68755 233rd St Dassel, MN 55325

Estimated Value: $298,000 - $386,000

2

Beds

2

Baths

1,131

Sq Ft

$289/Sq Ft

Est. Value

About This Home

This home is located at 68755 233rd St, Dassel, MN 55325 and is currently estimated at $327,353, approximately $289 per square foot. 68755 233rd St is a home located in Meeker County with nearby schools including Dassel-Cokato Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 22, 2020

Sold by

Hesse Chad J and Hesse Vanessa A

Bought by

Hesse Chad J and Hesse Vanessa A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$180,000

Outstanding Balance

$159,908

Interest Rate

3.2%

Mortgage Type

VA

Estimated Equity

$167,445

Purchase Details

Closed on

Jul 10, 2017

Sold by

Yara Ronald and Eaton Margaret L

Bought by

Hesse Chad J

Purchase Details

Closed on

Jun 22, 2017

Sold by

Pancorbo Salvador and Pancorbo Lilliam

Bought by

Hesse Chad J

Purchase Details

Closed on

Nov 10, 2016

Sold by

Rosenow Robert Robert

Bought by

Hesse Chad Chad

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$157,500

Interest Rate

3.57%

Purchase Details

Closed on

Jul 29, 2014

Sold by

Rosenow Robert A and Diane Rosenow E

Bought by

Rosenow Robert A and Diane Rosenow E

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hesse Chad J | $3,000 | First American Title | |

| Hesse Chad J | -- | None Available | |

| Hesse Chad J | -- | None Available | |

| Hesse Chad Chad | $158,000 | -- | |

| Rosenow Robert A | -- | Attorney |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hesse Chad J | $180,000 | |

| Previous Owner | Hesse Chad Chad | $157,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,164 | $277,900 | $102,200 | $175,700 |

| 2024 | $2,164 | $238,800 | $85,200 | $153,600 |

| 2023 | $2,324 | $241,100 | $85,200 | $155,900 |

| 2022 | $2,058 | $222,600 | $77,400 | $145,200 |

| 2021 | $1,968 | $198,000 | $70,200 | $127,800 |

| 2020 | $1,728 | $182,400 | $61,100 | $121,300 |

| 2019 | $1,598 | $161,400 | $60,600 | $100,800 |

| 2018 | $1,442 | $150,600 | $60,600 | $90,000 |

| 2017 | -- | $151,700 | $60,600 | $91,100 |

| 2016 | -- | $148,400 | $58,000 | $90,400 |

| 2015 | -- | $0 | $0 | $0 |

| 2014 | -- | $0 | $0 | $0 |

Source: Public Records

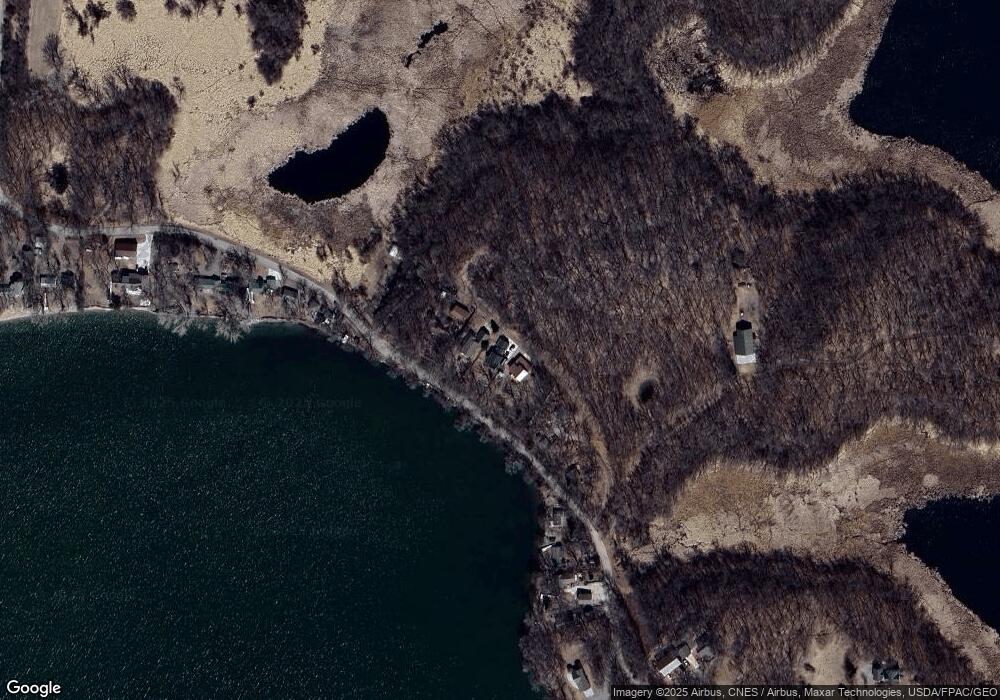

Map

Nearby Homes

- 69497 233rd St

- 22780 County State Aid Highway 14

- 69669 233rd St

- 68515 244th St

- 21820 Csah 14

- 67668 217th St

- 67705 217th St

- 431 Karen Ct

- 70348 219th St

- 22848 708th Ave

- 23120 705th Ave

- 307 Circle View Dr

- 68749 195th St

- 1140 Summit Cove

- 1000 Sunrise Cir

- 843 3rd St

- 65511 216th St

- 711 2nd St N

- 551 1st St

- 26377 705th Ave

- 68744 233rd St

- 68765 233rd St

- 68716 233rd St

- 68631 233rd St

- 68631 68631 233rd St

- 68837 233rd St

- 68845 233rd St

- 68744 68744 233rd-Street-

- 68607 233rd St

- 68898 233rd St

- 68898 68898 233rd St

- 68853 68853 233rd St

- 68853 68853 233rd-Street-

- 68853 233rd St

- 68551 233rd St

- 68887 233rd St

- 68881 233rd St

- 68891 233rd St

- 68525 233rd St

- 68365 233rd St