708 Crocus Ct Bourbon, IN 46504

Estimated Value: $270,000 - $316,000

4

Beds

3

Baths

2,758

Sq Ft

$107/Sq Ft

Est. Value

About This Home

This home is located at 708 Crocus Ct, Bourbon, IN 46504 and is currently estimated at $295,121, approximately $107 per square foot. 708 Crocus Ct is a home located in Marshall County with nearby schools including Triton Elementary School, Triton Junior-Senior High School, and Bourbon Christian School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 15, 2014

Sold by

Ashcraft Edward L and Ashcraft Jennifer

Bought by

Mcintyre Mason S and Mcintyre Lindsey A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$171,830

Outstanding Balance

$131,226

Interest Rate

4.23%

Mortgage Type

FHA

Estimated Equity

$163,895

Purchase Details

Closed on

Oct 12, 2005

Sold by

Cleland Builders Inc

Bought by

Ashcraft Edward L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$134,745

Interest Rate

6.48%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 16, 2005

Sold by

Ashcraft Edward L

Bought by

Ashcradt Edward L and Ashcradt Jennifer

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mcintyre Mason S | -- | Metropolitan Title In Llc | |

| Ashcraft Edward L | -- | Metropolitan Title | |

| Ashcradt Edward L | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Mcintyre Mason S | $171,830 | |

| Previous Owner | Ashcraft Edward L | $134,745 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,187 | $226,400 | $26,200 | $200,200 |

| 2022 | $2,187 | $211,900 | $24,000 | $187,900 |

| 2021 | $1,781 | $179,300 | $20,000 | $159,300 |

| 2020 | $1,807 | $181,800 | $20,600 | $161,200 |

| 2019 | $1,774 | $178,700 | $20,100 | $158,600 |

| 2018 | $1,827 | $175,300 | $19,400 | $155,900 |

| 2017 | $1,816 | $173,600 | $19,200 | $154,400 |

| 2016 | $1,832 | $174,600 | $18,300 | $156,300 |

| 2014 | $1,653 | $156,300 | $16,900 | $139,400 |

Source: Public Records

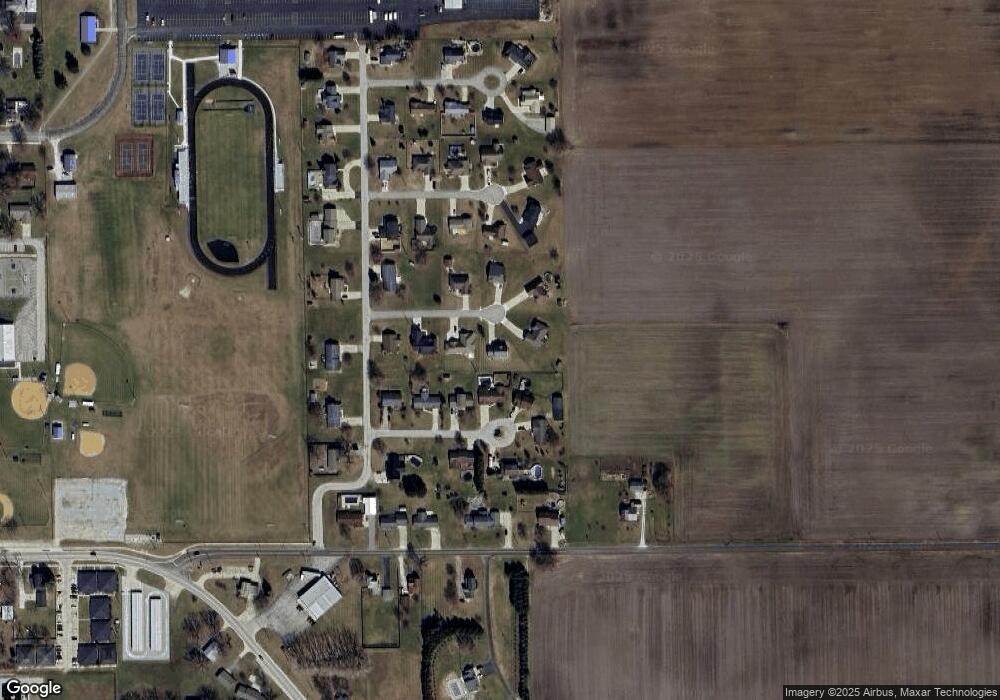

Map

Nearby Homes

- 404 E Center St

- 301 E Center St

- 606 N Thayer St

- 301 S Washington St

- 600 W Liberty Ave

- 320 N Walnut St

- 29 State Road 10

- 6974 Lincoln Hwy

- 9135 W 750 N

- 8805 W 125 N

- 2983 N Murphy Ln

- **** **** 15th Rd

- 3179 Center St

- 14229 Juniper Rd

- 11557 Jute Rd

- ** ** S Juniper Rd

- *** S Juniper Rd

- ** *** S Juniper Rd

- 8919 9b Rd

- TBD N 700 W

Your Personal Tour Guide

Ask me questions while you tour the home.