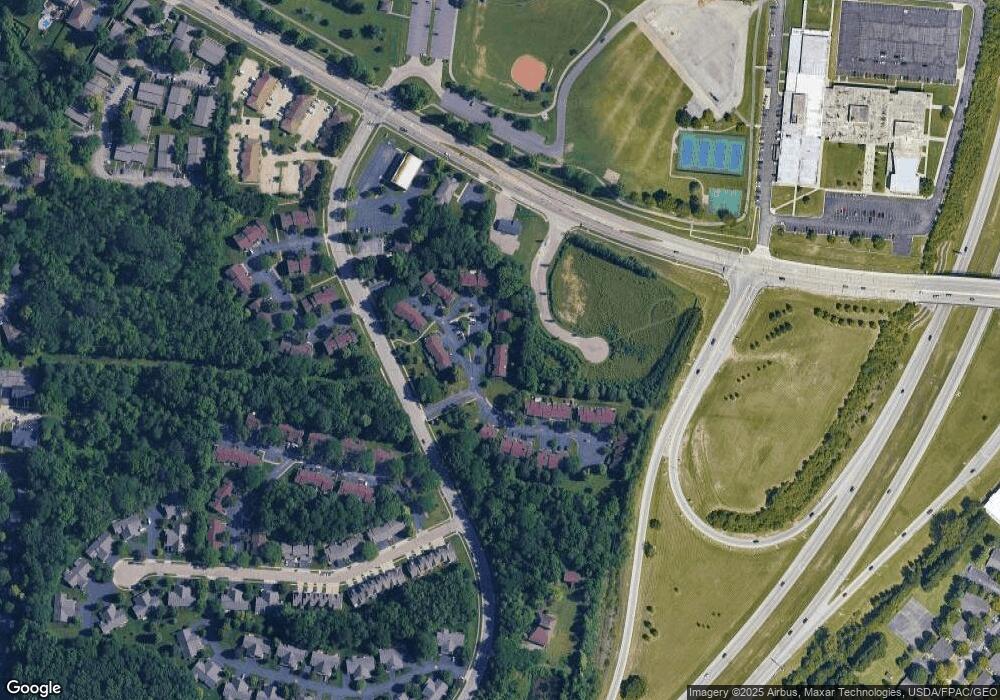

Map

Nearby Homes

- 630 Hidden Valley Ct

- 968 Arborview Ct

- 2181 Chapel Dr Unit 2181

- 474 Kalynn Cir

- 474 Kalynn Cir Unit 19

- 482 Kalynn Cir Unit 18

- 479 Park Hills Crossing Unit 17

- 479 Park Hills Crossing

- 427 Alisha Ln

- 444 Park Hills Crossing Unit 54

- 411 Kalynn Cir Unit 30

- 301 Faculty Dr

- 401 Zimmer Dr

- 435 Cherrywood Dr

- 1526 Wedgewood Dr

- 1101 Arden Way

- 1105 Windsong Trail

- 1128 Whitetail Dr

- 2411 Patrick Blvd

- 1558 Glendale Dr

- 667 Hidden Valley Ct

- 669 Hidden Valley Ct

- 659 Hidden Valley Ct

- 671 Hidden Valley Ct

- 657 Hidden Valley Ct

- 670 Hidden Valley Ct

- 664 Hidden Valley Ct

- 658 Hidden Valley Ct

- 717 Hidden Valley Ct

- 652 Hidden Valley Ct

- 649 Hidden Valley Ct

- 647 Hidden Valley Ct

- 639 Hidden Valley Ct

- 645 Hidden Valley Ct

- 729 Hidden Valley Ct

- 643 Hidden Valley Ct

- 635 Hidden Valley Ct

- 735 Hidden Valley Ct

- 642 Hidden Valley Ct

- 696 Hidden Valley Ct