7066 Corintia St Carlsbad, CA 92009

La Costa NeighborhoodEstimated Value: $2,392,722 - $3,063,000

4

Beds

5

Baths

3,641

Sq Ft

$727/Sq Ft

Est. Value

About This Home

This home is located at 7066 Corintia St, Carlsbad, CA 92009 and is currently estimated at $2,647,931, approximately $727 per square foot. 7066 Corintia St is a home located in San Diego County with nearby schools including La Costa Meadows Elementary, San Elijo Middle School, and San Marcos High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 19, 2011

Sold by

Wolf Kenneth E and Wolf Kristen E

Bought by

Wolf Kenneth E and Wolf Kristen E

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$650,000

Outstanding Balance

$445,116

Interest Rate

4.26%

Mortgage Type

New Conventional

Estimated Equity

$2,202,815

Purchase Details

Closed on

Mar 17, 2011

Sold by

Barrett Steve and Barrett Sherrie

Bought by

Wolf Kenneth E and Wolf Kristen E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$650,000

Interest Rate

4.9%

Mortgage Type

New Conventional

Purchase Details

Closed on

Dec 27, 2006

Sold by

Pulte Home Corp

Bought by

Barrett Steve and Barrett Sherrie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$944,000

Interest Rate

6.22%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wolf Kenneth E | -- | Lawyers Title | |

| Wolf Kenneth E | -- | Lawyers Title | |

| Wolf Kenneth E | $1,295,000 | None Available | |

| Barrett Steve | $1,180,000 | First American Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Wolf Kenneth E | $650,000 | |

| Closed | Wolf Kenneth E | $650,000 | |

| Previous Owner | Barrett Steve | $944,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $19,547 | $1,659,114 | $768,700 | $890,414 |

| 2024 | $19,547 | $1,626,583 | $753,628 | $872,955 |

| 2023 | $19,210 | $1,594,690 | $738,851 | $855,839 |

| 2022 | $18,918 | $1,563,422 | $724,364 | $839,058 |

| 2021 | $18,624 | $1,532,767 | $710,161 | $822,606 |

| 2020 | $18,495 | $1,517,052 | $702,880 | $814,172 |

| 2019 | $18,418 | $1,487,307 | $689,099 | $798,208 |

| 2018 | $18,008 | $1,458,145 | $675,588 | $782,557 |

| 2017 | $17,697 | $1,429,555 | $662,342 | $767,213 |

| 2016 | $17,431 | $1,401,525 | $649,355 | $752,170 |

| 2015 | $17,207 | $1,380,474 | $639,602 | $740,872 |

| 2014 | $16,853 | $1,353,434 | $627,074 | $726,360 |

Source: Public Records

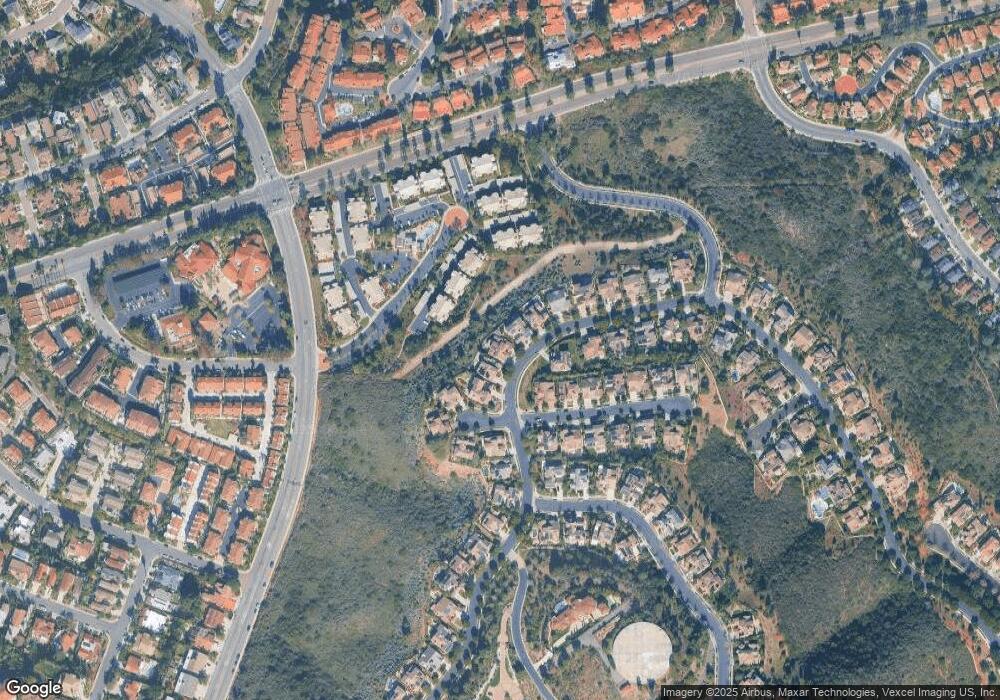

Map

Nearby Homes

- 6977 Corte Langosta

- 6844 Urubu St

- 6759 Paseo Del Vista

- 2930 Rancho Cortes

- 3137 Avenida Topanga

- 6417 Terraza Portico

- 6691 Corte Eduardo

- 6712 Cantil St

- 3428 Filoli Cir

- 2513 Antlers Way

- 2434 Sentinel Ln

- 2568 Abedul St

- 7133 Obelisco Cir

- 6541 Vispera Place

- 7146 Argonauta Way

- 2515 Luciernaga St

- 6267 Via Trato

- 7215 El Fuerte St

- 6502 La Paloma St

- 6817 Vianda Ct

- 7062 Corintia St

- 7070 Corintia St

- 7058 Corintia St

- 7074 Corintia St

- 7077 Corintia St

- 3200 Corte Tamarindo

- 3194 Corte Tamarindo

- 7078 Corintia St

- 3204 Corte Tamarindo

- 7081 Corintia St

- 7052 Corintia St

- 7082 Corintia St

- 3208 Corte Tamarindo

- 3195 Corte Tamarindo

- 3201 Corte Tamarindo

- 3199 Corte Tamarindo

- 3211 Sello Ln Unit 104

- 3211 Sello Ln Unit 103

- 3211 Sello Ln Unit 101

- 3211 Sello Ln Unit 100