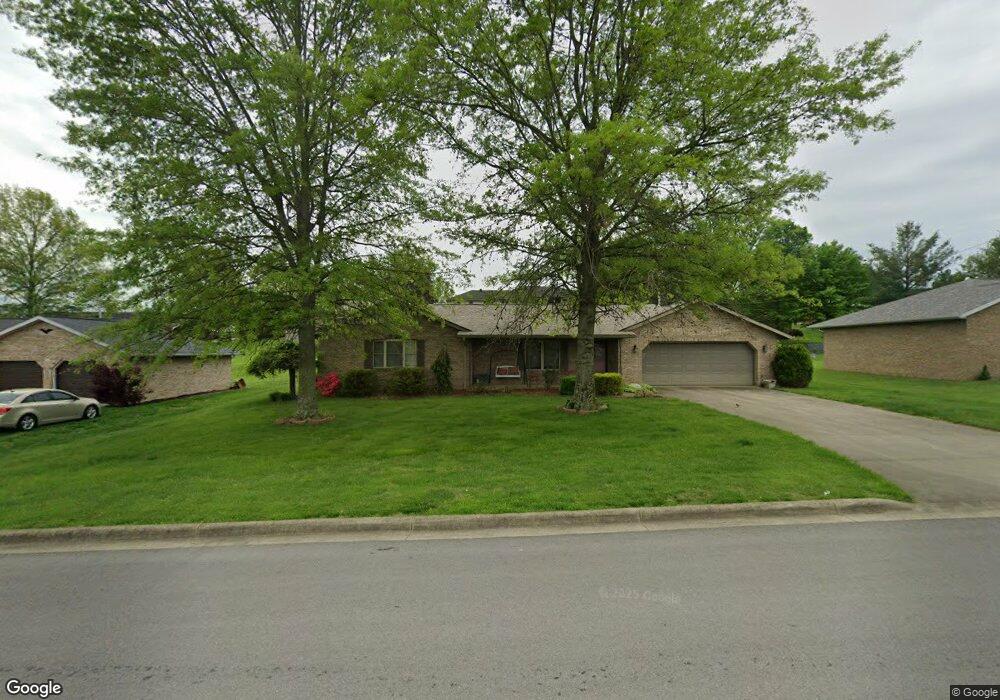

701 E 22nd St Ferdinand, IN 47532

Estimated Value: $256,000 - $287,000

3

Beds

2

Baths

1,524

Sq Ft

$179/Sq Ft

Est. Value

About This Home

This home is located at 701 E 22nd St, Ferdinand, IN 47532 and is currently estimated at $272,915, approximately $179 per square foot. 701 E 22nd St is a home located in Dubois County with nearby schools including Forest Park Junior/Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 16, 2014

Sold by

Sickbert Lindsey R

Bought by

Urbancic Charlene M

Current Estimated Value

Purchase Details

Closed on

Apr 30, 2010

Sold by

Sickbert Aaron E and Sickbert Lindsey R

Bought by

Sickbert Aaron E and Sickbert Lindsey R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$116,000

Interest Rate

5.16%

Mortgage Type

New Conventional

Purchase Details

Closed on

Oct 26, 2007

Sold by

William L Hoffman and Hoffman Shannon D

Bought by

Aaron E Sickbert and Hasenour Lindsey K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$119,622

Interest Rate

6.47%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Urbancic Charlene M | $149,500 | -- | |

| Sickbert Aaron E | -- | None Available | |

| Aaron E Sickbert | $121,500 | -- | |

| Sickbert Aaron E | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Sickbert Aaron E | $116,000 | |

| Previous Owner | Sickbert Aaron E | $119,622 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,164 | $222,800 | $23,800 | $199,000 |

| 2023 | $1,689 | $188,900 | $23,800 | $165,100 |

| 2022 | $1,596 | $169,200 | $22,000 | $147,200 |

| 2021 | $1,405 | $144,600 | $22,000 | $122,600 |

| 2020 | $1,310 | $139,800 | $28,100 | $111,700 |

| 2019 | $1,136 | $137,400 | $28,700 | $108,700 |

| 2018 | $1,083 | $128,100 | $19,100 | $109,000 |

| 2017 | $1,069 | $126,700 | $19,100 | $107,600 |

| 2016 | $1,009 | $123,700 | $19,100 | $104,600 |

| 2014 | $955 | $118,400 | $13,800 | $104,600 |

Source: Public Records

Map

Nearby Homes

- 342 E 23rd St

- 1725 Main St

- 1840 Field View Ct

- 0 Rd Unit 202417041

- 735 Virginia St

- 9555 S 475 E

- 1026 E Mariah Hill Rd

- 0 S 500 E

- 0 S 500 E Rd

- 2577 E 600 S

- S 50 West St

- 218 W 660 S

- 2031 E 550 S

- 0 E State Road 64

- 2980 Carlton Rd

- 1108 Vogel Ave

- 1235 Timber Ridge Dr

- 2990 Carleton Rd

- 701 Applewood Rd

- 215 S Washington St