6935 W Dvnshre Ave Unit 1360 Phoenix, AZ 85033

Estimated Value: $193,000 - $237,000

2

Beds

2

Baths

1,188

Sq Ft

$174/Sq Ft

Est. Value

About This Home

This home is located at 6935 W Dvnshre Ave Unit 1360, Phoenix, AZ 85033 and is currently estimated at $207,016, approximately $174 per square foot. 6935 W Dvnshre Ave Unit 1360 is a home located in Maricopa County with nearby schools including Heatherbrae School, Desert Sands Middle School, and Trevor Browne High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 23, 2014

Sold by

Mr Capital Llc

Bought by

Patino Cristina

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$15,000

Outstanding Balance

$11,394

Interest Rate

4.32%

Mortgage Type

Seller Take Back

Estimated Equity

$195,622

Purchase Details

Closed on

Sep 18, 2013

Sold by

Salazar Waldo and Salazar Lucille Irene

Bought by

Robson Ryan

Purchase Details

Closed on

Jul 8, 1999

Sold by

Soos Coleman John

Bought by

Salazar Waldo and Salazar Lucille Irene

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$4,400

Interest Rate

7.64%

Mortgage Type

Seller Take Back

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Patino Cristina | $35,000 | Old Republic Title Agency | |

| Robson Ryan | $22,000 | Old Republic Title Agency | |

| Salazar Waldo | $43,000 | First American Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Patino Cristina | $15,000 | |

| Previous Owner | Salazar Waldo | $4,400 | |

| Closed | Salazar Waldo | $34,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $445 | $2,540 | -- | -- |

| 2024 | $442 | $2,419 | -- | -- |

| 2023 | $442 | $10,980 | $2,190 | $8,790 |

| 2022 | $417 | $8,320 | $1,660 | $6,660 |

| 2021 | $422 | $7,410 | $1,480 | $5,930 |

| 2020 | $400 | $6,370 | $1,270 | $5,100 |

| 2019 | $383 | $5,410 | $1,080 | $4,330 |

| 2018 | $398 | $3,670 | $730 | $2,940 |

| 2017 | $385 | $3,100 | $620 | $2,480 |

| 2016 | $368 | $2,810 | $560 | $2,250 |

| 2015 | $343 | $2,350 | $470 | $1,880 |

Source: Public Records

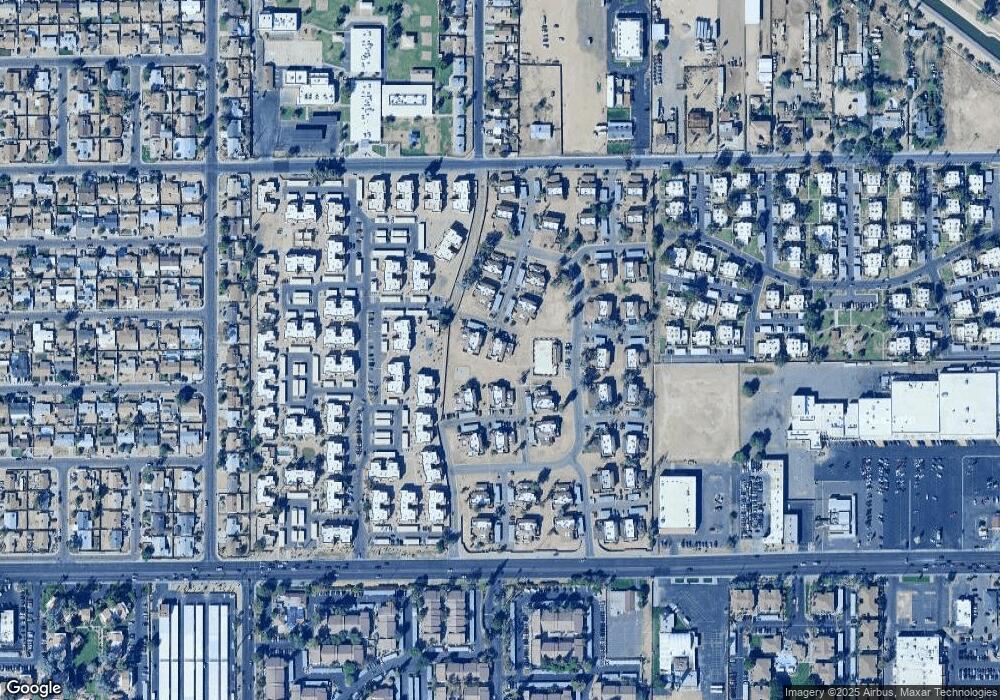

Map

Nearby Homes

- 6902 W Devonshire Ave Unit 1280

- 4242 N 69th Ln Unit 1333

- 6841 W Devonshire Ave

- 6866 W Indian School Rd Unit 1

- 6842 W Devonshire Ave Unit 265

- 4252 N 68th Ln Unit 512

- 6806 W Devonshire Ave

- 7125 W Heatherbrae Dr

- 4268 N 68th Ave Unit 447

- 4233 N 68th Ave Unit 430

- 6756 W Devonshire Ave Unit 362

- 4316 N 72nd Ave

- 4109 N 72nd Dr

- 7150 W Montecito Ave

- 6727 W Roma Ave

- 7321 W Devonshire Ave

- 3645 N 71st Ave Unit 10

- 3645 N 71st Ave Unit 28

- 3419 N 70th Ave

- 3645 N 69th Ave Unit 99

- 6935 W Dvnshre Ave Unit 1359

- 6935 W Dvnshre Ave Unit 1358

- 6935 W Dvnshre Ave Unit 1361

- 6935 W Dvnshre Ave Unit 1362

- 6935 W Dvnshre Ave

- 6935 W Devonshire Ave Unit 1361

- 6935 W Devonshire Ave Unit 1360

- 6935 W Devonshire Ave Unit 1359

- 4211 N 69th Ln

- 4211 N 69th Ln Unit 1314

- 4211 N 69th Ln Unit 1315

- 4211 N 69th Ln Unit 1316

- 4211 N 69th Ln Unit 1317

- 4211 N 69th Ln Unit 1313

- 6943 W Dvnshre Ave Unit 1354

- 6943 W Dvnshre Ave Unit 1357

- 6943 W Dvnshre Ave Unit 1355

- 6943 W Dvnshre Ave Unit 1353

- 6943 W Dvnshre Ave Unit 1356

- 6943 W Dvnshre Ave