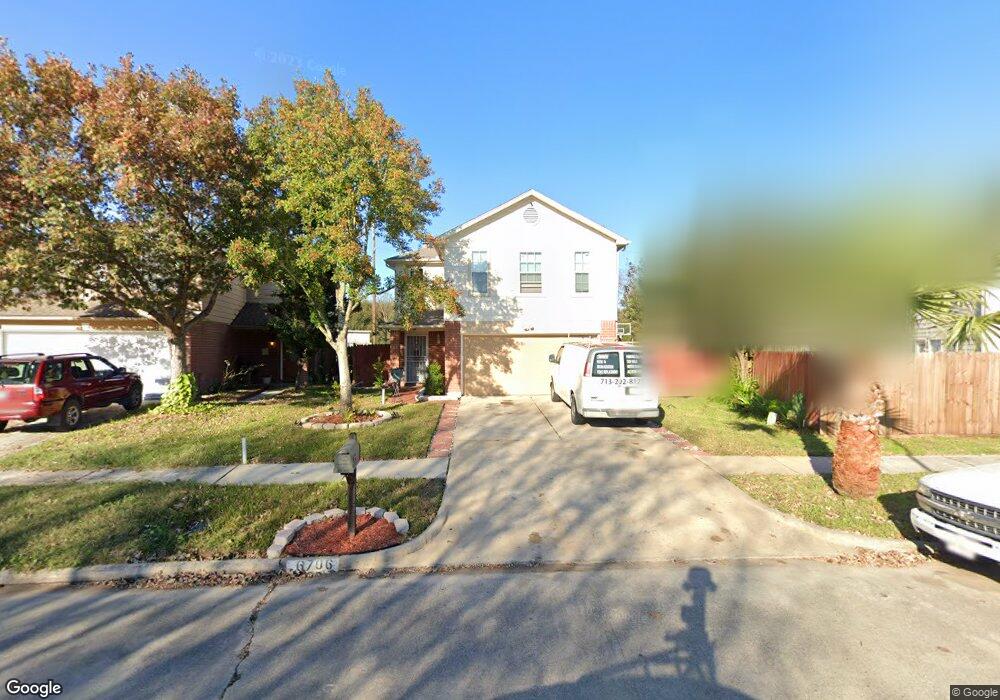

6706 Bayou Crest Dr Houston, TX 77088

Inwood North NeighborhoodEstimated Value: $252,000 - $260,000

4

Beds

3

Baths

1,872

Sq Ft

$136/Sq Ft

Est. Value

About This Home

This home is located at 6706 Bayou Crest Dr, Houston, TX 77088 and is currently estimated at $255,477, approximately $136 per square foot. 6706 Bayou Crest Dr is a home located in Harris County with nearby schools including Eiland Elementary School, Klein Intermediate School, and Klein Forest High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 2, 2010

Sold by

Fannie Mae

Bought by

Phillips Rosalee

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$72,030

Outstanding Balance

$48,346

Interest Rate

5%

Mortgage Type

FHA

Estimated Equity

$207,131

Purchase Details

Closed on

Jan 5, 2010

Sold by

Olvera Jose A

Bought by

Federal National Mortgage Association

Purchase Details

Closed on

Jun 23, 2006

Sold by

Acosta Henry and Acosta Shirley M

Bought by

Olvera Jose A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$102,400

Interest Rate

6.58%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Sep 27, 1996

Sold by

Ideal Builders Inc

Bought by

Acosta Henry and Acosta Shirley M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$73,550

Interest Rate

7.91%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Phillips Rosalee | -- | Star Tex Title Company 04 | |

| Federal National Mortgage Association | $107,828 | None Available | |

| Olvera Jose A | -- | Fidelity National Title | |

| Acosta Henry | -- | Statewide Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Phillips Rosalee | $72,030 | |

| Previous Owner | Olvera Jose A | $102,400 | |

| Previous Owner | Acosta Henry | $73,550 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,435 | $247,420 | $47,821 | $199,599 |

| 2024 | $3,435 | $246,373 | $47,821 | $198,552 |

| 2023 | $3,435 | $218,528 | $47,821 | $170,707 |

| 2022 | $4,105 | $205,656 | $37,754 | $167,902 |

| 2021 | $3,935 | $163,301 | $25,169 | $138,132 |

| 2020 | $3,775 | $151,089 | $25,169 | $125,920 |

| 2019 | $3,536 | $130,083 | $16,360 | $113,723 |

| 2018 | $1,265 | $130,083 | $16,360 | $113,723 |

| 2017 | $2,923 | $118,892 | $16,360 | $102,532 |

| 2016 | $2,657 | $105,390 | $16,360 | $89,030 |

| 2015 | $1,872 | $99,506 | $16,360 | $83,146 |

| 2014 | $1,872 | $79,522 | $16,360 | $63,162 |

Source: Public Records

Map

Nearby Homes

- 6713 Breen Dr

- 6902 Breen Dr

- 7122 Breen Dr

- 8918 Bold Forest Dr

- 5624 Spindle Dr

- 6222 Downwood Forest Dr

- 10126 Wild Hollow Ln

- 6703 Casablanca Dr

- 6111 Ogden Forest Dr

- 6006 Ogden Forest Dr

- 10143 Inwood Hollow Ln

- 5831 Longforest Dr

- 6122 Gallant Forest Dr

- 6011 Killough St

- 10126 Pine Moss Dr

- 6630 Inwood Dr W

- 6114 Elkwood Forest Dr

- 5718 Longforest Dr

- 5930 Killough St

- 5721 Breen Dr

- 6710 Bayou Crest Dr

- 9031 Winnsboro Dr

- 9027 Winnsboro Dr

- 6714 Bayou Crest Dr

- 6618 Bayou Crest Dr

- 6718 Bayou Crest Dr

- 119 County Rd

- 9019 Winnsboro Dr

- 6722 Bayou Crest Dr

- 6614 Bayou Crest Dr

- 6715 Bayou Crest Dr

- 6726 Bayou Crest Dr

- 9015 Winnsboro Dr

- 6723 Bayou Crest Dr

- 9026 Winnsboro Dr

- 6610 Bayou Crest Dr

- 9022 Winnsboro Dr

- 9018 Winnsboro Dr

- 6727 Bayou Crest Dr

- 9011 Winnsboro Dr