702 Deerfield Trail Unit 13 Springfield, OH 45503

Estimated Value: $270,515 - $299,000

3

Beds

3

Baths

1,609

Sq Ft

$176/Sq Ft

Est. Value

About This Home

This home is located at 702 Deerfield Trail Unit 13, Springfield, OH 45503 and is currently estimated at $282,629, approximately $175 per square foot. 702 Deerfield Trail Unit 13 is a home located in Clark County with nearby schools including Northridge Elementary School, Kenton Ridge Middle & High School, and Emmanuel Christian Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 18, 2018

Sold by

Slattery Jack E and Slattery Judith L

Bought by

Rutan Robert E and Stitt Rutan Beverly A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$139,200

Outstanding Balance

$119,080

Interest Rate

4.4%

Mortgage Type

New Conventional

Estimated Equity

$163,549

Purchase Details

Closed on

Jan 15, 2003

Sold by

Hoppes Builders & Development Co

Bought by

Slattery Jack E and Slattery Judith L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$132,000

Interest Rate

5.87%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Rutan Robert E | $174,000 | Team Title & Closing Service | |

| Slattery Jack E | $161,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Rutan Robert E | $139,200 | |

| Previous Owner | Slattery Jack E | $132,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,933 | $77,750 | $12,250 | $65,500 |

| 2024 | $2,838 | $65,790 | $10,500 | $55,290 |

| 2023 | $2,838 | $65,790 | $10,500 | $55,290 |

| 2022 | $2,848 | $65,790 | $10,500 | $55,290 |

| 2021 | $2,915 | $57,100 | $8,750 | $48,350 |

| 2020 | $2,918 | $57,100 | $8,750 | $48,350 |

| 2019 | $2,972 | $57,100 | $8,750 | $48,350 |

| 2018 | $2,448 | $53,680 | $8,750 | $44,930 |

| 2017 | $2,106 | $52,731 | $8,750 | $43,981 |

| 2016 | $2,092 | $52,731 | $8,750 | $43,981 |

| 2015 | $2,170 | $51,429 | $8,750 | $42,679 |

| 2014 | $2,170 | $51,429 | $8,750 | $42,679 |

| 2013 | $2,121 | $51,429 | $8,750 | $42,679 |

Source: Public Records

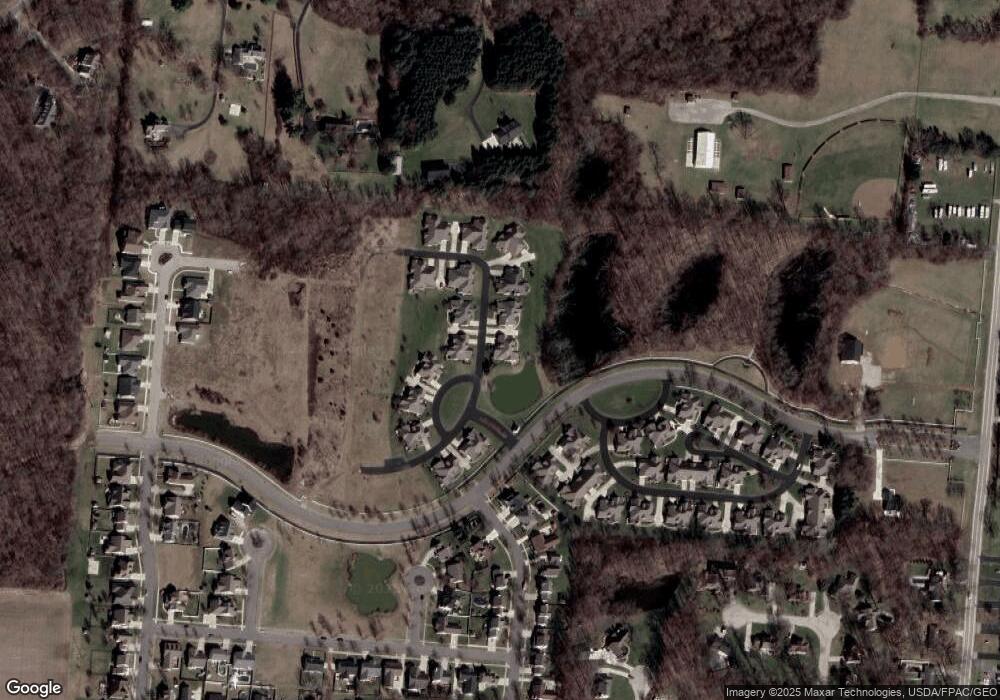

Map

Nearby Homes

- 593 Hiser Ave

- 4741 Cullen Ave

- 4802 Willowbrook Dr

- 4343 Burchill St

- 1341 Student Ave

- 0 Moorefield Rd

- 4256 Midfield St Unit 9

- 4446 Ridgewood Rd E Unit 3

- 5033 Ridgewood Rd E

- 1521 Erika Dr

- 4577 Reno Ln Unit 2

- 1709 Thomas Dr

- 4652 Reno Ln Unit 15

- 5564 Ridgewood Rd W

- 1162 Kingsgate Rd

- 1495 Victorian Way

- 1201 Kingsgate Rd

- 5564 Ridgewood Rd E Unit 7

- 3942 Harris Ln

- 335 Willow Rd

- 704 Deerfield Trail Unit 14

- 701 Deerfield Trail Unit 11

- 706 Deerfield Trail Unit 17

- 708 Deerfield Trail

- 703 Deerfield Trail Unit 12

- 707 Deerfield Trail Unit 15

- 709 Deerfield Trail Unit 16

- 710 Deerfield Trail Unit 19

- 712 Deerfield Trail Unit 20

- 785 Crescent Point

- 787 Crescent Point Unit 6

- 719 Deerfield Trail Unit 26

- 717 Deerfield Trail Unit 25

- 1 Hunt Pkwy

- 26 Hunt Pkwy

- 779 Crescent Point

- 778 Deerfield Trail Unit 9

- 725 Deerfield Trail

- 780 Deerfield Trail Unit 10

- 781 Crescent Point Unit 4

Your Personal Tour Guide

Ask me questions while you tour the home.