6823 Street W Bradenton, FL 34207

Oneco NeighborhoodEstimated Value: $2,372,171

--

Bed

--

Bath

14,596

Sq Ft

$163/Sq Ft

Est. Value

About This Home

This home is located at 6823 Street W, Bradenton, FL 34207 and is currently estimated at $2,372,171, approximately $162 per square foot. 6823 Street W is a home located in Manatee County with nearby schools including Florine J. Abel Elementary School, Electa Lee Magnet Middle School, and Southeast High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 3, 2021

Sold by

6823 Fourteenth Street W Llc

Bought by

Srq Holdings Company Llc

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$1,400,000

Outstanding Balance

$1,268,750

Interest Rate

3.1%

Mortgage Type

Future Advance Clause Open End Mortgage

Estimated Equity

$1,103,421

Purchase Details

Closed on

Jun 21, 2019

Sold by

Hurter Edward A

Bought by

6823 Fourteenth Street W Llc

Purchase Details

Closed on

Sep 19, 2006

Sold by

Serino Richard and Hurter Edward A

Bought by

Hurter Edward A

Purchase Details

Closed on

Feb 12, 1998

Sold by

Harschno Inc

Bought by

Hurter Edward A and Serino Richard

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$768,000

Interest Rate

6.89%

Mortgage Type

Commercial

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Srq Holdings Company Llc | $1,800,000 | Attorney | |

| 6823 Fourteenth Street W Llc | $1,100,000 | Attorney | |

| Hurter Edward A | $780,000 | Attorney | |

| Hurter Edward A | $475,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Srq Holdings Company Llc | $1,400,000 | |

| Previous Owner | Hurter Edward A | $768,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $28,606 | $1,820,687 | $388,170 | $1,432,517 |

| 2024 | $28,606 | $1,772,256 | $388,170 | $1,384,086 |

| 2023 | $27,966 | $1,718,272 | $388,170 | $1,330,102 |

| 2022 | $15,111 | $1,536,168 | $351,285 | $1,184,883 |

| 2021 | $14,507 | $829,014 | $341,799 | $487,215 |

| 2020 | $14,510 | $791,785 | $341,319 | $450,466 |

| 2019 | $12,934 | $742,063 | $341,799 | $400,264 |

| 2018 | $11,352 | $590,443 | $341,799 | $248,644 |

| 2017 | $10,840 | $590,443 | $0 | $0 |

| 2016 | $10,244 | $544,365 | $0 | $0 |

| 2015 | $9,659 | $514,125 | $0 | $0 |

| 2014 | $9,659 | $500,277 | $0 | $0 |

| 2013 | $9,816 | $473,425 | $260,228 | $213,197 |

Source: Public Records

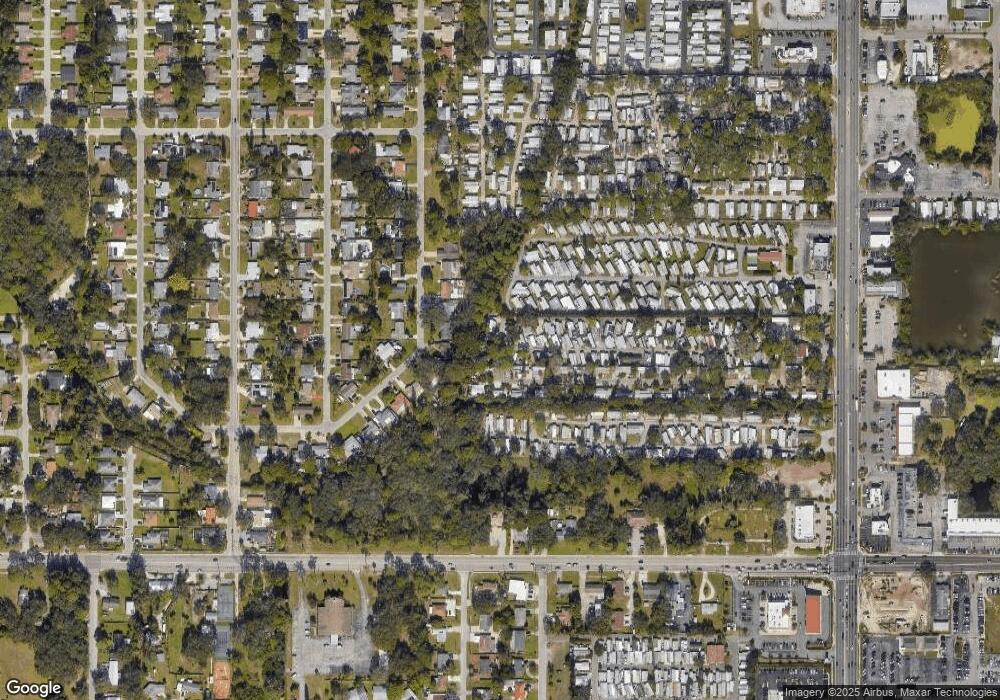

Map

Nearby Homes

- 1011 68th Ave W

- 1605 New York Ave

- 1612 New York Ave

- 1610 Iowa Ave

- 1616 Wisconsin Ave

- 909 67th Avenue Terrace W

- 1608 Minnesota Ave

- 1007 67th Avenue Dr W

- 1706 Iowa Ave

- 1714 69th Ave W Unit B203

- 0 Jungle Way

- 1811 New York Ave

- 1811 Pennsylvania Ave

- 1807 Iowa Ave

- 1812 Pennsylvania Ave

- 1716 Indiana Ave

- 1809 Illinois Ave

- 1817 Pennsylvania Ave

- 6528/ 6530 12th St W

- 7142 Hawks Harbor Cir

- 6823 14th St W

- 6815 14th St W

- 1214 68th Avenue Dr W Unit 48

- 1216 68th Avenue Dr W Unit 47

- 1212 68th Avenue Dr W Unit 1212

- 1212 68th Avenue Dr W Unit 1

- 1212 68th Avenue Dr W

- 1218 68th Avenue Dr W Unit 46

- 1210 68th Avenue Dr W

- 1220 68th Avenue Dr W Unit 45

- 1208 68th Avenue Dr W Unit 44

- 1231 68th Avenue Dr W

- 1231 68th Avenue Dr W Unit 1231

- 6807 14th St W

- 1229 68th Avenue Dr W

- 1229 68th Avenue Dr W Unit 1229

- 1206 68th Avenue Dr W

- 1215 69th Ave W

- 1227 68th Avenue Dr W

- 1204 68th Avenue Dr W