Estimated Value: $577,232 - $810,000

4

Beds

3

Baths

3,007

Sq Ft

$220/Sq Ft

Est. Value

About This Home

This home is located at 705 Charles Ct, Hurst, TX 76054 and is currently estimated at $660,058, approximately $219 per square foot. 705 Charles Ct is a home located in Tarrant County with nearby schools including W.A. Porter Elementary School, Smithfield Middle School, and Birdville High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 22, 2019

Sold by

Weichert Workforce Mobility Inc

Bought by

Cantrell Ryan and Cantrell Joanna

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$400,000

Outstanding Balance

$311,315

Interest Rate

3.6%

Mortgage Type

Commercial

Estimated Equity

$348,743

Purchase Details

Closed on

Jul 27, 2016

Sold by

Kruger Dustin Typer and Kruger Laura Kamenoff

Bought by

Kruger Dustin Typer and Kruger Laura Kamenoff

Purchase Details

Closed on

Dec 19, 2013

Sold by

Tarrant Group Series A Llc

Bought by

Kruger Dustin T and Kruger Laura K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$280,500

Interest Rate

4.21%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jan 19, 2012

Sold by

Fordyce James D

Bought by

Tarrant Group Series A Llc

Purchase Details

Closed on

Feb 2, 2010

Sold by

Ulmer John T and Ulmer Jamie

Bought by

Fordyce James D

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Cantrell Ryan | -- | Chicago Title | |

| Kruger Dustin Typer | -- | None Available | |

| Kruger Dustin T | -- | Fnt | |

| Tarrant Group Series A Llc | -- | None Available | |

| Fordyce James D | $227,675 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Cantrell Ryan | $400,000 | |

| Previous Owner | Kruger Dustin T | $280,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $9,067 | $487,111 | $70,000 | $417,111 |

| 2024 | $9,067 | $596,000 | $70,000 | $526,000 |

| 2023 | $10,261 | $463,362 | $70,000 | $393,362 |

| 2022 | $10,091 | $408,145 | $70,000 | $338,145 |

| 2021 | $10,629 | $409,743 | $70,000 | $339,743 |

| 2020 | $10,571 | $411,341 | $70,000 | $341,341 |

| 2019 | $9,622 | $412,939 | $70,000 | $342,939 |

| 2018 | $7,998 | $332,805 | $70,000 | $262,805 |

| 2017 | $8,073 | $302,550 | $70,000 | $232,550 |

| 2016 | $7,952 | $298,011 | $70,000 | $228,011 |

| 2015 | $8,631 | $345,400 | $45,000 | $300,400 |

| 2014 | $8,631 | $345,400 | $45,000 | $300,400 |

Source: Public Records

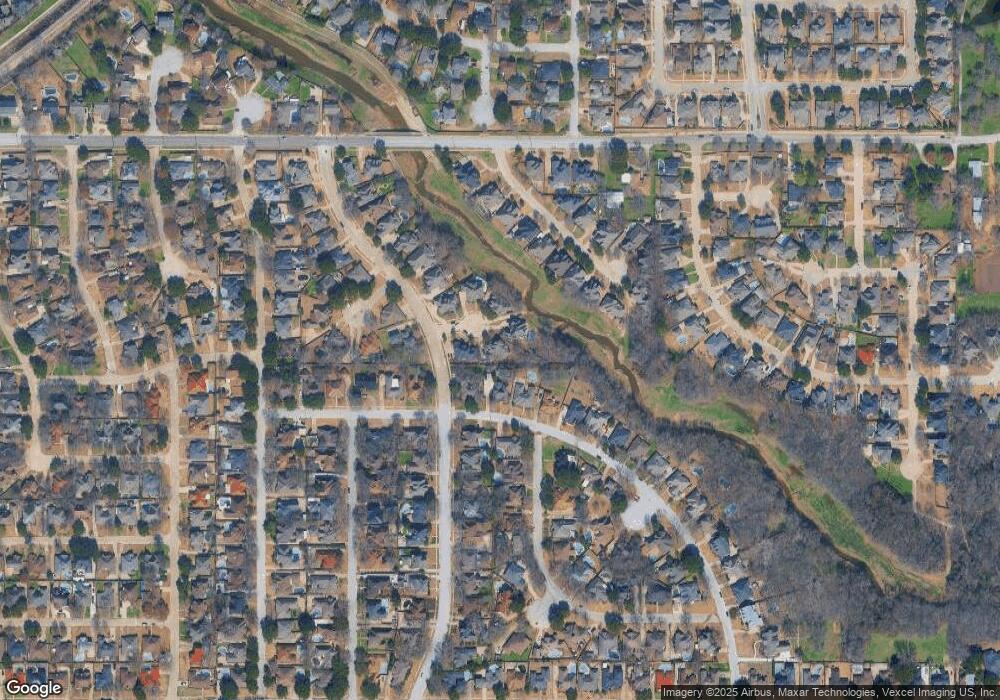

Map

Nearby Homes

- 3208 Glade Pointe Ct

- 3132 Hurstview Dr

- 3228 Oakdale Dr

- 3412 Glade Creek Dr

- 716 Bridget Way

- 3229 David Dr

- 3233 David Dr

- 717 Reese Ln

- 713 Paul Dr

- 405 Bremen Dr

- 312 Bremen Dr

- 3309 Texas Trail Ct

- 3317 S Riley Ct

- 2829 Sandstone Dr

- 2844 Hurstview Dr

- 2809 Sandstone Dr

- 712 Bear Creek Dr

- 621 Trails End Ct

- 713 Corsair Ct

- 716 Bear Creek Dr

- 700 Charles Ct

- 3144 Oakview Dr

- 3140 Oakview Dr

- 709 Charles Ct

- 3148 Oakview Dr

- 704 Charles Ct

- 3136 Oakview Dr

- 708 Charles Ct

- 712 Charles Ct

- 3134 Oakview Dr

- 3140 Hurstview Dr

- 557 Sunset Dr

- 600 Oakview Dr

- 3213 Glade Pointe Ct

- 3217 Glade Pointe Ct

- 3205 View St

- 3209 Glade Pointe Ct

- 3212 Hurstview Dr

- 3212 View St

- 3205 Hurstview Dr