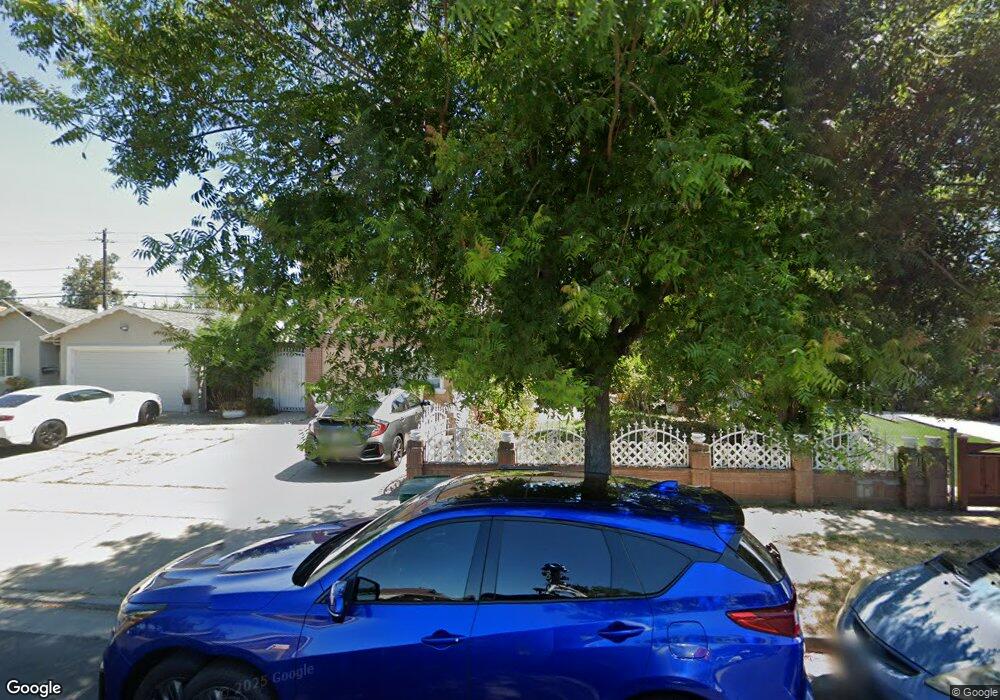

665 Serenade Way San Jose, CA 95111

Hellyer NeighborhoodEstimated Value: $1,055,000 - $1,300,000

6

Beds

3

Baths

1,137

Sq Ft

$998/Sq Ft

Est. Value

About This Home

This home is located at 665 Serenade Way, San Jose, CA 95111 and is currently estimated at $1,135,060, approximately $998 per square foot. 665 Serenade Way is a home located in Santa Clara County with nearby schools including Christopher Elementary School, Davis (Caroline) Intermediate School, and Andrew P. Hill High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 6, 2017

Sold by

The Socorro Lopez Family Trust and Lopez Socorro

Bought by

Lopez Jesus G and Lopez Angel G

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$455,000

Outstanding Balance

$378,569

Interest Rate

4.03%

Mortgage Type

New Conventional

Estimated Equity

$756,491

Purchase Details

Closed on

Nov 24, 2003

Sold by

Lopez Socorro

Bought by

The Socorro Lopez Family Trust and Lopez Socorro

Purchase Details

Closed on

May 28, 1997

Sold by

Grays Priscilla A

Bought by

Lopez Socorro

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$157,500

Interest Rate

8.08%

Purchase Details

Closed on

May 27, 1997

Sold by

Lopez Jesus L

Bought by

Lopez Socorro

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$157,500

Interest Rate

8.08%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lopez Jesus G | $665,000 | First American Title Company | |

| The Socorro Lopez Family Trust | -- | -- | |

| Lopez Socorro | $210,000 | Fidelity National Title Co | |

| Lopez Socorro | -- | Fidelity National Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Lopez Jesus G | $455,000 | |

| Previous Owner | Lopez Socorro | $157,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,906 | $392,139 | $153,896 | $238,243 |

| 2024 | $6,906 | $384,451 | $150,879 | $233,572 |

| 2023 | $6,756 | $376,914 | $147,921 | $228,993 |

| 2022 | $6,683 | $369,524 | $145,021 | $224,503 |

| 2021 | $6,510 | $362,279 | $142,178 | $220,101 |

| 2020 | $6,273 | $358,566 | $140,721 | $217,845 |

| 2019 | $6,084 | $351,536 | $137,962 | $213,574 |

| 2018 | $6,009 | $344,644 | $135,257 | $209,387 |

| 2017 | $6,006 | $337,887 | $132,605 | $205,282 |

| 2016 | $5,723 | $331,262 | $130,005 | $201,257 |

| 2015 | $5,602 | $326,287 | $128,053 | $198,234 |

| 2014 | $4,630 | $319,896 | $125,545 | $194,351 |

Source: Public Records

Map

Nearby Homes

- 640 Coyote Rd

- 774 River View Dr

- 4573 Bolero Dr

- 352 Via Primavera Dr

- 471 Serenade Way

- 355 Otono Ct

- 4171 Ambler Way

- 4996 Eberly Dr

- 490 Ella Dr

- 4614 Houndshaven Way

- 4219 Senter Rd

- 476 Branham Ln E

- 320 Battle Dance Dr

- 4943 Rice Dr

- 175 Page Mill Dr

- 25 Deer Run Cir

- 5068 Calwa Ct

- 5117 Discovery Ave

- 5077 Bengal Dr

- 4320 Monterey Rd Unit 39

- 661 Serenade Way

- 675 Serenade Way

- 688 Coyote Rd

- 679 Serenade Way

- 653 Serenade Way

- 680 Coyote Rd

- 696 Coyote Rd

- 676 Coyote Rd

- 4696 Tango Way

- 685 Serenade Way

- 704 Coyote Rd

- 649 Serenade Way

- 670 Coyote Rd

- 652 Serenade Way

- 678 Serenade Way

- 712 Coyote Rd

- 691 Serenade Way

- 4692 Tango Way

- 645 Serenade Way

- 684 Serenade Way Unit 4