6650 Wishing Well Way Loomis, CA 95650

Estimated Value: $662,000 - $1,039,000

3

Beds

2

Baths

1,890

Sq Ft

$453/Sq Ft

Est. Value

About This Home

This home is located at 6650 Wishing Well Way, Loomis, CA 95650 and is currently estimated at $856,797, approximately $453 per square foot. 6650 Wishing Well Way is a home located in Placer County with nearby schools including Del Oro High School, Loomis Basin Charter School, and Sierra Foothills Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 17, 2008

Sold by

Kittle Morrow Thomas O and Kittle Morrow Paige

Bought by

Kittle Morrow Thomas O and Kittle Morrow Paige

Current Estimated Value

Purchase Details

Closed on

Jun 4, 2003

Sold by

Morrow Paige Kittle

Bought by

Morrow Thomas O

Purchase Details

Closed on

Jul 11, 2001

Sold by

Morrow Thomas O and Morrow Kathleen

Bought by

Morrow Thomas O

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$140,000

Interest Rate

7.26%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Mar 22, 2000

Sold by

Morrow Thomas O

Bought by

Morrow Thomas O

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kittle Morrow Thomas O | -- | None Available | |

| Morrow Thomas O | -- | Financial Title Company | |

| Morrow Thomas O | -- | Financial Title Company | |

| Kittle Morrow Thomas O | -- | Financial Title Company | |

| Morrow Thomas O | -- | Alliance Title Company | |

| Morrow Thomas O | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Morrow Thomas O | $140,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,123 | $267,220 | $93,213 | $174,007 |

| 2023 | $3,123 | $256,846 | $89,595 | $167,251 |

| 2022 | $3,050 | $251,811 | $87,839 | $163,972 |

| 2021 | $2,967 | $246,874 | $86,117 | $160,757 |

| 2020 | $2,926 | $244,343 | $85,234 | $159,109 |

| 2019 | $2,873 | $239,553 | $83,563 | $155,990 |

| 2018 | $2,724 | $234,857 | $81,925 | $152,932 |

| 2017 | $2,673 | $230,253 | $80,319 | $149,934 |

| 2016 | $2,612 | $225,740 | $78,745 | $146,995 |

| 2015 | $2,555 | $222,350 | $77,563 | $144,787 |

| 2014 | $2,512 | $217,995 | $76,044 | $141,951 |

Source: Public Records

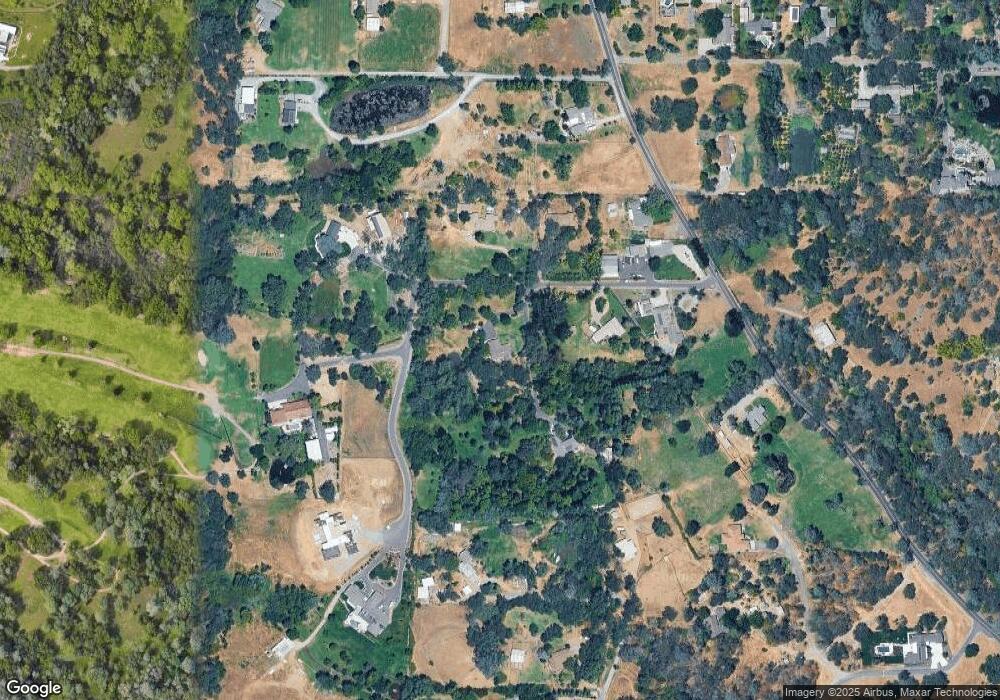

Map

Nearby Homes

- 6 Wishing Well Rd

- 4 Wishing Well Rd

- 5 Wishing Well Rd

- 4272 Laird Rd

- 6740 Brooks Ln

- 5726 Secret Creek Dr

- 5740 Golden Pond Dr

- 5731 Secret Creek Dr

- 6505 Rutherford Canyon Rd

- 6600 Rutherford Canyon Rd

- 4227 Whitethorn Dr

- Residence Five Plan at The Woods at Crowne Point

- The Starling Plan at The Lake at Crowne Point II

- Residence Two Plan at The Woods at Crowne Point

- Residence Four Plan at The Woods at Crowne Point

- Residence One Plan at The Woods at Crowne Point

- The Meadowlark Plan at The Lake at Crowne Point II

- Residence Three Plan at The Woods at Crowne Point

- The Cardinal Plan at The Lake at Crowne Point II

- The Crane Plan at The Lake at Crowne Point II

- 6714 Wishing Well Way

- 6670 Wishing Well Way

- 6647 Wishing Well Way

- 6675 Wishing Well Way

- 6639 Wishing Well Way

- 6755 Wishing Well Way

- 6629 Wishing Well Way

- 4600 Laird Rd

- 4514 Laird Rd

- 6500 Wishing Well Way

- 6935 Brooks Ln

- 4469 Laird Rd

- 4479 Laird Rd

- 6965 Brooks Ln

- 4410 Laird Rd

- 4612 Laird Rd

- 4515 Laird Rd

- 6985 Brooks Ln

- 6855 Brooks Ln

- 6619 Wishing Well Way