6815 Etruscan Way West Jordan, UT 84084

Shadow Mountain NeighborhoodEstimated Value: $350,000 - $405,822

3

Beds

3

Baths

1,254

Sq Ft

$297/Sq Ft

Est. Value

About This Home

This home is located at 6815 Etruscan Way, West Jordan, UT 84084 and is currently estimated at $372,956, approximately $297 per square foot. 6815 Etruscan Way is a home located in Salt Lake County with nearby schools including Mountain Shadows School, West Hills Middle School, and Copper Hills High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 20, 2003

Sold by

Harrison Jenny and Vanderbeek Jenny

Bought by

Newman Shenole S

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$99,250

Outstanding Balance

$42,480

Interest Rate

5.82%

Estimated Equity

$330,476

Purchase Details

Closed on

Aug 30, 2000

Sold by

Trujillo Clinton T

Bought by

Vanderbeek Jenny

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$104,000

Interest Rate

8.2%

Purchase Details

Closed on

Aug 13, 1999

Sold by

Tuscany Properties Inc

Bought by

Trujillo Clinton T

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$98,700

Interest Rate

7.7%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Newman Shenole S | -- | Superior Title | |

| Vanderbeek Jenny | -- | Sutherland Title | |

| Trujillo Clinton T | -- | Meridian Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Newman Shenole S | $99,250 | |

| Previous Owner | Vanderbeek Jenny | $104,000 | |

| Previous Owner | Trujillo Clinton T | $98,700 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,574 | $320,600 | $96,200 | $224,400 |

| 2024 | $1,574 | $302,800 | $90,800 | $212,000 |

| 2023 | $1,604 | $290,800 | $87,200 | $203,600 |

| 2022 | $1,746 | $311,500 | $93,400 | $218,100 |

| 2021 | $1,361 | $221,000 | $66,300 | $154,700 |

| 2020 | $1,361 | $207,400 | $62,200 | $145,200 |

| 2019 | $1,287 | $192,400 | $57,700 | $134,700 |

| 2018 | $1,175 | $174,100 | $52,200 | $121,900 |

| 2017 | $1,067 | $157,400 | $47,200 | $110,200 |

| 2016 | $966 | $134,000 | $40,200 | $93,800 |

| 2015 | $944 | $127,600 | $38,300 | $89,300 |

| 2014 | $949 | $126,300 | $37,900 | $88,400 |

Source: Public Records

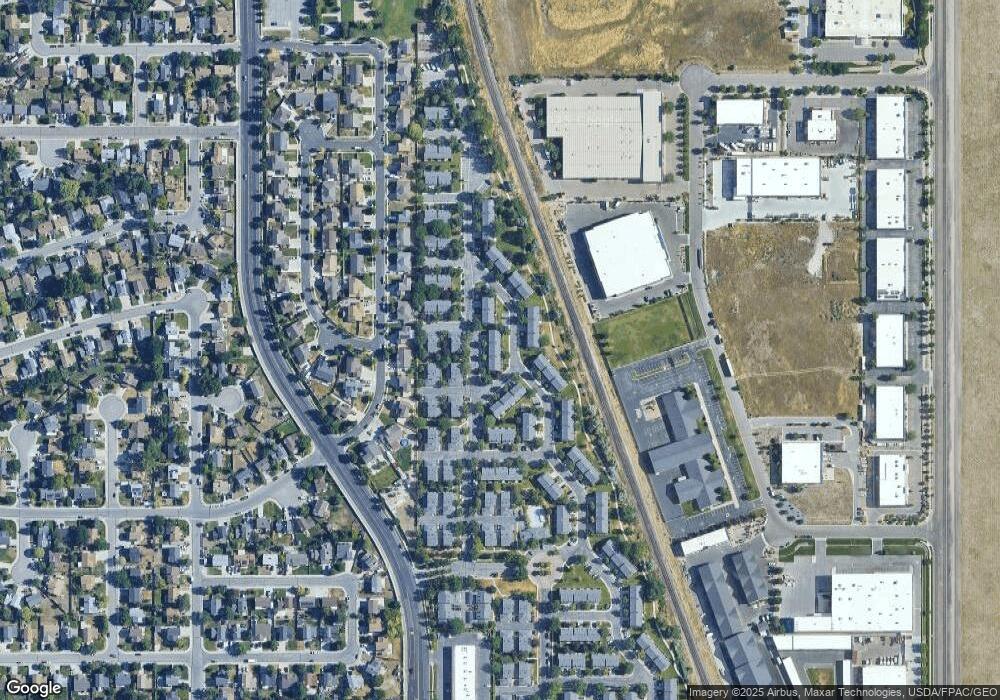

Map

Nearby Homes

- 4763 W Arno Way

- 4785 Foggio Ct

- 6900 S Florentine Way

- 6811 S Etruscan Way

- 4790 W Barletta Ct

- 4888 Ticklegrass Rd

- 4891 Calyx Cir

- 6983 Florentine Way

- 7071 S Kristilyn Ln

- 4983 Shooting Star Ave

- 7093 S Greensand Dr

- 7138 S Brittany Town Dr

- 7173 S Kristilyn Ln

- 4909 Sakura Ct

- 6706 Marshrock Rd

- 6928 Beargrass Rd

- 6635 S Milfoil Cir

- 5183 W Cadenza Dr

- 7232 W Terraine Rd

- 7238 W Terraine Rd

- 6817 Etruscan Way

- 6813 S Etruscan Way

- 6813 Etruscan Way

- 6819 S Etruscan Way

- 6819 Etruscan Way

- 6811 Etruscan Way

- 6821 Etruscan Way

- 6797 Etruscan Way

- 6797 S Etruscan Way

- 6809 S Florentine Way

- 6809 Florentine Way

- 6807 Florentine Way

- 6795 S Etruscan Way

- 6807 S Florentine Way

- 6795 Etruscan Way Unit 2

- 6805 Florentine Way

- 6805 S Florentine Way

- 6803 Florentine Way Unit 4

- 6803 S Florentine Way

- 4783 Potenza Ct