7043 Marymount Way Goleta, CA 93117

Estimated Value: $794,000 - $932,000

2

Beds

2

Baths

990

Sq Ft

$864/Sq Ft

Est. Value

About This Home

This home is located at 7043 Marymount Way, Goleta, CA 93117 and is currently estimated at $855,309, approximately $863 per square foot. 7043 Marymount Way is a home located in Santa Barbara County with nearby schools including Isla Vista Elementary School, Goleta Valley Junior High School, and Dos Pueblos Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 17, 2009

Sold by

Drake Harrington

Bought by

Zanecchia Thomas E

Current Estimated Value

Purchase Details

Closed on

Apr 14, 2008

Sold by

Drake Harrington

Bought by

Drake Harrington

Purchase Details

Closed on

Nov 9, 1999

Sold by

Jones Godlis Brian and Lynn Julie Lynn

Bought by

Drake Harrington

Purchase Details

Closed on

Aug 6, 1998

Sold by

Best Theodore M and Best Marilyn A

Bought by

Godlis Brian Joseph

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$187,600

Interest Rate

6.95%

Purchase Details

Closed on

Dec 5, 1997

Sold by

Morales Robert P and Morales Kelly J

Bought by

Best Theodore M and Best Marilyn A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Zanecchia Thomas E | -- | Chicago Title Company | |

| Drake Harrington | -- | None Available | |

| Drake Harrington | $282,000 | Stewart Title | |

| Godlis Brian Joseph | $234,500 | Fidelity National Title Co | |

| Best Theodore M | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Godlis Brian Joseph | $187,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,944 | $433,404 | $222,849 | $210,555 |

| 2023 | $4,944 | $416,577 | $214,197 | $202,380 |

| 2022 | $4,664 | $408,410 | $209,998 | $198,412 |

| 2021 | $4,588 | $400,403 | $205,881 | $194,522 |

| 2020 | $4,471 | $396,298 | $203,770 | $192,528 |

| 2019 | $4,393 | $388,528 | $199,775 | $188,753 |

| 2018 | $4,313 | $380,910 | $195,858 | $185,052 |

| 2017 | $4,246 | $373,442 | $192,018 | $181,424 |

| 2016 | $4,153 | $366,120 | $188,253 | $177,867 |

| 2014 | $4,010 | $353,559 | $181,794 | $171,765 |

Source: Public Records

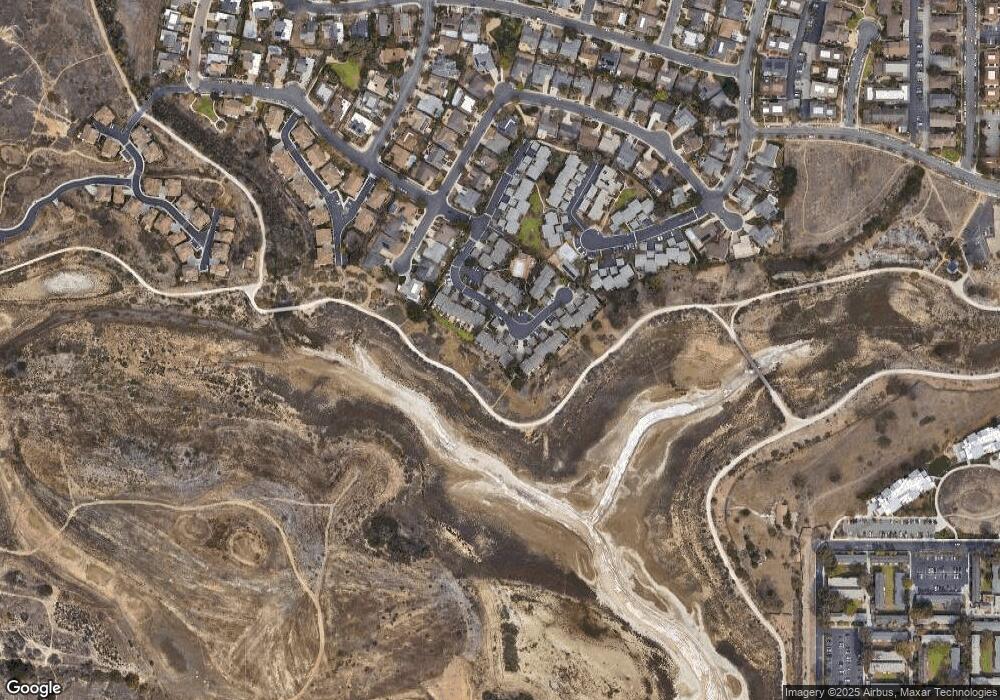

Map

Nearby Homes

- 544 Mills Way

- 7295 Georgetown Rd

- 541 Sweet Rain Place

- 565 Sweet Rain Place

- 562 Poppyfield Place

- 7352 Elmhurst Place

- 7344 Davenport Rd

- 7465 Hollister Avenue Condo #448

- 7465 Hollister Ave Unit Condo Unit 130

- 7465 Hollister Ave Unit 130

- 7368 Hollister Ave Unit Spc 37

- 7368 Hollister Ave Unit Spc 28

- 231 Mathilda Dr

- 925 Camino Lindo

- 239 Palo Alto Dr

- 7469 San Bergamo Dr

- 6767 Del Playa Dr

- 6765 Del Playa Dr

- 6745-6747 Del Playa Dr

- 7620 Hollister Ave Unit 111

- 7041 Marymount Way

- 7045 Marymount Way

- 7047 Marymount Way

- 7049 Marymount Way

- 7051 Marymount Way

- 7053 Marymount Way

- 7055 Marymount Way Unit 48

- 7035 Marymount Way

- 7035 Marymount Way

- 7029 Marymount Way

- 7033 Marymount Way

- 7019 Marymount Way

- 7019 Marymount Way

- 7069 Marymount Way

- 7057 Marymount Way

- 7071 Marymount Way

- 7023 Marymount Way

- 7017 Marymount Way

- 7061 Marymount Way

- 7031 Marymount Way