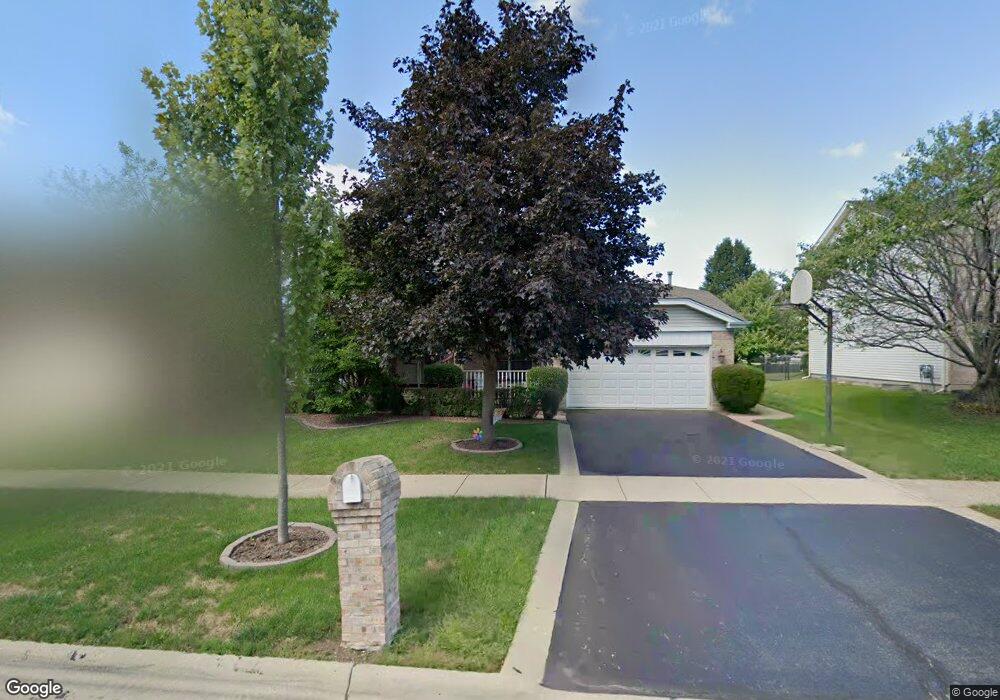

702 Stuart Dr Carol Stream, IL 60188

Estimated Value: $516,000 - $563,000

5

Beds

3

Baths

2,571

Sq Ft

$209/Sq Ft

Est. Value

About This Home

This home is located at 702 Stuart Dr, Carol Stream, IL 60188 and is currently estimated at $537,859, approximately $209 per square foot. 702 Stuart Dr is a home located in DuPage County with nearby schools including Roy De Shane Elementary School, Stratford Middle School, and Glenbard North High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 5, 2011

Sold by

Camp Christopher and Camp Caryn

Bought by

Cisko Jeffrey and Cisko Christina

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$280,000

Outstanding Balance

$193,086

Interest Rate

4.56%

Mortgage Type

New Conventional

Estimated Equity

$344,773

Purchase Details

Closed on

Mar 17, 2005

Sold by

Gagliardi Mark F and Gagliardi Gina M

Bought by

Camp Christopher and Lobodzinski Caryn

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$300,000

Interest Rate

5.71%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Cisko Jeffrey | $334,000 | Fort Dearborn Land Title Llc | |

| Camp Christopher | $375,000 | Multiple |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Cisko Jeffrey | $280,000 | |

| Previous Owner | Camp Christopher | $300,000 | |

| Closed | Camp Christopher | $37,500 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $12,337 | $151,810 | $32,925 | $118,885 |

| 2023 | $11,690 | $138,830 | $30,110 | $108,720 |

| 2022 | $11,758 | $133,460 | $29,910 | $103,550 |

| 2021 | $11,221 | $126,800 | $28,420 | $98,380 |

| 2020 | $10,495 | $117,880 | $27,730 | $90,150 |

| 2019 | $10,101 | $113,280 | $26,650 | $86,630 |

| 2018 | $11,363 | $128,310 | $25,950 | $102,360 |

| 2017 | $10,761 | $118,920 | $24,050 | $94,870 |

| 2016 | $10,209 | $110,060 | $22,260 | $87,800 |

| 2015 | $9,994 | $102,700 | $20,770 | $81,930 |

| 2014 | $8,861 | $90,180 | $18,240 | $71,940 |

| 2013 | $8,903 | $93,260 | $18,860 | $74,400 |

Source: Public Records

Map

Nearby Homes

- 545 Alton Ct Unit 273

- 514 Alton Ct Unit 2

- 848 Birchbark Trail

- 734 Colorado Ct Unit 734

- 454 Esselen Ct Unit 2

- 862 Omaha Ct

- 522 Apache Ln

- 552 Cochise Place

- 27W270 Jefferson St

- 813 Kansas St

- 992 Navajo St

- 403 Arrowhead Trail

- 27W046 North Ave

- 426 Thunderbird Trail

- 352 Sioux Ln

- 933 Columbia Ct

- 1430 Preserve Dr Unit 29

- 1N053 Lot 1 Farwell St

- 1N063 LOT 2 Farwell St

- 1N083 LOT 4 Farwell St

Your Personal Tour Guide

Ask me questions while you tour the home.