6831 Maple Leaf Dr Unit 7 Carlsbad, CA 92011

Poinsettia NeighborhoodEstimated Value: $976,000 - $1,210,000

3

Beds

3

Baths

1,443

Sq Ft

$734/Sq Ft

Est. Value

About This Home

This home is located at 6831 Maple Leaf Dr Unit 7, Carlsbad, CA 92011 and is currently estimated at $1,058,911, approximately $733 per square foot. 6831 Maple Leaf Dr Unit 7 is a home located in San Diego County with nearby schools including Pacific Rim Elementary, Aviara Oaks Middle, and Sage Creek High.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 19, 2023

Sold by

Bevacqua Philip A and Bevacqua Erin M

Bought by

Bevacqua Philip A and Dewey Erin M

Current Estimated Value

Purchase Details

Closed on

Aug 4, 2021

Sold by

Warner Scott M and Warner Mayumi

Bought by

Bevacqua Philip A and Dewey Erin M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$634,500

Interest Rate

2.8%

Mortgage Type

New Conventional

Purchase Details

Closed on

Aug 29, 2001

Sold by

Fallon Joseph D and Fallon Diane

Bought by

Warner Scott M and Warner Mayumi

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$275,000

Interest Rate

6.5%

Purchase Details

Closed on

Jun 12, 1997

Sold by

Mcdonough James C and Mcdonough Rita A

Bought by

Fallon Joseph D and Fallon Diana M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$154,800

Interest Rate

7.7%

Purchase Details

Closed on

Apr 16, 1996

Sold by

Jones Robert L and Jones Maryrae E

Bought by

Mcdonough James C and Mcdonough Rita A

Purchase Details

Closed on

Jul 28, 1987

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bevacqua Philip A | -- | None Listed On Document | |

| Bevacqua Philip A | $705,000 | Lawyers Title Sd | |

| Warner Scott M | $321,500 | First American Title | |

| Fallon Joseph D | $172,000 | Old Republic Title Company | |

| Mcdonough James C | $8,000 | First American Title | |

| -- | $124,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Bevacqua Philip A | $634,500 | |

| Previous Owner | Warner Scott M | $275,000 | |

| Previous Owner | Fallon Joseph D | $154,800 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,861 | $748,148 | $465,419 | $282,729 |

| 2024 | $7,861 | $733,480 | $456,294 | $277,186 |

| 2023 | $7,821 | $719,099 | $447,348 | $271,751 |

| 2022 | $7,701 | $705,000 | $438,577 | $266,423 |

| 2021 | $4,876 | $438,763 | $272,952 | $165,811 |

| 2020 | $4,844 | $434,265 | $270,154 | $164,111 |

| 2019 | $4,757 | $425,751 | $264,857 | $160,894 |

| 2018 | $4,557 | $417,404 | $259,664 | $157,740 |

| 2017 | $4,482 | $409,221 | $254,573 | $154,648 |

| 2016 | $4,302 | $401,198 | $249,582 | $151,616 |

| 2015 | $4,285 | $395,173 | $245,834 | $149,339 |

| 2014 | $4,214 | $387,433 | $241,019 | $146,414 |

Source: Public Records

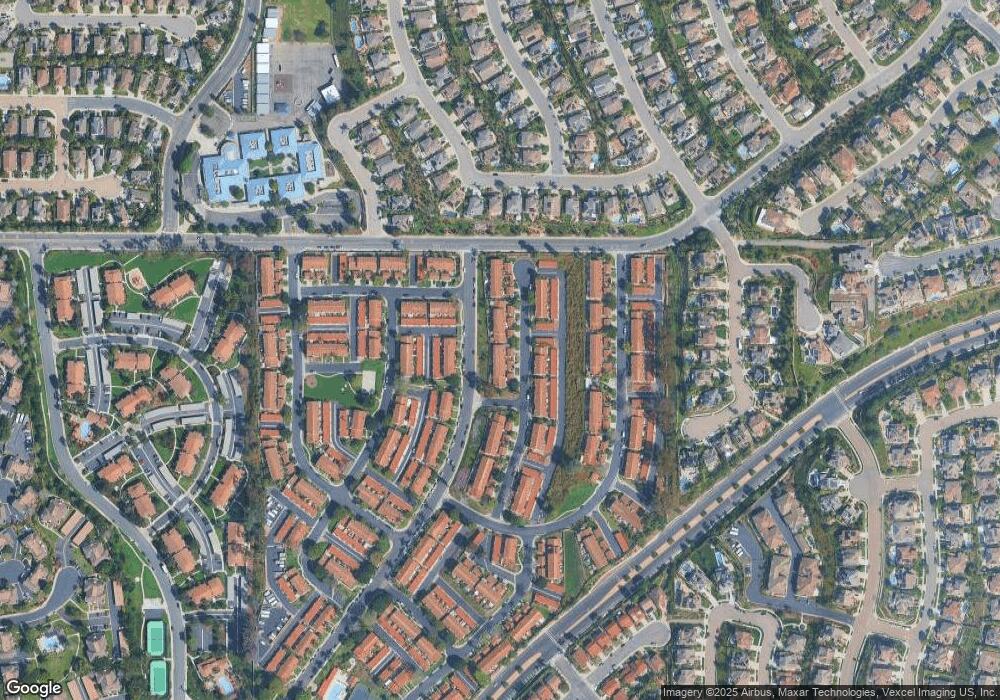

Map

Nearby Homes

- 6777 Lonicera St

- 6915 Pear Tree Dr

- 874 Marigold Ct

- 6557 Coneflower Dr

- 7030 Lantana Terrace

- 7013 Lavender Way

- 6951 Quiet Cove Dr

- 839 Skysail Ave

- 6497 Wayfinders Ct

- 802 Spindrift Ln

- 907 Caminito Estrada Unit E

- 7089 Tatler Rd

- 803 Skysail Ave

- 909 Caminito Madrigal Unit B

- 7219 Linden Terrace

- 6925 Waters End Dr

- 6462 Camino Del Parque

- 811 Caminito Del Sol

- 6548 Camino Del Parque

- 7124 Aviara Dr Unit D

- 6833 Maple Leaf Dr

- 6827 Maple Leaf Dr Unit 7

- 6835 Maple Leaf Dr

- 6825 Maple Leaf Dr

- 6837 Maple Leaf Dr

- 6823 Maple Leaf Dr

- 6839 Maple Leaf Dr

- 6821 Maple Leaf Dr

- 6819 Maple Leaf Dr Unit 7

- 6841 Maple Leaf Dr

- 6817 Maple Leaf Dr

- 6830 Maple Leaf Dr Unit 7

- 6832 Maple Leaf Dr

- 6834 Maple Leaf Dr

- 6836 Maple Leaf Dr

- 6813 Maple Leaf Dr

- 6820 Maple Leaf Dr Unit 7

- 6840 Maple Leaf Dr

- 6829 Batiquitos Dr

- 938 Hawthorne Ave